Question: ncome Statement 4. In the [Inc St-Vert] sheet, complete preparing a common-size income statement (vertical analysis) for all three fiscal years. In common-size income statements,

![ncome Statement 4. In the [Inc St-Vert] sheet, complete preparing a](https://s3.amazonaws.com/si.experts.images/answers/2024/07/668d6fdab1e8d_242668d6fda545b4.jpg)

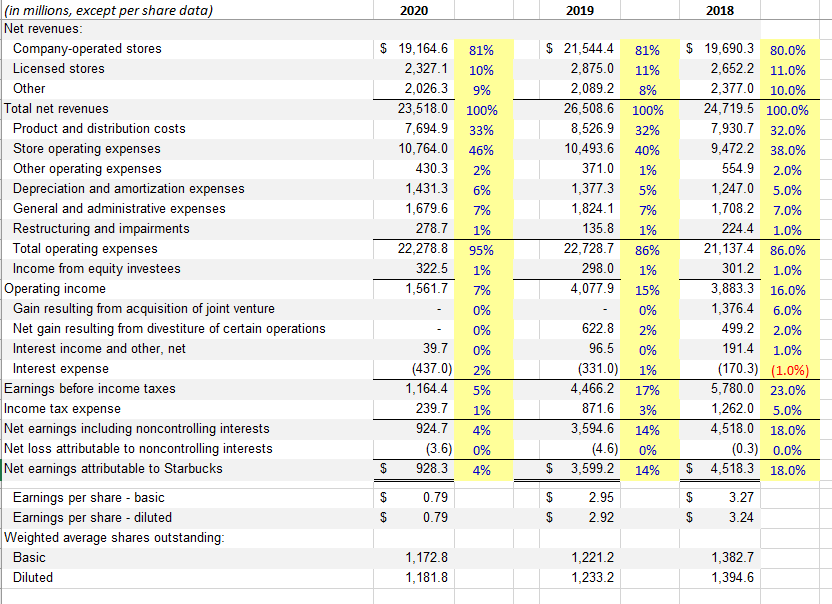

ncome Statement 4. In the [Inc St-Vert] sheet, complete preparing a common-size" income statement (vertical analysis) for all three fiscal years. In common-size income statements, net sales revenue is 100 percent and every other number is a percentage of sales. Link to the sheet to complete the Income Statement vertical analysis ==> Inc St-Vert'!B8 Calculate the following values: Note: Starbucks does not present "Gross Margin as a line item on its Income Statements, so you'll need to calculate this by subtracting "Product and distribution costs" from "Total net revenues." To calculate the Net margin percentage, use "Net earnings attributable to Starbucks." Fiscal 2020 Fiscal 2019 Starbucks Corporation (ended Sep. 27, 2020) (ended Sep. 29, 2019) 5. Gross margin percentage 6. Net margin percentage 7. During which of these two years did Starbucks have better profitability performance? 2020 2019 2018 (in millions, except per share data) Net revenues: Company-operated stores Licensed stores Other Total net revenues Product and distribution costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other, net Interest expense Earnings before income taxes Income tax expense Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests Net earnings attributable to Starbucks Earnings per share - basic Earnings per share - diluted Weighted average shares outstanding Basic Diluted $ 19,164.6 2,327.1 2,026.3 23,518.0 7,694.9 10,764.0 430.3 1,431.3 1,679.6 278.7 22,278.8 322.5 1,561.7 81% 10% 9% 100% 33% 46% 2% 6% 7% 1% 95% 1% 7% $ 21,544.4 81% 2,875.0 11% 2,089.2 8% 26,508.6 100% 8,526.9 32% 10,493.6 40% 371.0 1% 1,377.3 5% 1,824.1 7% 135.8 1% 22,728.7 86% 298.0 1% 4,077.9 15% $ 19,690.3 80.0% 2,652.2 11.0% 2,377.0 10.0% 24,719.5 100.0% 7,930.7 32.0% 9,472.2 38.0% 554.9 2.0% 1,247.0 5.0% 1,708.2 7.0% 224.4 1.0% 21,137.4 86.0% 301.2 1.0% 3,883.3 16.0% 1,376.4 6.0% 499.2 2.0% 191.4 1.0% (170.3) (1.0%) 5,780.0 23.0% 1,262.0 5.0% 4,518.0 18.0% (0.3) 0.0% $ 4,518.3 18.0% 0% 0% 0% 0% 39.7 (4370) 1,164.4 239.7 924.7 (3.6) 928.3 2% 5% 1% 4% 0% 4% 622.8 96.5 (331.0) 4,466.2 871.6 3,594.6 (4.6) 3,599.2 2% 0% 1% 17% 3% 14% 0% 14% $ $ $ $ 0.79 0.79 2.95 2.92 3.27 3.24 $ $ $ 1,172.8 1,181.8 1,221.2 1,233.2 1,382.7 1,394.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts