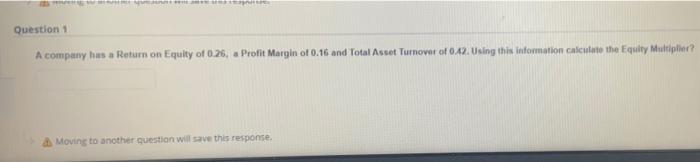

Question: NE Question 1 A company has a Return on Equity of 0.26, a Profit Margin of 0.16 and Total Asset Turnover of 0.42. Using this

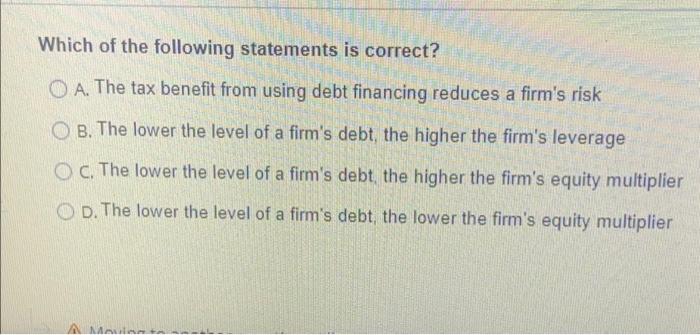

NE Question 1 A company has a Return on Equity of 0.26, a Profit Margin of 0.16 and Total Asset Turnover of 0.42. Using this information calculate the Equity Multiplier? Moving to another question will save this response. Which of the following statements is correct? O A. The tax benefit from using debt financing reduces a firm's risk O B. The lower the level of a firm's debt, the higher the firm's leverage OC. The lower the level of a firm's debt, the higher the firm's equity multiplier O D. The lower the level of a firm's debt, the lower the firm's equity multiplier A Mul

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock