Question: need a decent explaination to this problem, please. About Support - O X P13-3A (LO 2) AP At the beginning of its first year of

need a decent explaination to this problem, please.

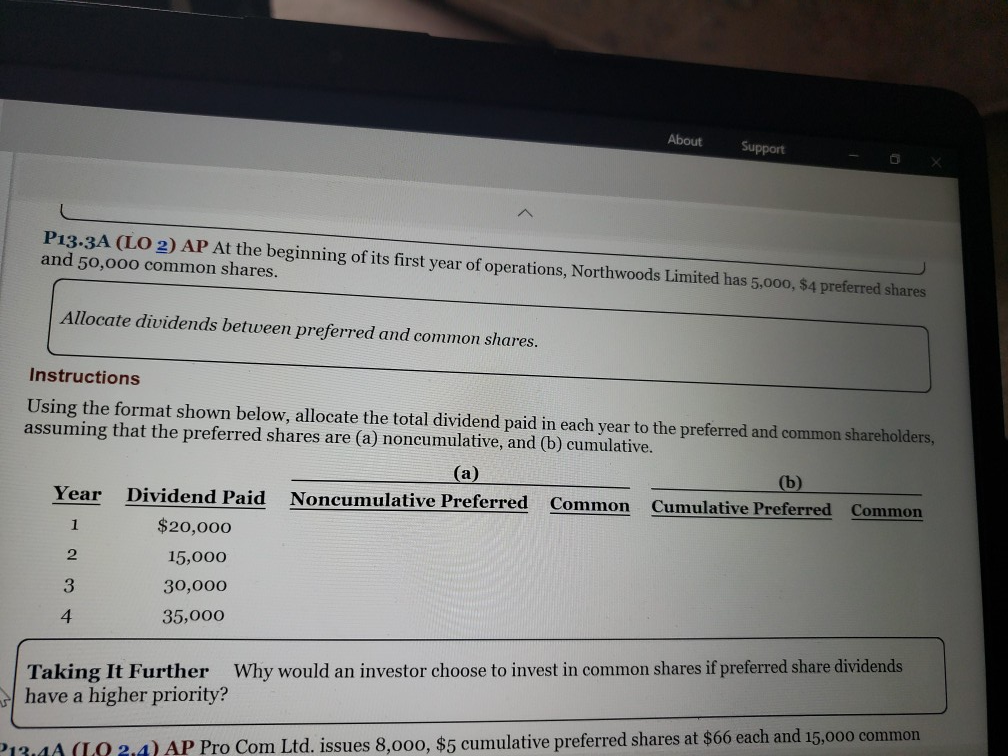

About Support - O X P13-3A (LO 2) AP At the beginning of its first year of operations, Northwoods Limited has 5,000, $4 preferred shares and 50,000 common shares. Allocate dividends between preferred and common shares. Instructions Using the format shown below, allocate the total dividend paid in each year to the preferred and common shareholders, assuming that the preferred shares are (a) noncumulative, and (b) cumulative. (a) (b) Year Noncumulative Preferred Common Cumulative Preferred Common A con Dividend Paid $20,000 15,000 30,000 35,000 Taking It Further Why would an investor choose to invest in common shares if preferred share dividends have a higher priority? P13.4A (LO 2.4) AP Pro Com Ltd. issues 8,000, $5 cumulative preferred shares at $66 each and 15,000 common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts