Question: need 4 and 5 please :) BAFN370 Fall 2021 For the following questions: CDCC is considering an expansion project that requires an initial fined asset

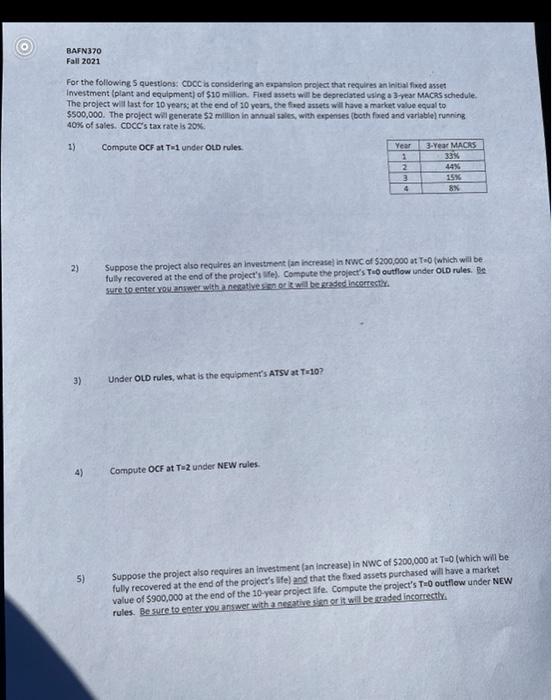

BAFN370 Fall 2021 For the following questions: CDCC is considering an expansion project that requires an initial fined asset Investment plant and equipment of $10 milion. Fleed assets will be deprecated using a 3 year MACRS schedule. The project will last for 10 years at the end of 20 years, the feed assets will have a market value equal to $500,000. The project will generate 52 million in annual sales, with expenses (both fired and variable) running 40% of sales. CDCC's tax rate is 20% Compute OCF at T 1 under OLD rules Year 1 3-Year MACRS 33% 3 4 15% 8X ) 2) Suppose the project also requires an investment an increase in NWC of $200,000 at Te which will be fully recovered at the end of the project's e Compute the project's Te outflow under OLD rules. De sure to enter you answer with a negative sent will be ded incorrectly. 3) Under OLD rules, what is the equipment's ATSV at T-107 4) Compute OCF at Tw2 under NEW rules 5) Suppose the project also requires an investment an increase) in NWC of $200,000 at Te (which will be fully recovered at the end of the project's life) and that the foxed assets purchased will have a market value of $900,000 at the end the 10-year project life Compute the project's Toutflow under NEW rules. Be sure to enter you answer with a negative snor it will be traded incorrectly BAFN370 Fall 2021 For the following questions: CDCC is considering an expansion project that requires an initial fined asset Investment plant and equipment of $10 milion. Fleed assets will be deprecated using a 3 year MACRS schedule. The project will last for 10 years at the end of 20 years, the feed assets will have a market value equal to $500,000. The project will generate 52 million in annual sales, with expenses (both fired and variable) running 40% of sales. CDCC's tax rate is 20% Compute OCF at T 1 under OLD rules Year 1 3-Year MACRS 33% 3 4 15% 8X ) 2) Suppose the project also requires an investment an increase in NWC of $200,000 at Te which will be fully recovered at the end of the project's e Compute the project's Te outflow under OLD rules. De sure to enter you answer with a negative sent will be ded incorrectly. 3) Under OLD rules, what is the equipment's ATSV at T-107 4) Compute OCF at Tw2 under NEW rules 5) Suppose the project also requires an investment an increase) in NWC of $200,000 at Te (which will be fully recovered at the end of the project's life) and that the foxed assets purchased will have a market value of $900,000 at the end the 10-year project life Compute the project's Toutflow under NEW rules. Be sure to enter you answer with a negative snor it will be traded incorrectly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts