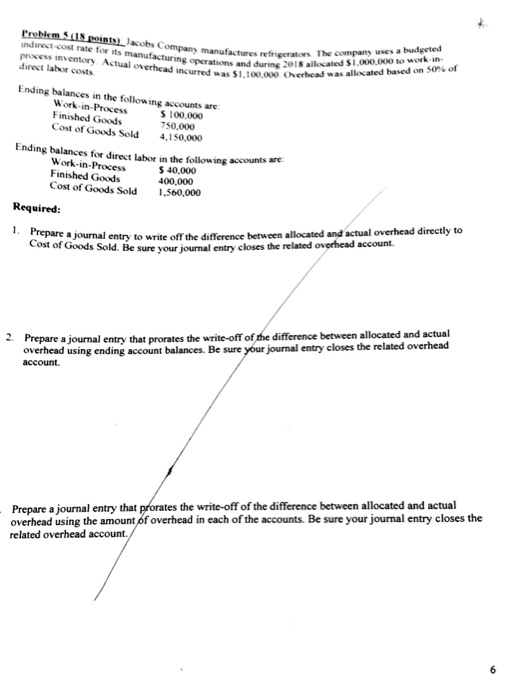

Question: ndirect-cost rate for its process inventory Actual overhead incurred was $1,100.000 direct labor costs operations and during 2018 allocated $1,000,000 to Overhead was allocated based

ndirect-cost rate for its process inventory Actual overhead incurred was $1,100.000 direct labor costs operations and during 2018 allocated $1,000,000 to Overhead was allocated based on 50% of Ending balances in the following accounts are Work-in-Process Finished Goods Cost of Goods Sold S 100,000 750,000 4,150,000 Ending balances for direct labor in the following accounts are Work-in-Process Finished Goods Cost of Goods Sold $40,000 400,00 1.560,000 Required 1. Prepare a journal entry to write off the difference between allocated and actual overhead directly to Cost of Goods Sold. Be sure y our journal entry closes the related ovorhead account. overhead using ending account balances. Be sure your journal entry account. 2. closes the related overhead Prepare a journal entry that prorates the write-off of the difference between allocated and actual the write-off of the difference between allocated and actual Prepare a journal entry that overhead using the amount of overhead in each of the accounts. Be sure your journal entry closes the related overhead account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts