Question: need A, B and C Problem: Module 7 Textbook Problem 9 Learning Objectives: - 7-6 Adjust the tax basis in a partnership interest - 7-7

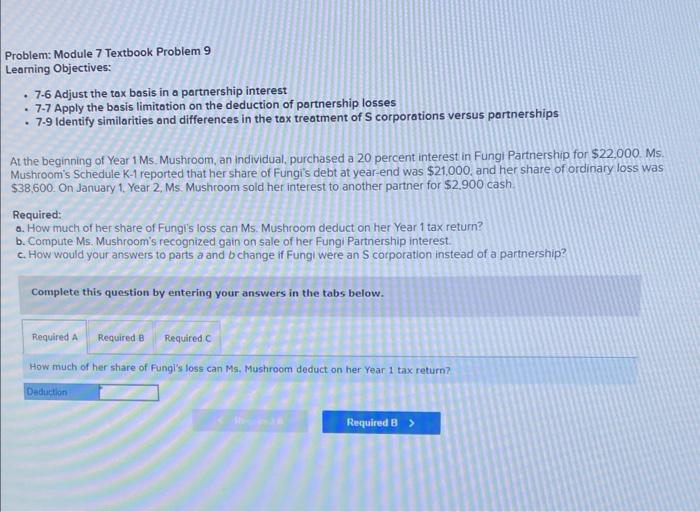

Problem: Module 7 Textbook Problem 9 Learning Objectives: - 7-6 Adjust the tax basis in a partnership interest - 7-7 Apply the bosis limitation on the deduction of partnership losses - 7-9 Identify similarities and differences in the tox treatment of S corporations versus partnerships At the beginning of Year 1Ms. Mushroom, an individual, purchased a 20 percent interest in Fungi Partnership for $22,000. Ms. Mushroom's Schedule K-1 reported that her share of Fungi's debt at year-end was $21,000, and her share of ordinary loss was $38,600. On January 1, Year 2. Ms. Mushroom sold her interest to another parther for $2,900 cash Required: a. How much of her share of Fungi's loss can Ms. Mushroom deduct on her Year 1 tax return? b. Compute Ms. Mushroom's recognized gain on sale of her Fungi Partnership interest. c. How would your answers to parts a and b change if Fungi were an S corporation instead of a partnership? Complete this question by entering your answers in the tabs below. How much of her share of Fungi's loss can Ms. Mushroom deduct on her Year 1 tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts