Question: N.B.: Figures in the margin indicate full marks. Answer any four questions. All parts of a question must be answered in a single group. a)

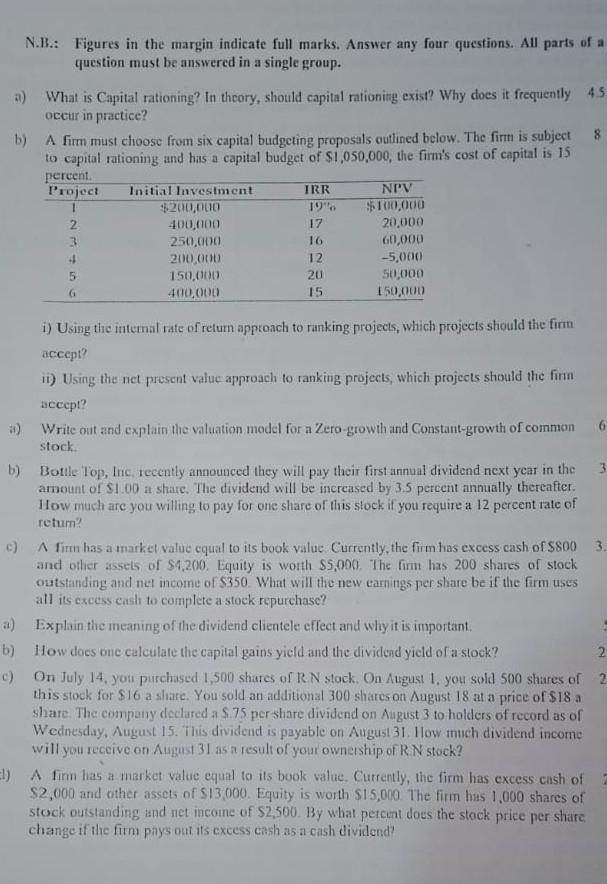

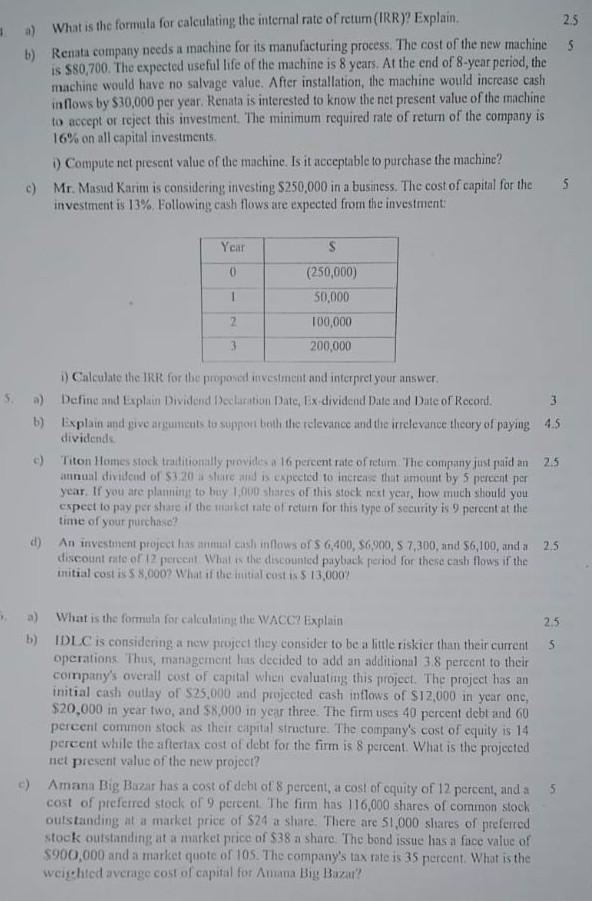

N.B.: Figures in the margin indicate full marks. Answer any four questions. All parts of a question must be answered in a single group. a) What is Capital rationing? In theory, should capital rationing exist? Why does it frequently 45 occur in practice? b) A firm must choose from six capital budgeting proposals outlined below. The firm is subject 8 to capital rationing and has a capital budget of $1,050,000, the firm's cost of capital is 15 percent Project Initial Investment NIV $200,000 $100,000 2 400,000 20.000 250,000 60,000 200,000 12 -5,000 150,000 50,000 400,000 15 150,000 IRR 16 17 16 WN 4 5 G 20 6 i) Using the internal rate ofretum approach to ranking projects, which projects should the firm accept? 1) Using the net present value approach to ranking projects, which projects should the fimm accept? 2) Write out and explain the valuation model for a Zero-growth and Constant-growth of common stock b) Bottle Top, Inc. recently announced they will pay their first annual dividend next year in the amount of S1.00 a share. The dividend will be increased by 35 percent annually thereafter. How much are you willing to pay for one share of this stock if you require a 12 percent rate of return? c) A firm has a market value equal to its book value Currently, the firm has excess cash or s800 3. and other assets of $4,200 Equity is worth $5,000. The firm has 200 shares of stock outstanding and net income of S350 What will the new earnings per share be if the firm uses all its excess cash to complete a stock repurchase? a) Explain the meaning of the dividend clientele effect and why it is important b) How does one calculate the capital gains yield and the dividend yield of a stock? c) On July 14, you purchased 1,500 shares of R N stock. On August 1. you sold 500 shares of 2 this stock for $16 a share. You sold an additional 300 shares on August 18 at a price of $18 a share. The company declared a 5.75 per share dividend on August 3 to holders of record as of Wednesday, August 15. This dividend is payable on August 31. How much dividend income will you receive on August 31 as a result of your ownership of R.N stock? El) A finn has a market value equal to its book value. Currently, the firm has excess cash of $2,000 and other assets of S13000. Equity is worth $15,000. The firm hus 1,000 shares of stock outstanding and net income of $2,500. By what percent does the stock price per share change if the firm pays out its excess cash as a cash dividend? 2.5 5 #) What is the formula for calculating the internal rate of retum(IRR)? Explain. b) Renata company needs a machine for its manufacturing process. The cost of the new machine is $80,700. The expected useful life of the machine is 8 years. At the end of 8-year period, the machine would have no salvage value. After installation, the machine would increase cash inflows by 30,000 per year. Renata is interested to know the not present value of the machine to accept or reject this investment. The minimum required rate of return of the company is 16% on all capital investments 0) Compute net present value of the machine. Is it acceptable to purchase the machine? c) Mr. Masud Karim is considering investing $250,000 in a business. The cost of capital for the investment is 13% Following cash flows are expected from the investments 5 Year S 0 1 (250,000) 50,000 100,000 200,000 2 3 i) Calculate the IRR for the proposed investment and interpret your answer. 5. a) Define and explain Dividend Declaration Date Ex dividend Date and Date of Record 3 b) Explain and give arguments to support bell the relevance and the irrelevance theory of paying 4.5 dividends c) Titon Homes stock traditionally provides a 16 percent rate of retum The company just paid an 25 annual dividend of 20 state and is expected to increase thit amount by 5 percent per year. If you are planning to buy 1000 litres of this stock next year, how much should you espect to pay per shit the market rate of return for this type of security is 9 percent at the time of your purchase? d) An investment project has a shinlows of S 6,400, S6,900,5 7,300 and 56,100, and a 2.5 discount rate of 12 percent What is the discounted payback period for these cash flows if the initial cost is $8,000? What if the initial cost is $13,000? 25 5 a) What is the formula for calculating the WACC? Explain b) IDLC is considering a new project they consider to be a little riskier than their current operations. Thus, management has decided to add an additional 38 percent to their company's overall cost of capital when evaluating this project. The project has an initial cash outlay of $25,000 and projected cash inflows of $12,000 in year one, $20,000 in year two, and $8,000 in year three. The firm uses 40 percent debt and 60 percent common stock as their capital structure. The company's cost of equity is 14 percent while the aftertax cost of debt for the firm is 8 percent. What is the projected nel present value of the new project? e) Amann Big Bazar has a cost of debt of 8 percent, a cost of equity of 12 percent, and a cost of preferred stock of 9 percent. The firm has 116,000 shares of common stock outstanding at a market price of $24 a share. There are 51,000 shares of preferred stock outstanding at a market price of $38 n share. The bond issue has a face value of $900,000 and a market quote of 105. The company's tax rate is 35 percent. What is the weighted average cost of capital for Ama Big Bazu

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock