Question: NB: ** Use the indirect method Indirect method QUESTION 4 (IAS 7) (10) Alfa Ltd The following are the draft annual financial statements of Alfa

NB: ** Use the indirect method

Indirect method

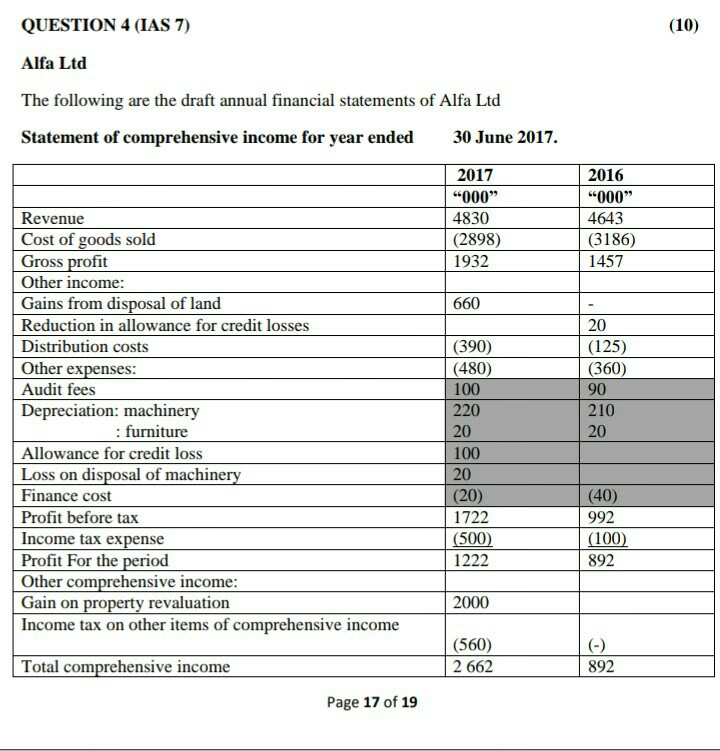

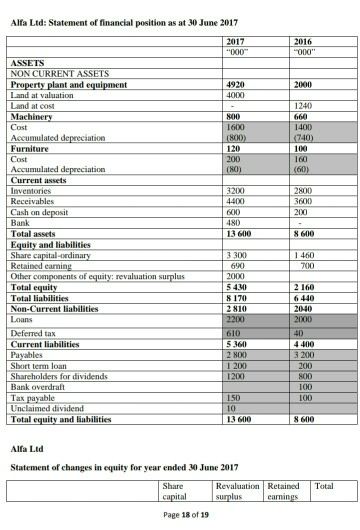

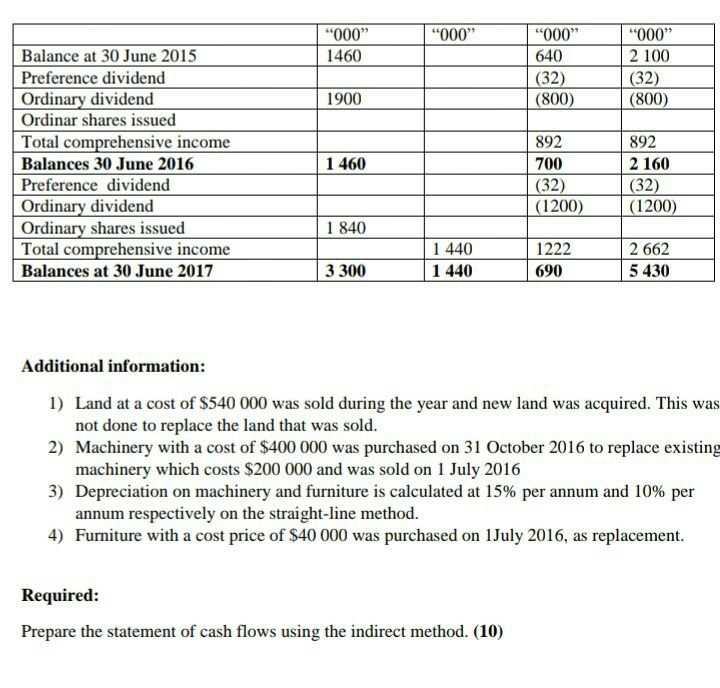

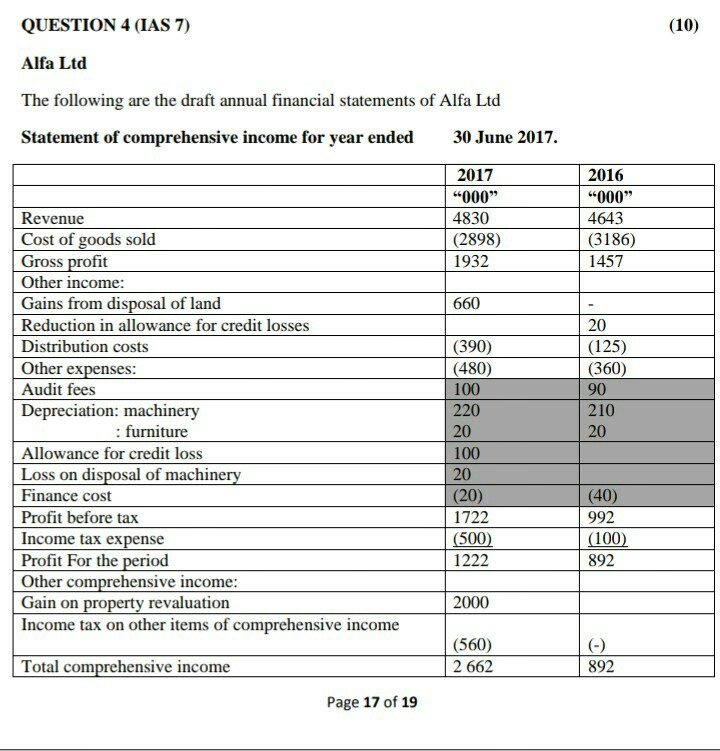

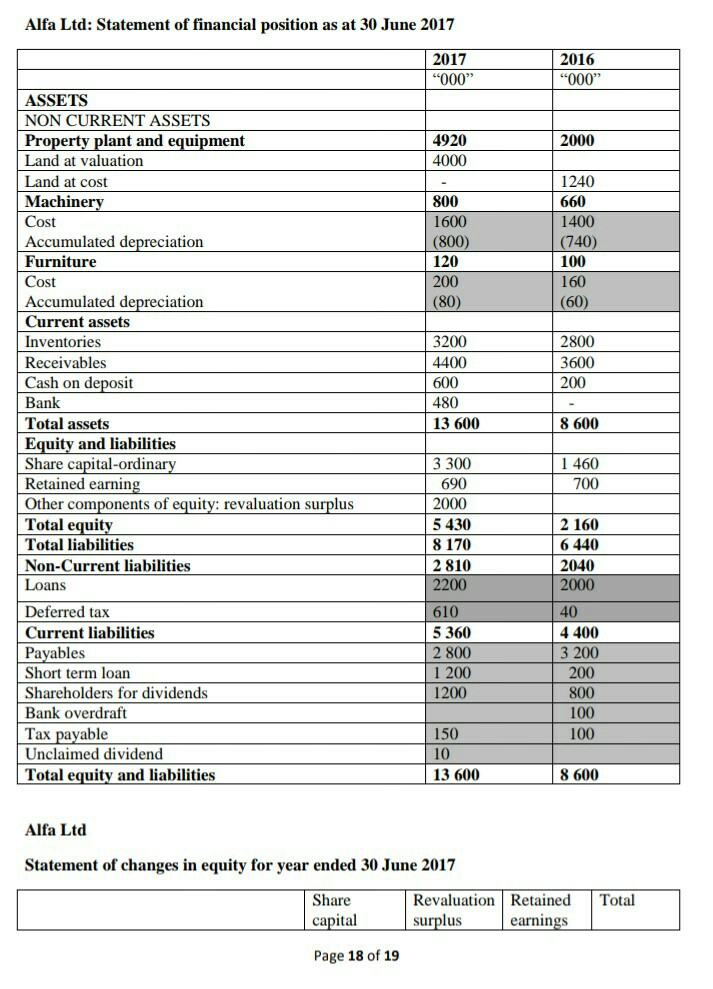

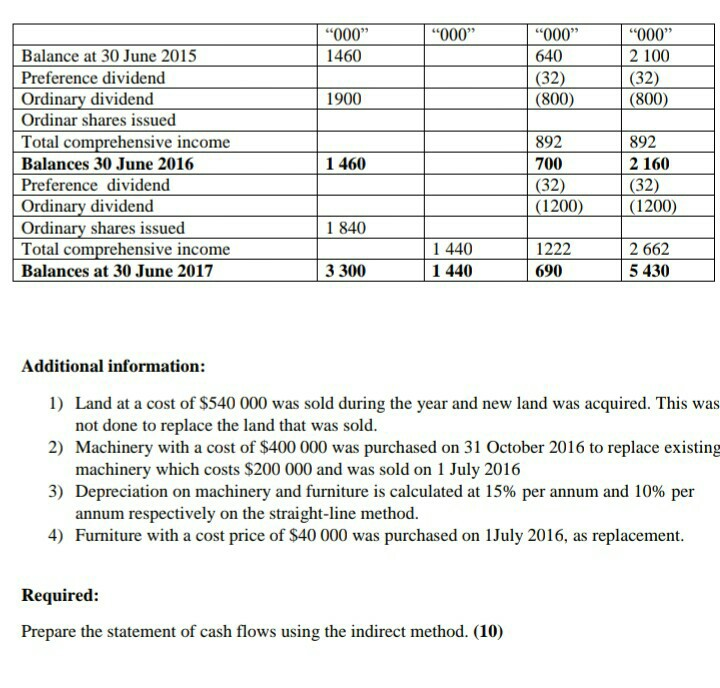

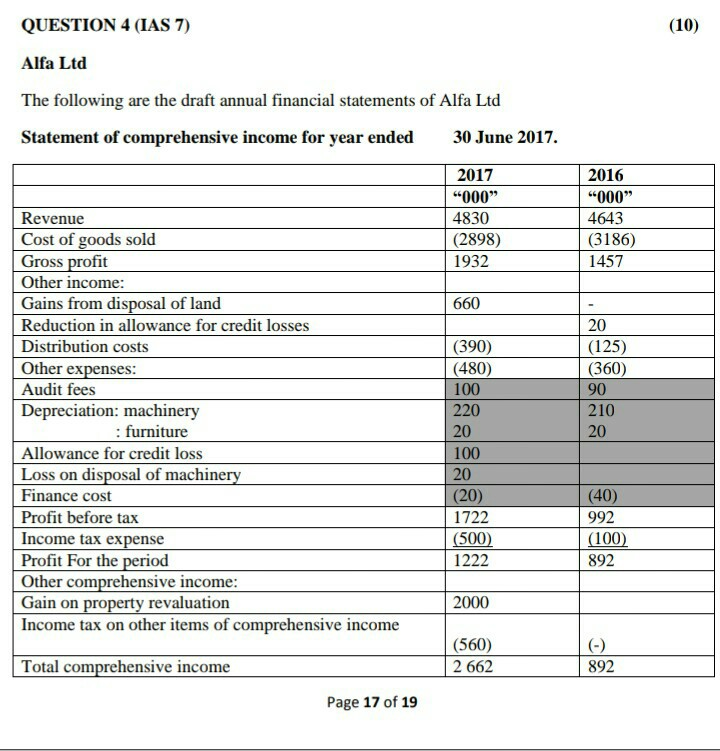

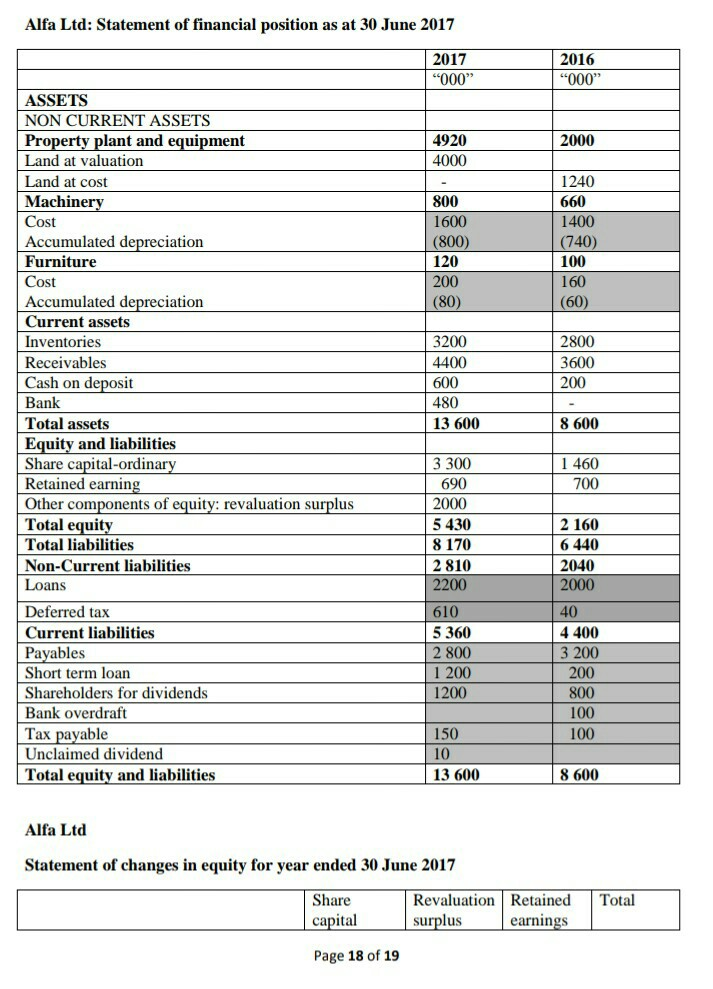

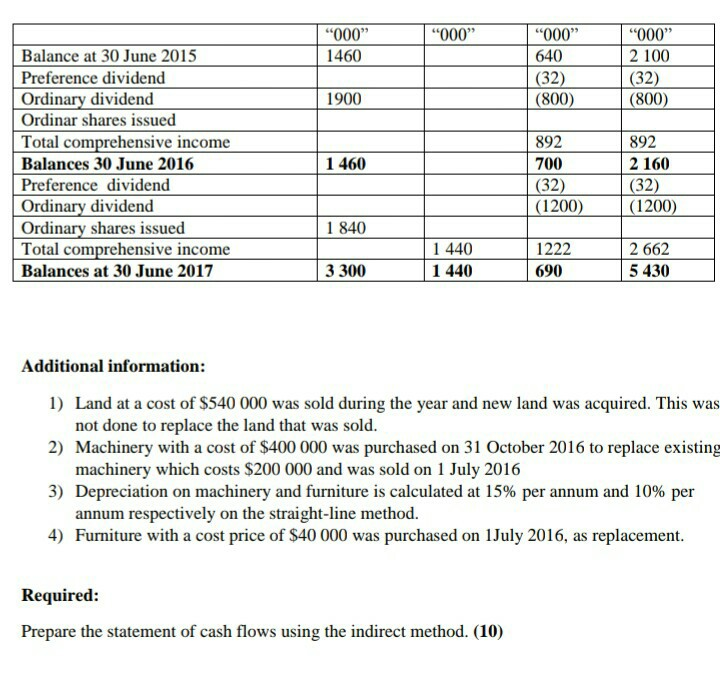

QUESTION 4 (IAS 7) (10) Alfa Ltd The following are the draft annual financial statements of Alfa Ltd Statement of comprehensive income for year ended 30 June 2017. 2017 "000" 4830 (2898) 1932 2016 "000" 4643 (3186) 1457 660 Revenue Cost of goods sold Gross profit Other income: Gains from disposal of land Reduction in allowance for credit losses Distribution costs Other expenses: Audit fees Depreciation: machinery : furniture Allowance for credit loss Loss on disposal of machinery Finance cost Profit before tax Income tax expense Profit For the period Other comprehensive income: Gain on property revaluation Income tax on other items of comprehensive income 20 (125) (360) 90 210 20 (390) (480) 100 220 20 100 20 (20) | 1722 (500) 1222 (40) 992 (100) 892 2000 (560) 2 662 Total comprehensive income 892 Page 17 of 19 Alfa Lido Statement of financial position as at 30 June 2017 2017 2016 000 AENETS NON CURRENT ASSETS Property plant and equipment 2000 4000 1240 Land cost Machines 660 1400 (740) 1600 CRO I 120 200 (0 (60) I 3200 14400 160 2 ) 3000 200 Accumulated depreciation Furniture Cost Accumulated depreciation Current assets Inventories Receivables Cash on deposit Bank Total assets Equity and liabilities Share capital-ordinary Retained earning Other components of equity: revaluation surplus Total equity Total liabilities Non-Current liabilities 113 600 NM00 11160 13 100 160 2000 154.90 IS 170 12810 2200 1 2 160 6 un 1 20-40 2000 610 5160 2 NDO Deferred tax Current liabilities Payables Short term loan Shareholders for dividends Bank overdraft Tax payable Unclaimed dividend Total equity and liabilities 40 T4000 3200 200 NOO 1200 100 150 100 13 600 8600 Alfa Ltd Statement of changes in equity for year ended 30 June 2017 Total capital Revaluation Retained surplus earnings Page 18 of 19 "000" "000" 1460 "000" 640 (32) | (800) "000" 2 100 (32) (800) 1900 892 Balance at 30 June 2015 Preference dividend Ordinary dividend Ordinar shares issued Total comprehensive income Balances 30 June 2016 Preference dividend Ordinary dividend Ordinary shares issued Total comprehensive income Balances at 30 June 2017 1 460 700 (32) (1200) 892 2 160 (32) (1200) 1 840 3 300 1 440 1 440 1222 690 2 662 5 430 Additional information: 1) Land at a cost of $540 000 was sold during the year and new land was acquired. This was not done to replace the land that was sold. 2) Machinery with a cost of $400 000 was purchased on 31 October 2016 to replace existing machinery which costs $200 000 and was sold on 1 July 2016 3) Depreciation on machinery and furniture is calculated at 15% per annum and 10% per annum respectively on the straight-line method. 4) Furniture with a cost price of $40 000 was purchased on July 2016, as replacement. Required: Prepare the statement of cash flows using the indirect method. (10) Alfa Ltd: Statement of financial position as at 30 June 2017 2017 "000" 2016 "000" 2000 4920 4000 800 1600 (800) 120 200 (80) 1240 660 1400 (740) 100 160 (60) 3200 4400 600 480 13 600 2800 3600 200 8 600 ASSETS NON CURRENT ASSETS Property plant and equipment Land at valuation Land at cost Machinery Cost Accumulated depreciation Furniture Cost Accumulated depreciation Current assets Inventories Receivables Cash on deposit Bank Total assets Equity and liabilities Share capital-ordinary Retained earning Other components of equity: revaluation surplus Total equity Total liabilities Non-Current liabilities Loans Deferred tax Current liabilities Payables Short term loan Shareholders for dividends Bank overdraft Tax payable Unclaimed dividend Total equity and liabilities 1 460 700 3 300 690 2000 5 430 8 170 2 810 2200 610 5360 2 800 1 200 1200 2 160 6 440 2040 2000 40 4 400 3 200 200 800 100 100 150 10 13 600 8 600 Alfa Ltd Statement of changes in equity for year ended 30 June 2017 Total Share capital Revaluation Retained surplus earnings Page 18 of 19 "000" "000" 1460 "000" 640 (32) | (800) "000" 2 100 (32) (800) 1900 892 Balance at 30 June 2015 Preference dividend Ordinary dividend Ordinar shares issued Total comprehensive income Balances 30 June 2016 Preference dividend Ordinary dividend Ordinary shares issued Total comprehensive income Balances at 30 June 2017 1 460 700 (32) (1200) 892 2 160 (32) (1200) 1 840 3 300 1 440 1 440 1222 690 2 662 5 430 Additional information: 1) Land at a cost of $540 000 was sold during the year and new land was acquired. This was not done to replace the land that was sold. 2) Machinery with a cost of $400 000 was purchased on 31 October 2016 to replace existing machinery which costs $200 000 and was sold on 1 July 2016 3) Depreciation on machinery and furniture is calculated at 15% per annum and 10% per annum respectively on the straight-line method. 4) Furniture with a cost price of $40 000 was purchased on July 2016, as replacement. Required: Prepare the statement of cash flows using the indirect method. (10) "000" "000" 1460 "000" 640 (32) | (800) "000" 2 100 (32) (800) 1900 892 Balance at 30 June 2015 Preference dividend Ordinary dividend Ordinar shares issued Total comprehensive income Balances 30 June 2016 Preference dividend Ordinary dividend Ordinary shares issued Total comprehensive income Balances at 30 June 2017 1 460 700 (32) (1200) 892 2 160 (32) (1200) 1 840 3 300 1 440 1 440 1222 690 2 662 5 430 Additional information: 1) Land at a cost of $540 000 was sold during the year and new land was acquired. This was not done to replace the land that was sold. 2) Machinery with a cost of $400 000 was purchased on 31 October 2016 to replace existing machinery which costs $200 000 and was sold on 1 July 2016 3) Depreciation on machinery and furniture is calculated at 15% per annum and 10% per annum respectively on the straight-line method. 4) Furniture with a cost price of $40 000 was purchased on July 2016, as replacement. Required: Prepare the statement of cash flows using the indirect method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts