Question: Need a full solution showing all calculations please. not by Excel Annual cash flow from a proposed small gold leaching operation is expected to be

Need a full solution showing all calculations please. not by Excel

Need a full solution showing all calculations please. not by Excel

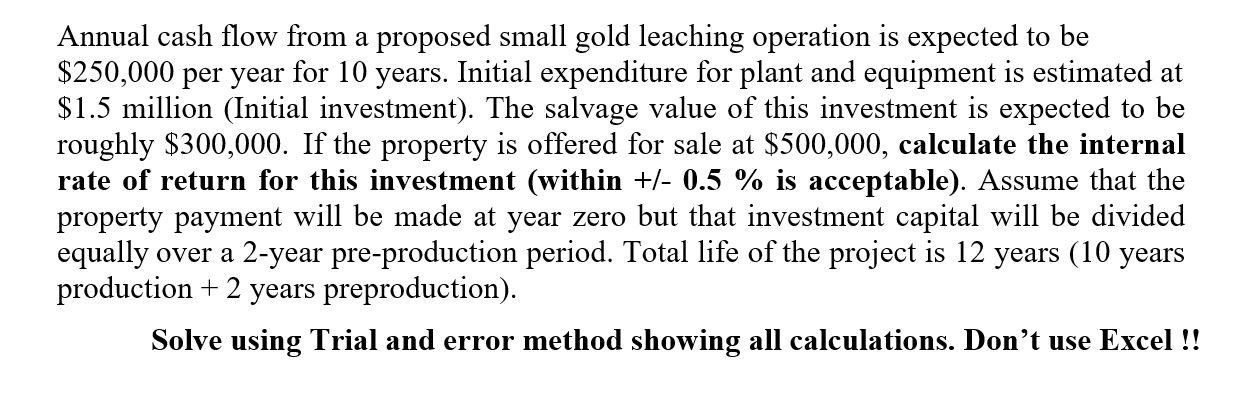

Annual cash flow from a proposed small gold leaching operation is expected to be $250,000 per year for 10 years. Initial expenditure for plant and equipment is estimated at $1.5 million (Initial investment). The salvage value of this investment is expected to be roughly $300,000. If the property is offered for sale at $500,000, calculate the internal rate of return for this investment (within +/- 0.5 % is acceptable). Assume that the property payment will be made at year zero but that investment capital will be divided equally over a 2-year pre-production period. Total life of the project is 12 years (10 years production + 2 years preproduction). Solve using Trial and error method showing all calculations. Don't use Excel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts