Question: Nebraska Company uses the weighted average method in its process costing system. The first processing department, the Welding Department, started the month with 20,000 units

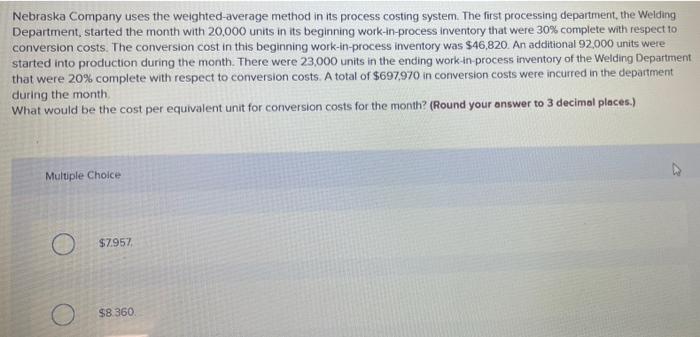

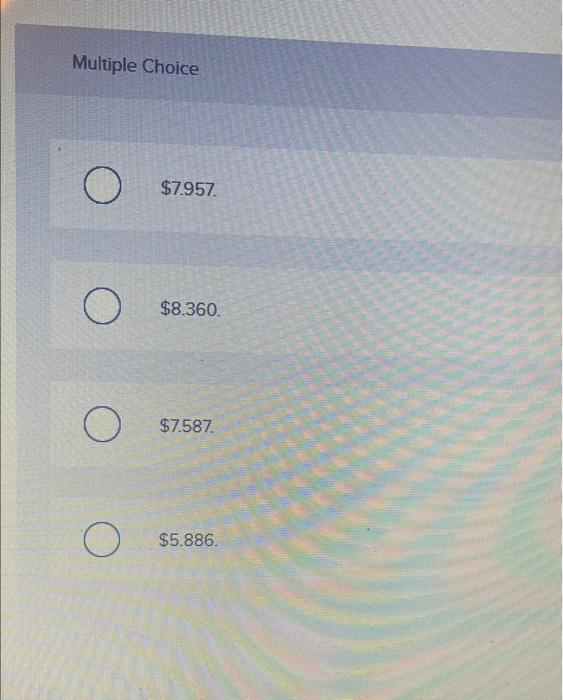

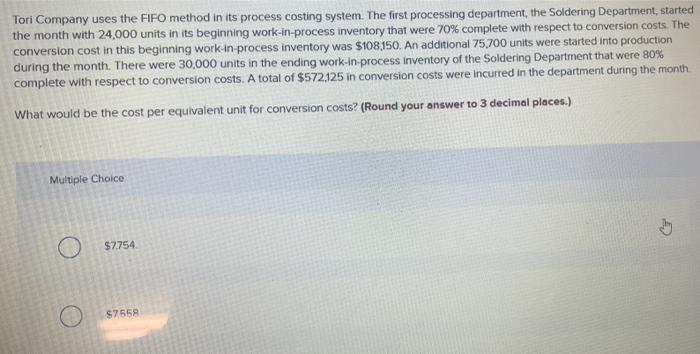

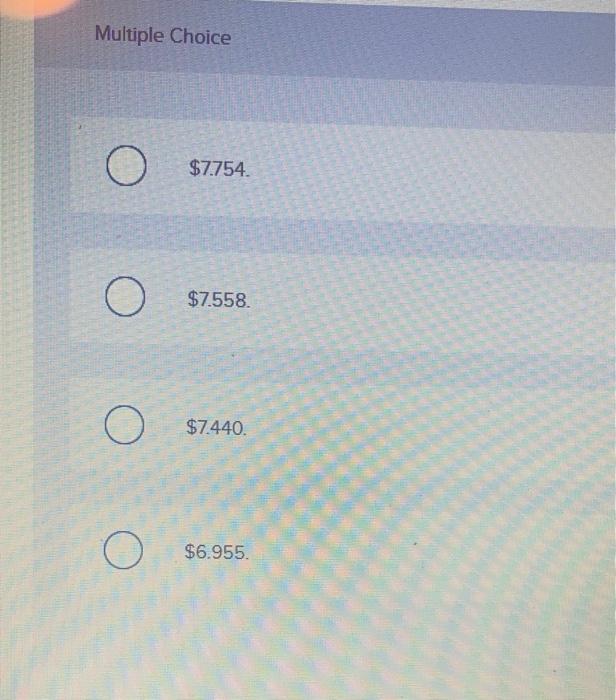

Nebraska Company uses the weighted average method in its process costing system. The first processing department, the Welding Department, started the month with 20,000 units in its beginning work-in-process inventory that were 30% complete with respect to conversion costs. The conversion cost in this beginning work-in-process inventory was $46,820. An additional 92,000 units were started into production during the month. There were 23,000 units in the ending work in process inventory of the Welding Department that were 20% complete with respect to conversion costs. A total of $697,970 in conversion costs were incurred in the department during the month What would be the cost per equivalent unit for conversion costs for the month? (Round your answer to 3 decimal places.) Multiple Choice $7957 $8 360 Multiple Choice O $7.957 O $8.360. O $7.587 $5.886. Tori Company uses the FIFO method in its process costing system. The first processing department, the Soldering Department, started the month with 24,000 units in its beginning work-in-process inventory that were 70% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $108,150. An additional 75,700 units were started into production during the month. There were 30,000 units in the ending work in process inventory of the Soldering Department that were 80% complete with respect to conversion costs. A total of $572,125 in conversion costs were incurred in the department during the month What would be the cost per equivalent unit for conversion costs? (Round your answer to 3 decimal places.) Multiple Choice $2754 57558 Multiple Choice O $7.754. O $7.558. $7.440. O O $6.955

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts