Question: . Navier is currently considering introducing a new model targeted specifically at the recreational boating market. The development of the proposed model has been in

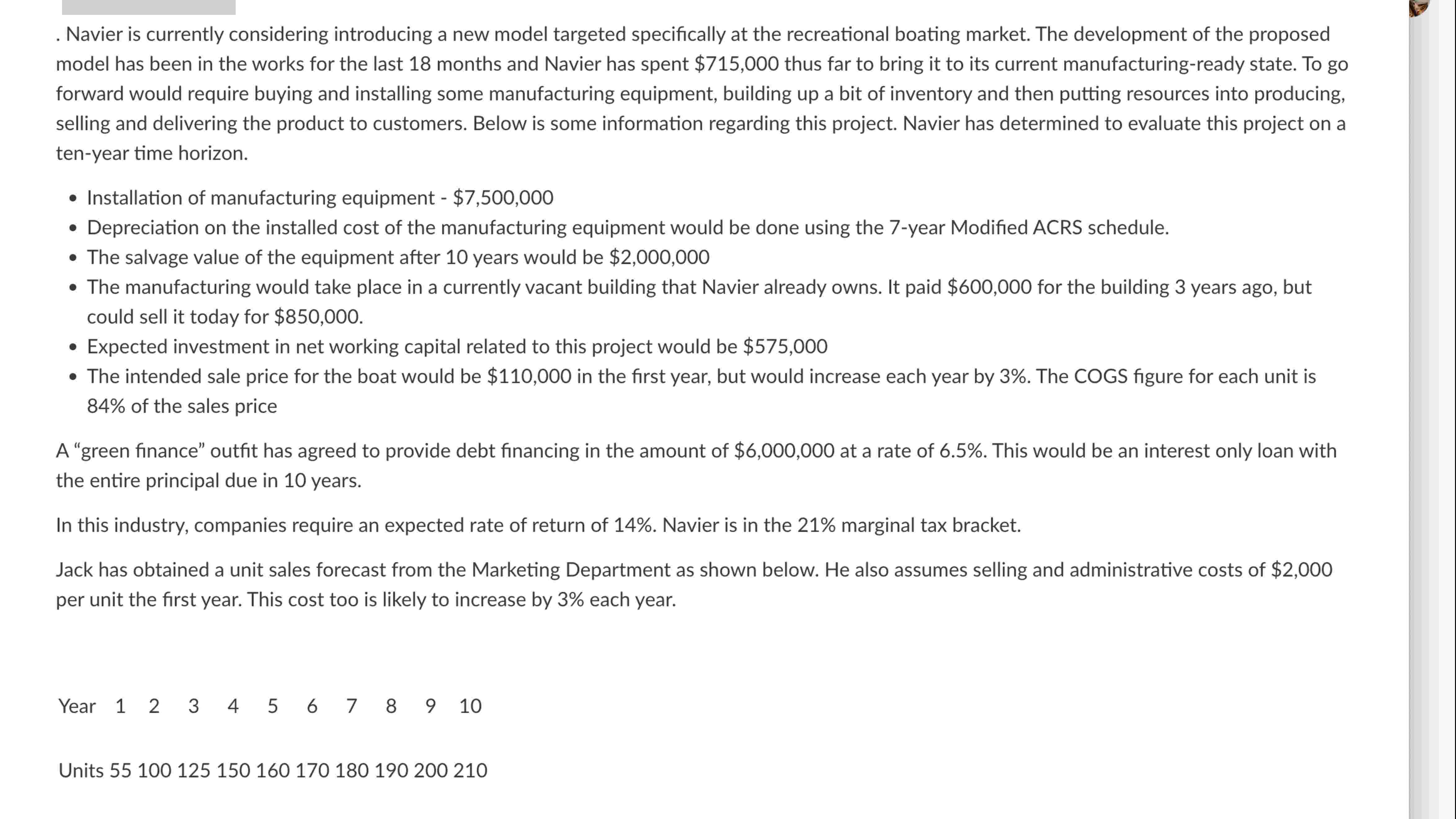

Navier is currently considering introducing a new model targeted specifically at the recreational boating market. The development of the proposed model has been in the works for the last months and Navier has spent $ thus far to bring it to its current manufacturingready state. To go forward would require buying and installing some manufacturing equipment, building up a bit of inventory and then putting resources into producing, selling and delivering the product to customers. Below is some information regarding this project. Navier has determined to evaluate this project on a tenyear time horizon. Installation of manufacturing equipment $ Depreciation on the installed cost of the manufacturing equipment would be done using the year Modified ACRS schedule. The salvage value of the equipment after years would be $ The manufacturing would take place in a currently vacant building that Navier already owns. It paid $ for the building years ago, but could sell it today for $ Expected investment in net working capital related to this project would be $ The intended sale price for the boat would be $ in the first year, but would increase each year by The COGS figure for each unit is of the sales price A green finance outfit has agreed to provide debt financing in the amount of $ at a rate of This would be an interest only loan with the entire principal due in years. In this industry, companies require an expected rate of return of Navier is in the marginal tax bracket. Jack has obtained a unit sales forecast from the Marketing Department as shown below. He also assumes selling and administrative costs of $ per unit the first year. This cost too is likely to increase by each year. Year Units Complete and submit a general spreadsheet to depict the cash flows for this investment proposal. Have the spreadsheet produce the NPV and IRR. Write a recommendation concerning the financial aspects of this investment and support it with your findings.

Navier is currently considering introducing a new model targeted specifically at the recreational boating market. The development of the proposed

model has been in the works for the last months and Navier has spent $ thus far to bring it to its current manufacturingready state. To go

forward would require buying and installing some manufacturing equipment, building up a bit of inventory and then putting resources into producing,

selling and delivering the product to customers. Below is some information regarding this project. Navier has determined to evaluate this project on a

tenyear time horizon.

Installation of manufacturing equipment $

Depreciation on the installed cost of the manufacturing equipment would be done using the year Modified ACRS schedule.

The salvage value of the equipment after years would be $

The manufacturing would take place in a currently vacant building that Navier already owns. It paid $ for the building years ago, but

could sell it today for $

Expected investment in net working capital related to this project would be $

The intended sale price for the boat would be $ in the first year, but would increase each year by The COGS figure for each unit is

of the sales price

A "green finance" outfit has agreed to provide debt financing in the amount of $ at a rate of This would be an interest only loan with

the entire principal due in years.

In this industry, companies require an expected rate of return of Navier is in the marginal tax bracket.

Jack has obtained a unit sales forecast from the Marketing Department as shown below. He also assumes selling and administrative costs of $

per unit the first year. This cost too is likely to increase by each year.

: Year :

Units

Complete and submit a general spreadsheet to depict the cash flows for this investment proposal. Have the spreadsheet produce the NPV and IRR. Write a recommendation concerning the financial aspects of this investment and support it with your findings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock