Question: need 16-20 please!! CHAPTERS 8 & 9: Please read the chapters and watch the videos provided to answer the questions. 16. Use the CAPM formula

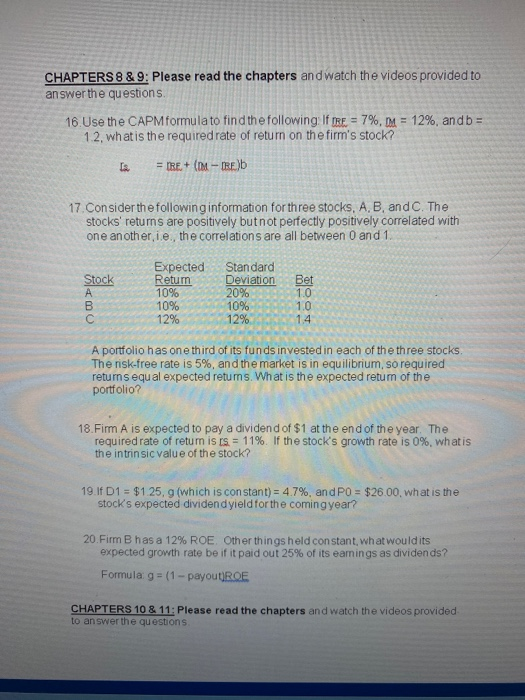

CHAPTERS 8 & 9: Please read the chapters and watch the videos provided to answer the questions. 16. Use the CAPM formula to find the following: If IRE = 7%, M = 12%, andb= 1.2. what is the required rate of return on the firm's stock? I = TRE+ (- IRE) 17. Consider the following information for three stocks, A, B, and C. The stocks' returns are positively but not perfectly positively correlated with one another, ie, the correlations are all between 0 and 1. Stock Expected Retum 10% 10% 12% Standard Deviation 20% 10% 12% Bet 1.0 1.0 1.4 C A portfolio has one third of its funds invested in each of the three stocks The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected retums. What is the expected retum of the portfolio? 18. Fimm A is expected to pay a dividend of $1 at the end of the year. The required rate of retum is is = 11%. If the stock's growth rate is 0%. what is the intrinsic value of the stock? 19.If D1 = $1.25, 9 (which is constant) = 4.7%, and PO = $26.00. what is the stocks expected dividend yield for the coming year? 20.Firm B has a 12% ROE Other things held constant, what would its expected growth rate be if it paid out 25% of its earnings as dividends? Formula: g = (1 - payout)ROE CHAPTERS 10 & 11: Please read the chapters and watch the videos provided to answer the questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts