Question: need a b and c Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets

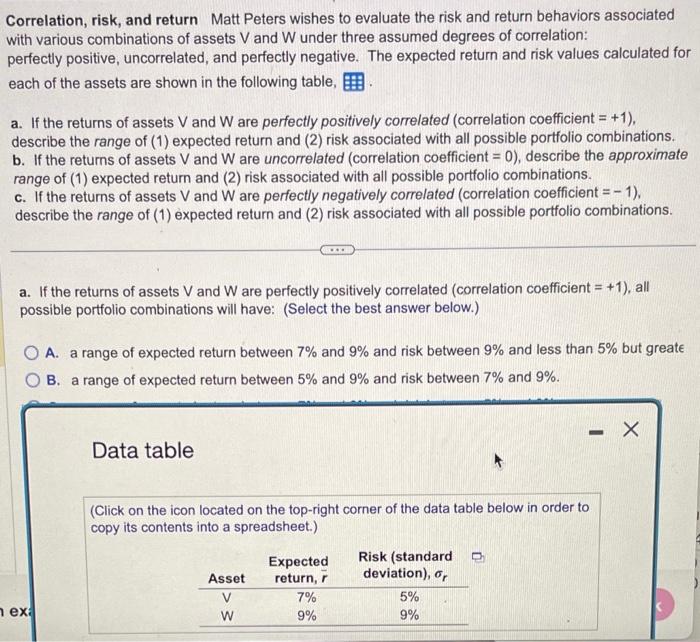

Correlation, risk, and return Matt Peters wishes to evaluate the risk and return behaviors associated with various combinations of assets V and W under three assumed degrees of correlation: perfectly positive, uncorrelated, and perfectly negative. The expected return and risk values calculated for each of the assets are shown in the following table, a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient =+1 ), describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. b. If the returns of assets V and W are uncorrelated (correlation coefficient =0 ), describe the approximate range of (1) expected return and (2) risk associated with all possible portfolio combinations. c. If the returns of assets V and W are perfectly negatively correlated (correlation coefficient =1 ). describe the range of (1) expected return and (2) risk associated with all possible portfolio combinations. a. If the returns of assets V and W are perfectly positively correlated (correlation coefficient =+1 ), all possible portfolio combinations will have: (Select the best answer below.) A. a range of expected return between 7% and 9% and risk between 9% and less than 5% but greate B. a range of expected return between 5% and 9% and risk between 7% and 9%. Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts