Question: Need a Microsoft Excel Layout please Page 48Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of

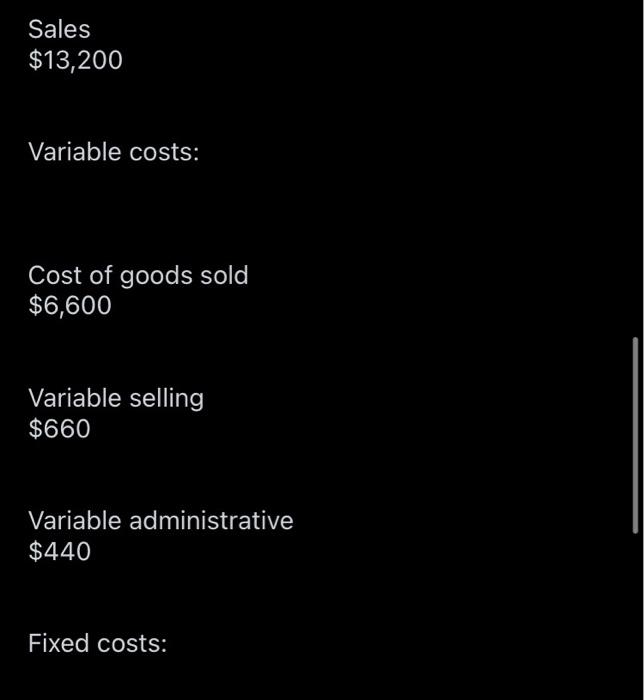

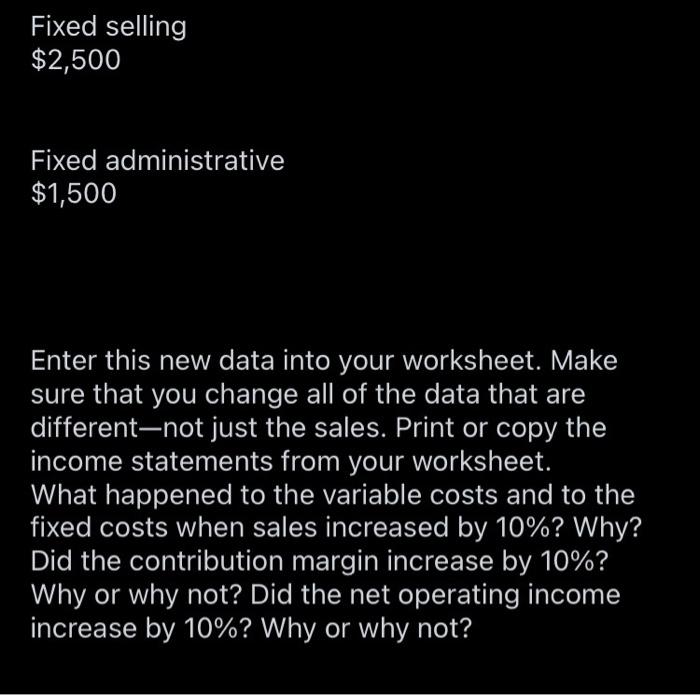

Page 48Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4,700. If you do not get these answers, find the errors in your worksheet and correct them. How much is the gross margin? Did it change? Why or why not? Suppose that sales are 10% higher as shown below: Table Summary: Table lists dollar amounts for sales, types of variable costs, and types of fixed costs. There are three types of variable costs and two types of fixed costs. Sales $13,200 Variable costs: Cost of goods sold $6,600 Variable selling $660 Variable administrative $440 Fixed costs: Fixed selling $2,500 Fixed administrative $1,500 Enter this new data into your worksheet. Make sure that you change all of the data that are different-not just the sales. Print or copy the income statements from your worksheet. What happened to the variable costs and to the fixed costs when sales increased by 10%? Why? Did the contribution margin increase by 10%? Why or why not? Did the net operating income increase by 10%? Why or why not? Page 48Check your worksheet by changing the variable selling cost in the Data area to $900, keeping all of the other data the same as in Exhibit 1-7. If your worksheet is operating properly, the net operating income under the traditional format income statement and under the contribution format income statement should now be $700 and the contribution margin should now be $4,700. If you do not get these answers, find the errors in your worksheet and correct them. How much is the gross margin? Did it change? Why or why not? Suppose that sales are 10% higher as shown below: Table Summary: Table lists dollar amounts for sales, types of variable costs, and types of fixed costs. There are three types of variable costs and two types of fixed costs. Sales $13,200 Variable costs: Cost of goods sold $6,600 Variable selling $660 Variable administrative $440 Fixed costs: Fixed selling $2,500 Fixed administrative $1,500 Enter this new data into your worksheet. Make sure that you change all of the data that are different-not just the sales. Print or copy the income statements from your worksheet. What happened to the variable costs and to the fixed costs when sales increased by 10%? Why? Did the contribution margin increase by 10%? Why or why not? Did the net operating income increase by 10%? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts