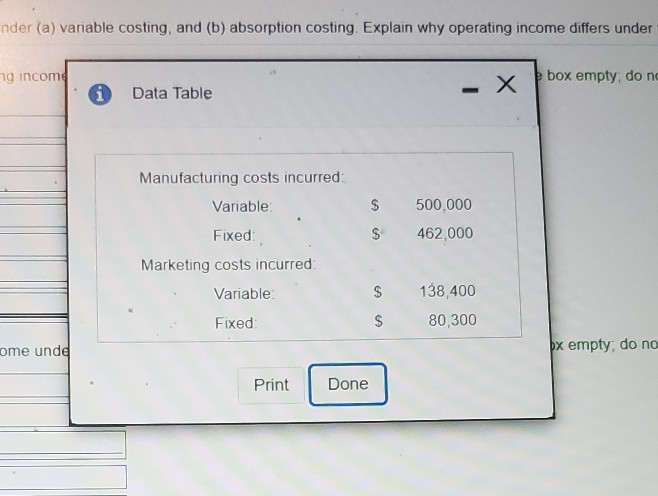

Question: nder (a) variable costing, and (b) absorption costing. Explain why operating income differs under ng income box empty, do no i Data Table Manufacturing costs

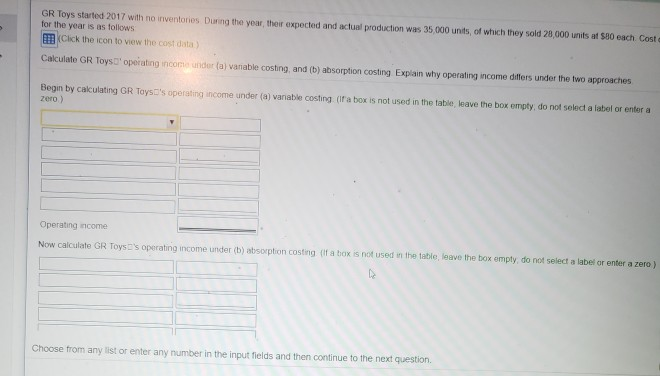

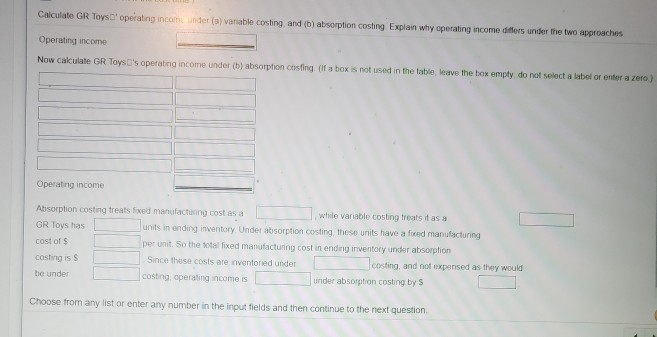

nder (a) variable costing, and (b) absorption costing. Explain why operating income differs under ng income box empty, do no i Data Table Manufacturing costs incurred S 500,000 S 462,000 Variable Fixed Marketing costs incurred S 138,400 80,300 Variable Fixed ome unde x empty, do no Print Done Calculate GR Toys' operating incom, under (a) vaniable costing, and (b) absorption costing Explain why operating income difiters under the two approaches Operating income Now cakculate GR Toys's operating income under tb) absorption costing (lif a box is not used in the table, leave the box empty do not select a label or entor a zero ) Operating income Absorption costing treats fxed manufacturing cost as a GR Toys has cost of $ costing is S be unde while variable costing treats it as a units in ending inventory Under absorption costing, these units have a fxed manufacturing per unit. So the otal fixed manufacturing cost in endinig inventory under absorption Since these costs are inventoried under costing, operaling income is_ costing, and not expensed as they would under absorption costing by S Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts