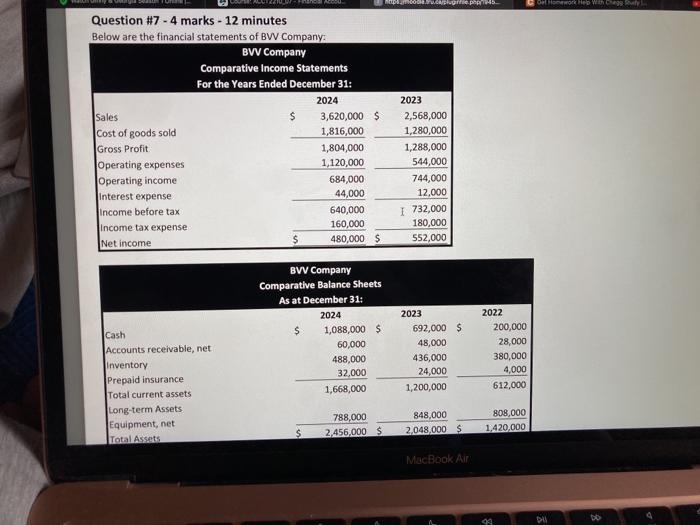

Question: NE nap.com.cap. 145. COOH W Question #7 - 4 marks - 12 minutes Below are the financial statements of BWV Company BWV Company Comparative Income

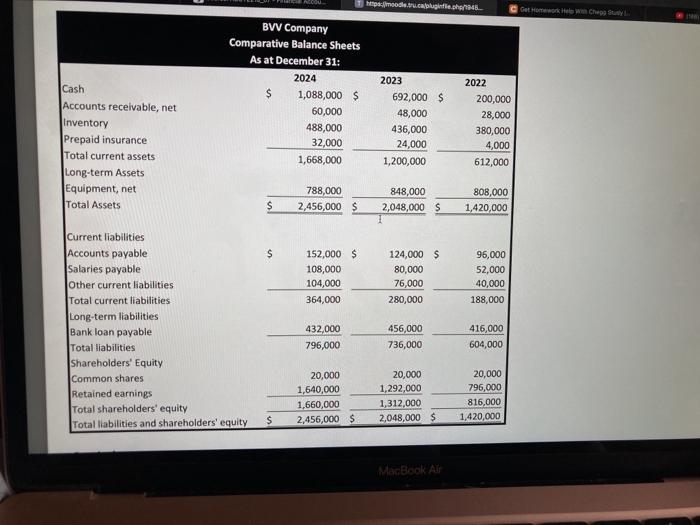

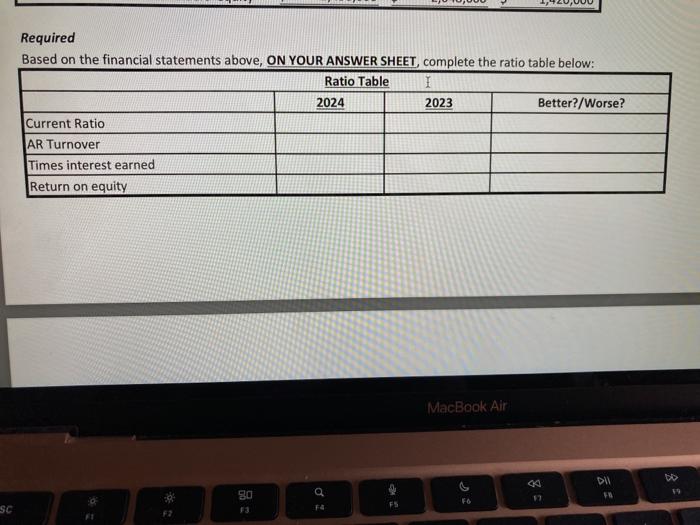

NE nap.com.cap. 145. COOH W Question #7 - 4 marks - 12 minutes Below are the financial statements of BWV Company BWV Company Comparative Income Statements For the Years Ended December 31: 2024 Sales $ 3,620,000 $ Cost of goods sold 1,816,000 Gross Profit 1,804,000 Operating expenses 1,120,000 Operating income 684,000 Interest expense 44,000 Income before tax 640,000 Income tax expense 160,000 Net income 480,000 $ 2023 2,568,000 1,280,000 1,288,000 544,000 744,000 12,000 I 732,000 180,000 552,000 BWV Company Comparative Balance Sheets As at December 31: 2024 $ 1,088,000 $ 60,000 488,000 32,000 1,668,000 Cash Accounts receivable, net Inventory Prepaid insurance Total current assets Long-term Assets Equipment, net Total Assets 2023 692,000 $ 48,000 436,000 24,000 1,200,000 2022 200,000 28,000 380,000 4,000 612,000 788,000 2.456,000 $ 848,000 2,048,000 $ 808,000 1,420,000 MacBook Air hoodieu.capluginle.ge Cash BWV Company Comparative Balance Sheets As at December 31: 2024 $ 1,088,000 $ 60,000 488,000 32,000 1,668,000 Accounts receivable, net Inventory Prepaid insurance Total current assets Long-term Assets Equipment, net Total Assets 2023 692,000 $ 48,000 436,000 24,000 1,200,000 2022 200,000 28,000 380,000 4,000 612,000 788,000 2,456,000 $ $ 848,000 2,048,000 $ 808,000 1,420,000 S 152,000 $ 108,000 104,000 364,000 124,000 $ 80,000 76,000 280,000 96,000 52,000 40,000 188,000 Current liabilities Accounts payable Salaries payable Other current liabilities Total current liabilities Long-term liabilities Bank loan payable Total liabilities Shareholders' Equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 432,000 796,000 456,000 736,000 416,000 604,000 20,000 1,640,000 1,660,000 2,456,000 $ 20,000 1,292,000 1,312,000 2,048,000 $ 20,000 796,000 816,000 1.420,000 S MacBook Air Required Based on the financial statements above, ON YOUR ANSWER SHEET, complete the ratio table below: Ratio Table I 2024 2023 Better?/Worse? Current Ratio AR Turnover Times interest earned Return on equity MacBook Air to 59 90 FO FA FS SC F2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts