Question: NB: NEED ASAP!!!!!!! a. Kevin plans to start saving for retirement and has the option of choosing between two investment opportunities. Option One: Invest $6,000

NB: NEED ASAP!!!!!!!

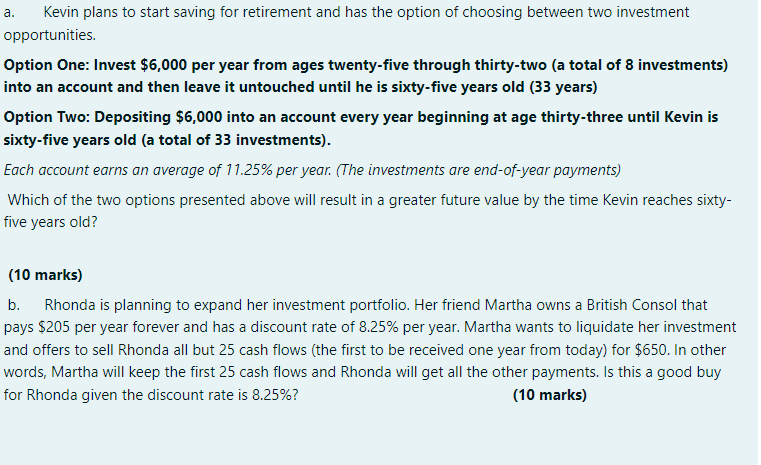

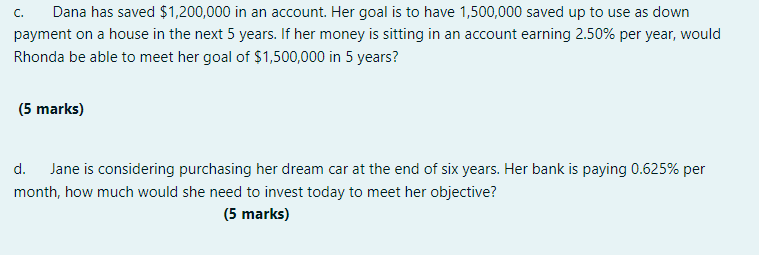

a. Kevin plans to start saving for retirement and has the option of choosing between two investment opportunities. Option One: Invest $6,000 per year from ages twenty-five through thirty-two (a total of 8 investments) into an account and then leave it untouched until he is sixty-five years old (33 years) Option Two: Depositing $6,000 into an account every year beginning at age thirty-three until Kevin is sixty-five years old (a total of 33 investments). Each account earns an average of 11.25% per year. (The investments are end-of-year payments) Which of the two options presented above will result in a greater future value by the time Kevin reaches sixty- five years old? (10 marks) b. Rhonda is planning to expand her investment portfolio. Her friend Martha owns a British Consol that pays $205 per year forever and has a discount rate of 8.25% per year. Martha wants to liquidate her investment and offers to sell Rhonda all but 25 cash flows (the first to be received one year from today) for $650. In other words, Martha will keep the first 25 cash flows and Rhonda will get all the other payments. Is this a good buy for Rhonda given the discount rate is 8.25%? (10 marks) C. Dana has saved $1,200,000 in an account. Her goal is to have 1,500,000 saved up to use as down payment on a house in the next 5 years. If her money is sitting in an account earning 2.50% per year, would Rhonda be able to meet her goal of $1,500,000 in 5 years? (5 marks) d. Jane is considering purchasing her dream car at the end of six years. Her bank is paying 0.625% per month, how much would she need to invest today to meet her objective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts