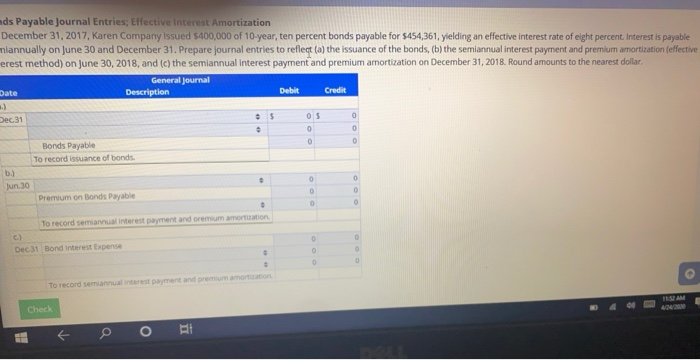

Question: nds Payable Journal Entries; Effective interest Amortization December 31, 2017, Karen Company issued $400,000 of 10 year, ten percent bonds payable for $454,361, yielding an

nds Payable Journal Entries; Effective interest Amortization December 31, 2017, Karen Company issued $400,000 of 10 year, ten percent bonds payable for $454,361, yielding an effective interest rate of eight percent. Interest is payable miannually on June 30 and December 31. Prepare journal entries to reflect (a) the issuance of the bonds, (b) the semiannual interest payment and premium amortization (effective erest method) on June 30, 2018, and (c) the semiannual interest payment and premium amortization on December 31, 2018. Round amounts to the nearest dollar General Journal Date Description Debit Credit 5050 Dec31 Bonds Payable To record issuance of bonds. b.) Jun 30 Premium on Bonds Payable To record semiannus interest payment and oremum mortation Dec 31 Bond interest Expense To record semiannual interest payment and 13:52 AM Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts