Question: Need a detail step by step answer for this problem with formula and don't use Excel. Only hand calculations 6) (35 points) EmKay Industries is

Need a detail step by step answer for this problem with formula and don't use Excel. Only hand calculations

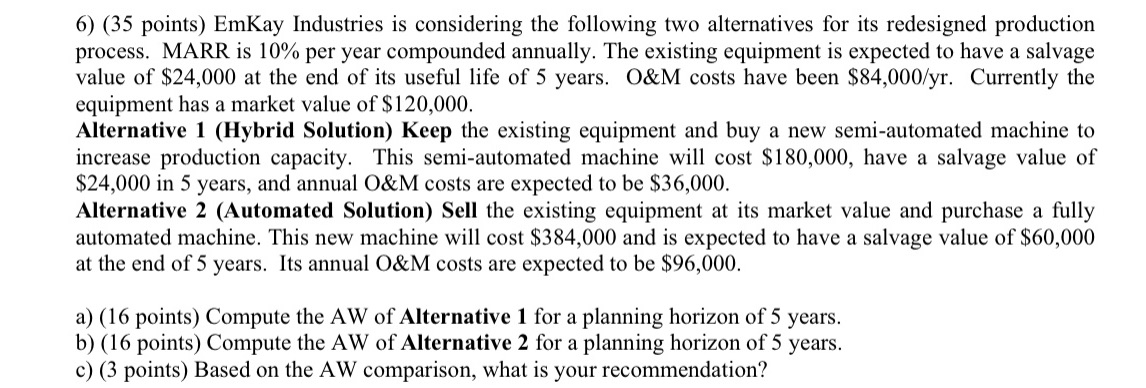

6) (35 points) EmKay Industries is considering the following two alternatives for its redesigned production process. MARR is 10% per year compounded annually. The existing equipment is expected to have a salvage value of $24,000 at the end of its useful life of 5 years. 0&M costs have been $84,000fyr. Currently the equipment has a market value of $120,000. Alternative 1 (Hybrid Solution) Keep the existing equipment and buy a new semi-automated machine to increase production capacity. This semi-automated machine will cost $180,000, have a salvage value of $24,000 in 5 years, and annual 0&M costs are expected to be $36,000. Alternative 2 (Automated Solution) Sell the existing equipment at its market value and purchase a ully automated machine. This new machine will cost $384,000 and is expected to have a salvage value of $60,000 at the end of 5 years. Its annual 0&M costs are expected to be $96,000. a) (16 points) Compute the AW of Alternative 1 for a planning horizon of 5 years. b) (16 points) Compute the AW of Alternative 2 for a planning horizon of 5 years. c) (3 points) Based on the AW comparison, what is your recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts