Question: Need a help to make sure I solved this right. Thanks in Advance 4. Compare and contrast Pass-Through mortgage-backed securities with multi-structure collateralized mortgage obligations

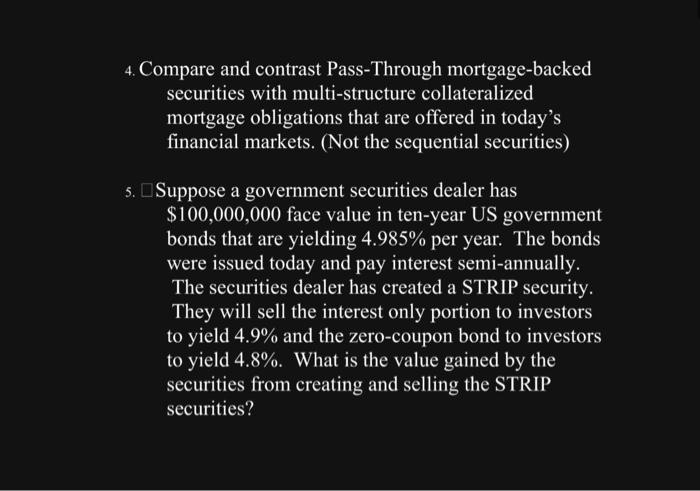

4. Compare and contrast Pass-Through mortgage-backed securities with multi-structure collateralized mortgage obligations that are offered in today's financial markets. (Not the sequential securities) 5. Suppose a government securities dealer has $100,000,000 face value in ten-year US government bonds that are yielding 4.985% per year. The bonds were issued today and pay interest semi-annually. The securities dealer has created a STRIP security. They will sell the interest only portion to investors to yield 4.9% and the zero-coupon bond to investors to yield 4.8%. What is the value gained by the securities from creating and selling the STRIP securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts