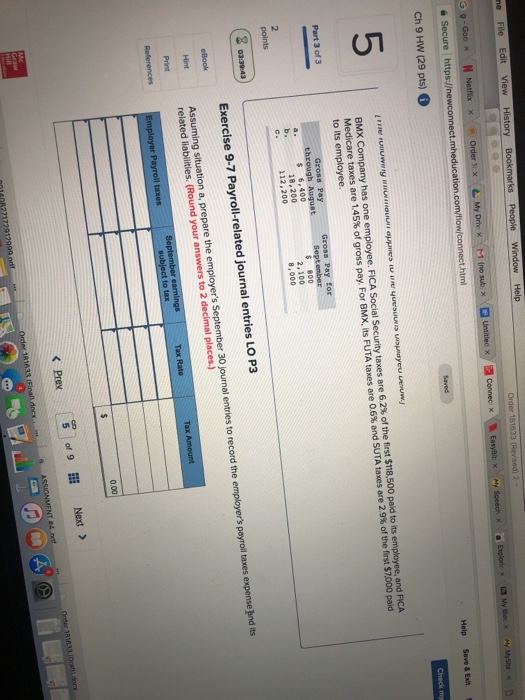

Question: ne File Edit View ks Order 181633 ( Ch 9 HW (29 pts) Help Save&Exit 5 BMX Company has one employee. FICA Social Security taxes

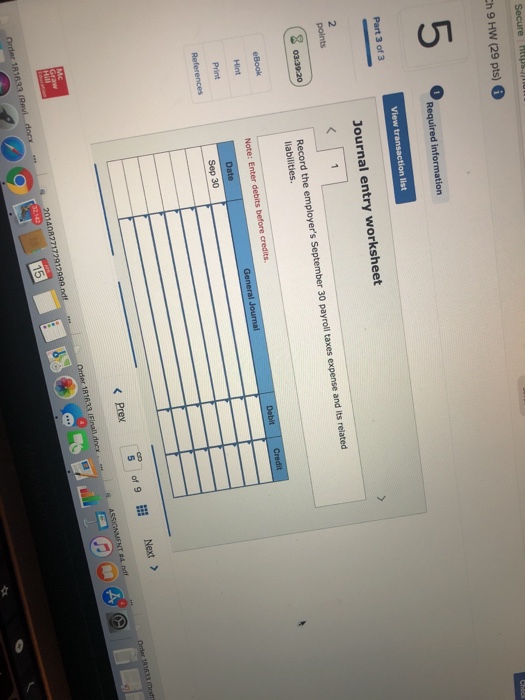

ne File Edit View ks Order 181633 ( Ch 9 HW (29 pts) Help Save&Exit 5 BMX Company has one employee. FICA Social Security taxes are 6.2% of the first S118.500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes ere 06% and SUTA ta es are 29% of tho tni smo prid to its employee. Part 3 of 3 Gross Pay Gross Pay for August $ 6,400 18,200 112,200 800 2,100 8,000 Exercise 9-7 Payroll-related journal entries LO P3 employer's payroll taxes expense end its Assuming situation a, prepare related liabilities. (Round your answers to 2 the employer's September 30 journal entries to record the Tax Rate Tax Amount to tax 0.00 PrexNext>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts