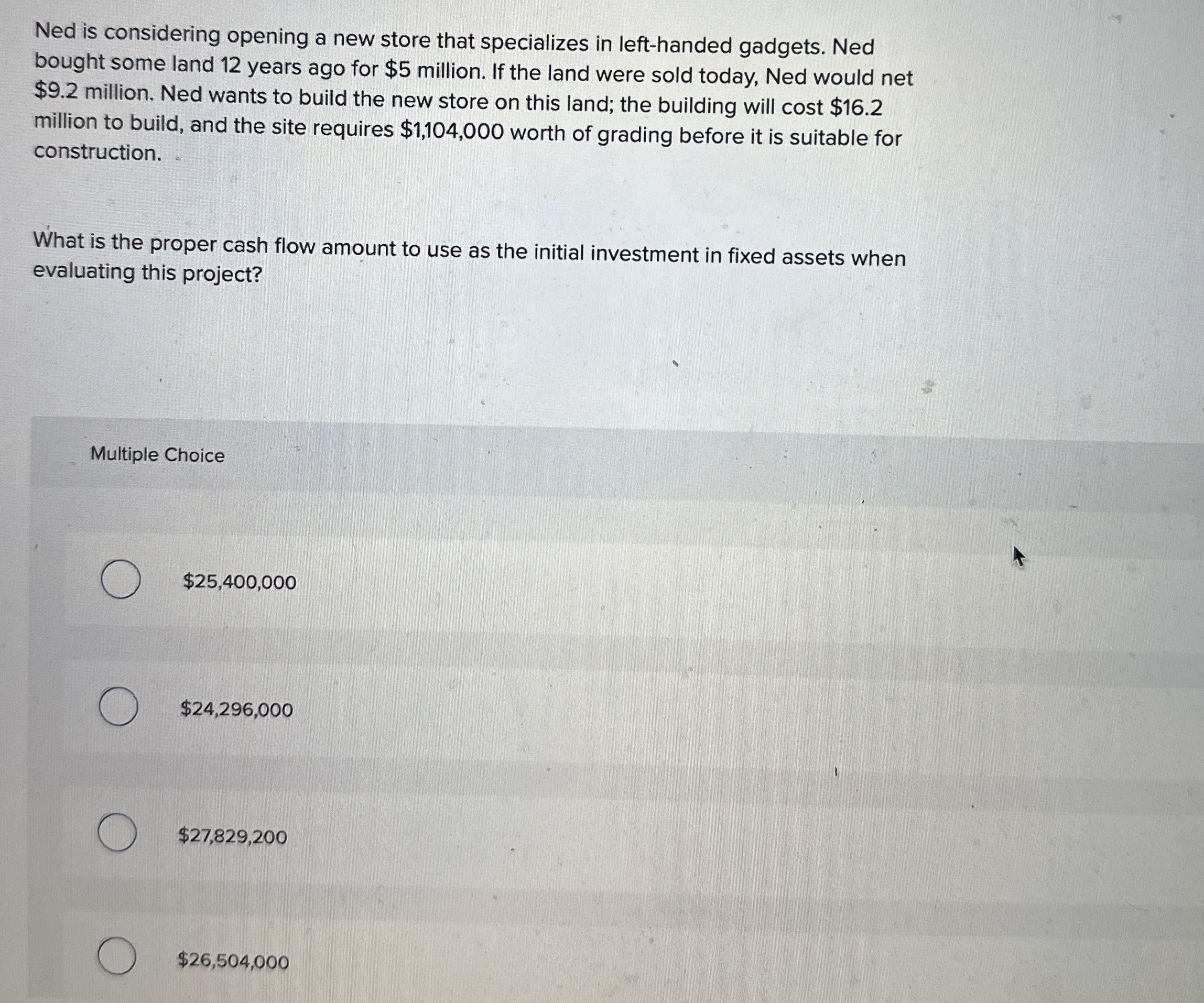

Question: Ned is considering opening a new store that specializes in left - handed gadgets. Ned bought some land 1 2 years ago for $ 5

Ned is considering opening a new store that specializes in lefthanded gadgets. Ned bought some land years ago for $ million. If the land were sold today, Ned would net $ million. Ned wants to build the new store on this land; the building will cost $ million to build, and the site requires $ worth of grading before it is suitable for construction.

What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project?

Multiple Choice

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock