Question: Need a little help solving this one. Learning Objectives 2, 4 P26-30A Using payback, ARR, NPV, IRR, and profitability index to make capital investment decisions

Need a little help solving this one.

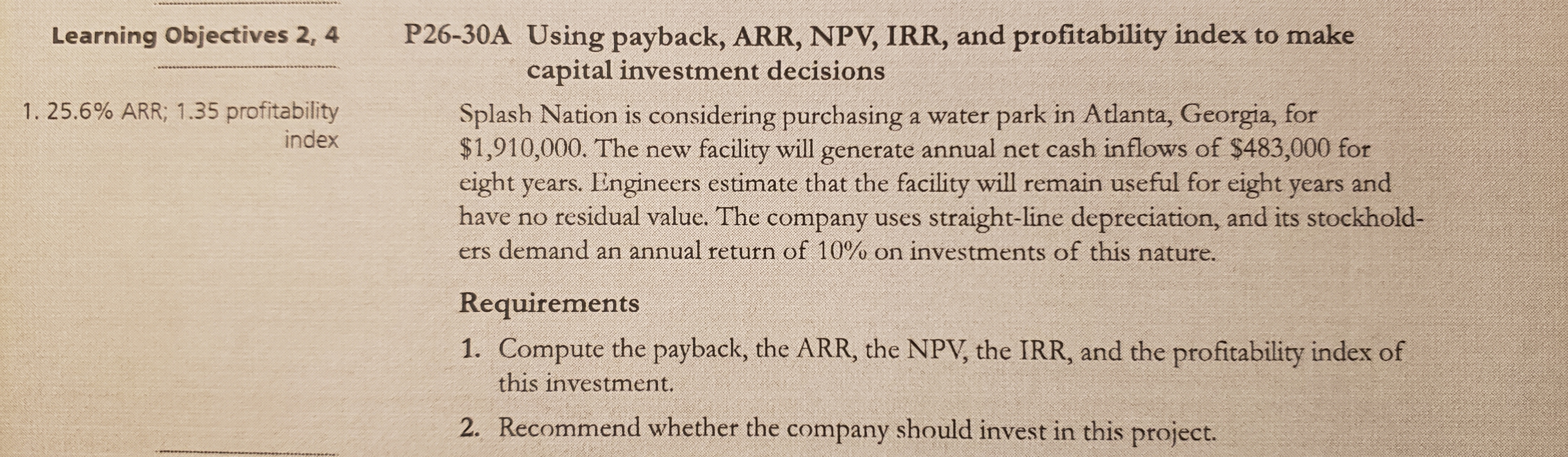

Learning Objectives 2, 4 P26-30A Using payback, ARR, NPV, IRR, and profitability index to make capital investment decisions 1. 25.6% ARR; 1.35 profitability index Splash Nation is considering purchasing a water park in Atlanta, Georgia, for $1,910,000. The new facility will generate annual net cash inflows of $483,000 for eight years. Engineers estimate that the facility will remain useful for eight years and have no residual value. The company uses straight-line depreciation, and its stockhold- ers demand an annual return of 10% on investments of this nature. Requirements 1. Compute the payback, the ARR, the NPV, the IRR, and the profitability index of this investment. 2. Recommend whether the company should invest in this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts