Question: need a quick neat Solution with calculations & formula in excel with in word style Question 1 a. You have computed the Net Present Value

need a quick neat Solution with calculations & formula in excel with in word style

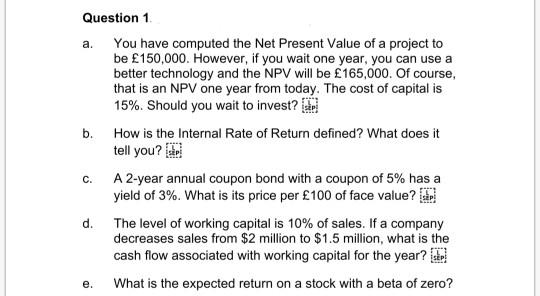

Question 1 a. You have computed the Net Present Value of a project to be 150,000. However, if you wait one year, you can use a better technology and the NPV will be 165,000. Of course, that is an NPV one year from today. The cost of capital is 15%. Should you wait to invest? b. How is the Internal Rate of Return defined? What does it tell you? A 2-year annual coupon bond with a coupon of 5% has a yield of 3%. What is its price per 100 of face value? The level of working capital is 10% of sales. If a company decreases sales from $2 million to $1.5 million, what is the cash flow associated with working capital for the year? What is the expected return on a stock with a beta of zero? c. d. e. equity after the firm completes these transactions? What is the new WACC? What is the new share price (calculate it, don't just assume it)? Are shareholders better or worse off as a result of the change in capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts