Question: Need 3rd part Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does

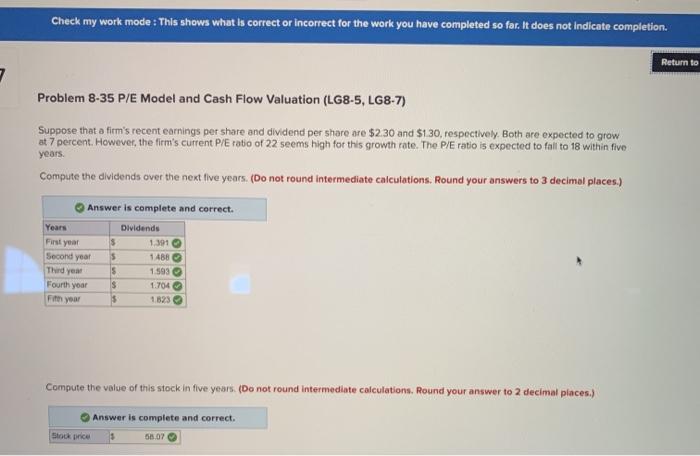

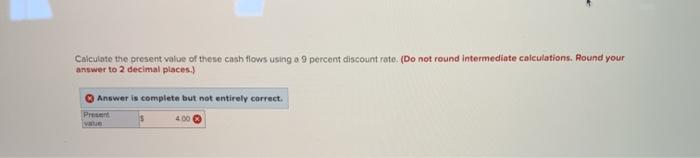

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to 7 Problem 8-35 P/E Model and Cash Flow Valuation (LG8-5, LG8-7) Suppose that o firm's recent earnings per share and dividend per share are $2.30 and $130, respectively. Both are expected to grow at 7 percent. However, the firm's current P/E ratio of 22 seems high for this growth rate. The PlE ratio is expected to fill to 18 within five years Compute the dividends over the next five years. (Do not round intermediate calculations. Round your answers to 3 decimal places.) Answer is complete and correct. Dividends Years First year Second year Third year Fourth year Fith your $ $ s 1391 1488 1.593 $ 1.704 1823 $ Compute the value of this stock in five years. (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. 5 58.07 Calculate the present value of these cash flows using a 9 percent discount rote: (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct 4.00 Present

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts