Question: need a correct answers for these 3 please Question 12 (4 points) You have a participating whole life insurance policy with a face value of

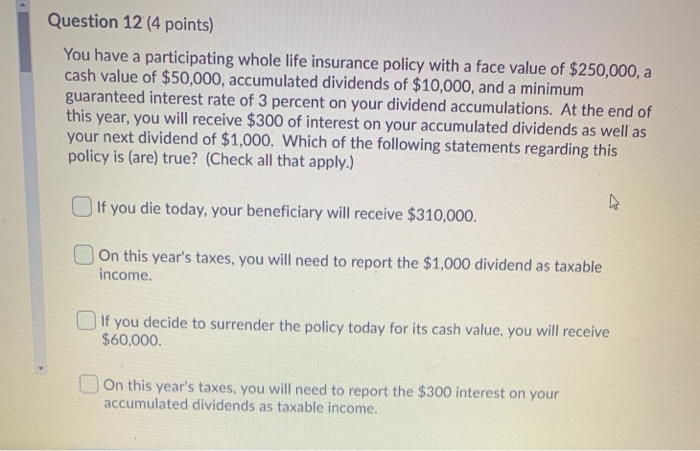

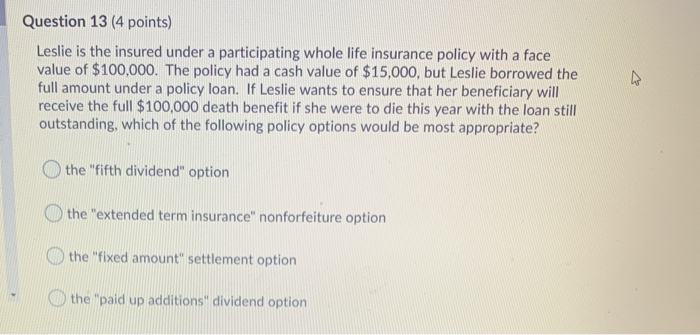

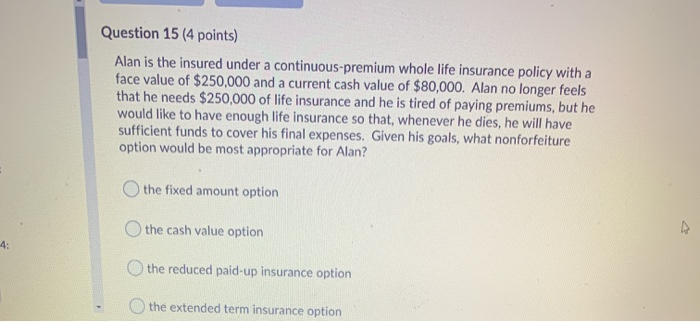

Question 12 (4 points) You have a participating whole life insurance policy with a face value of $250,000, a cash value of $50,000, accumulated dividends of $10,000, and a minimum guaranteed interest rate of 3 percent on your dividend accumulations. At the end of this year, you will receive $300 of interest on your accumulated dividends as well as your next dividend of $1,000. Which of the following statements regarding this policy is (are) true? (Check all that apply.) If you die today, your beneficiary will receive $310,000. ^ On this year's taxes, you will need to report the $1,000 dividend as taxable income. If you decide to surrender the policy today for its cash value, you will receive $60,000. On this year's taxes, you will need to report the $300 interest on your accumulated dividends as taxable income. Question 13 (4 points) Leslie is the insured under a participating whole life insurance policy with a face value of $100,000. The policy had a cash value of $15,000, but Leslie borrowed the full amount under a policy loan. If Leslie wants to ensure that her beneficiary will receive the full $100,000 death benefit if she were to die this year with the loan still outstanding, which of the following policy options would be most appropriate? the "fifth dividend" option the "extended term insurance" nonforfeiture option the "fixed amount" settlement option the "paid up additions" dividend option Question 15 (4 points) Alan is the insured under a continuous-premium whole life insurance policy with a face value of $250,000 and a current cash value of $80,000. Alan no longer feels that he needs $250,000 of life insurance and he is tired of paying premiums, but he would like to have enough life insurance so that, whenever he dies, he will have sufficient funds to cover his final expenses. Given his goals, what nonforfeiture option would be most appropriate for Alan? the fixed amount option the cash value option 4: the reduced paid-up insurance option the extended term insurance option Question 12 (4 points) You have a participating whole life insurance policy with a face value of $250,000, a cash value of $50,000, accumulated dividends of $10,000, and a minimum guaranteed interest rate of 3 percent on your dividend accumulations. At the end of this year, you will receive $300 of interest on your accumulated dividends as well as your next dividend of $1,000. Which of the following statements regarding this policy is (are) true? (Check all that apply.) If you die today, your beneficiary will receive $310,000. ^ On this year's taxes, you will need to report the $1,000 dividend as taxable income. If you decide to surrender the policy today for its cash value, you will receive $60,000. On this year's taxes, you will need to report the $300 interest on your accumulated dividends as taxable income. Question 13 (4 points) Leslie is the insured under a participating whole life insurance policy with a face value of $100,000. The policy had a cash value of $15,000, but Leslie borrowed the full amount under a policy loan. If Leslie wants to ensure that her beneficiary will receive the full $100,000 death benefit if she were to die this year with the loan still outstanding, which of the following policy options would be most appropriate? the "fifth dividend" option the "extended term insurance" nonforfeiture option the "fixed amount" settlement option the "paid up additions" dividend option Question 15 (4 points) Alan is the insured under a continuous-premium whole life insurance policy with a face value of $250,000 and a current cash value of $80,000. Alan no longer feels that he needs $250,000 of life insurance and he is tired of paying premiums, but he would like to have enough life insurance so that, whenever he dies, he will have sufficient funds to cover his final expenses. Given his goals, what nonforfeiture option would be most appropriate for Alan? the fixed amount option the cash value option 4: the reduced paid-up insurance option the extended term insurance option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts