Question: need 2,4, and 6 please requirea: 1. Assuming Dance Creations uses variable costing, calculate the varlable manufacturing cost per unit for last month 2. Complete

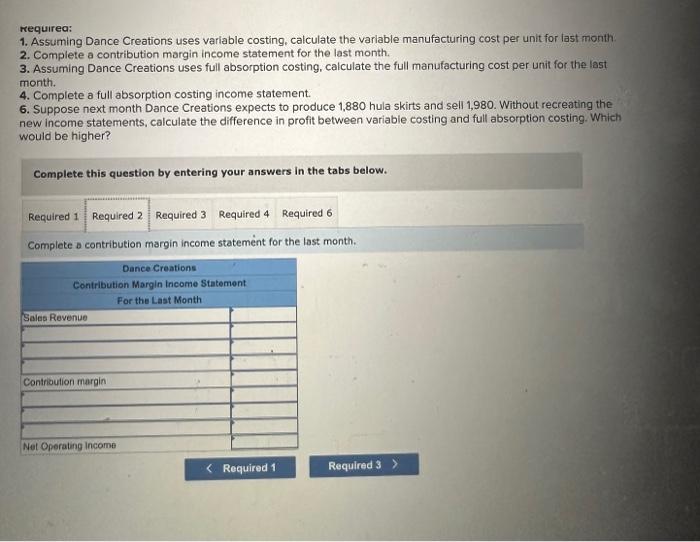

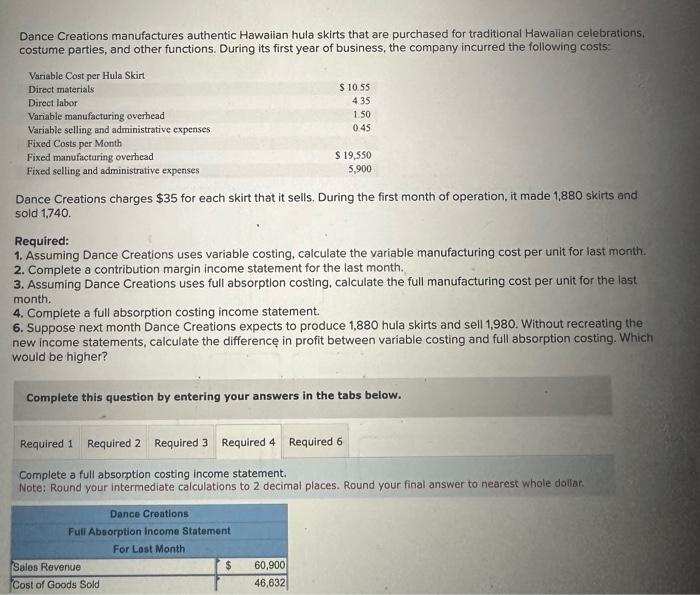

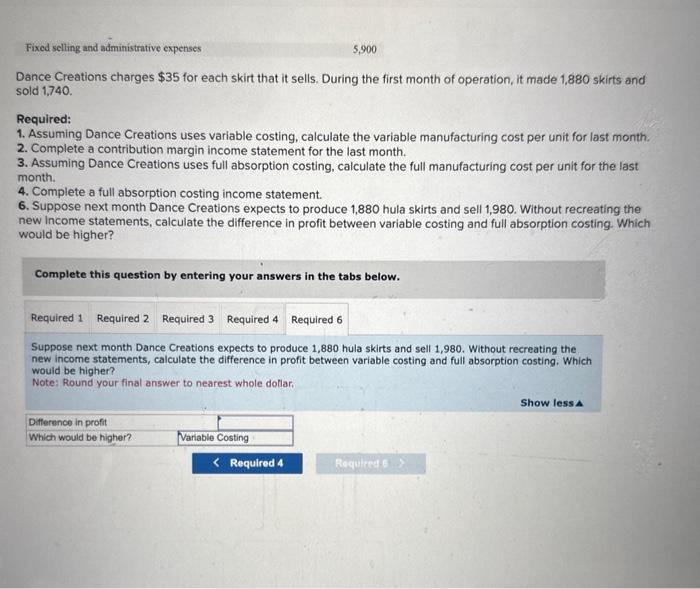

requirea: 1. Assuming Dance Creations uses variable costing, calculate the varlable manufacturing cost per unit for last month 2. Complete a contribution margin income statement for the last month. 3. Assuming Dance Creations uses full absorption costing, calculate the full manufacturing cost per unit for the last month. 4. Complete a full absorption costing income statement. 6. Suppose next month Dance Creations expects to produce 1,880 hula skirts and sell 1,980. Without recreating the new income statements, calculate the difference in profit between variabie costing and full absorption costing. Which would be higher? Complete this question by entering your answers in the tabs below. Complete a contribution margin income statement for the last month. Dance Creations manufactures authentic Hawailan hula skirts that are purchased for traditional Hawalian celebrations, costume parties, and other functions. During its first year of business, the company incurred the following costs: Dance Creations charges $35 for each skirt that it sells. During the first month of operation, it made 1,880 skirts and sold 1,740. Required: 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. 2. Complete a contribution margin income statement for the last month. 3. Assuming Dance Creations uses full absorption costing, calculate the full manufacturing cost per unit for the last month. 4. Complete a full absorption costing income statement. 6. Suppose next month Dance Creations expects to produce 1,880 hula skirts and sell 1,980. Without recreating the new income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Complete this question by entering your answers in the tabs below. Complete a full absorption costing income statement. Note: Round your intermediate calculations to 2 decimal places. Round your final answer to nearest whole dollar. Dance Creations charges $35 for each skirt that it sells. During the first month of operation, it made 1,880 skirts and sold 1,740. Required: 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. 2. Complete a contribution margin income statement for the last month. 3. Assuming Dance Creations uses full absorption costing, calculate the full manufacturing cost per unit for the last month. 4. Complete a full absorption costing income statement. 6. Suppose next month Dance Creations expects to produce 1,880 hula skirts and sell 1,980. Without recreating the new Income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Complete this question by entering your answers in the tabs below. Suppose next month Dance Creations expects to produce 1,880 hula skirts and sell 1,980 . Without recreating the new income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Note: Round your final answer to nearest whole doliar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts