Question: Need a solution for this ASAP please Immunization: Assume that your employer has a $1.5 million liability coming due in precisely six years. CFO of

Need a solution for this ASAP please

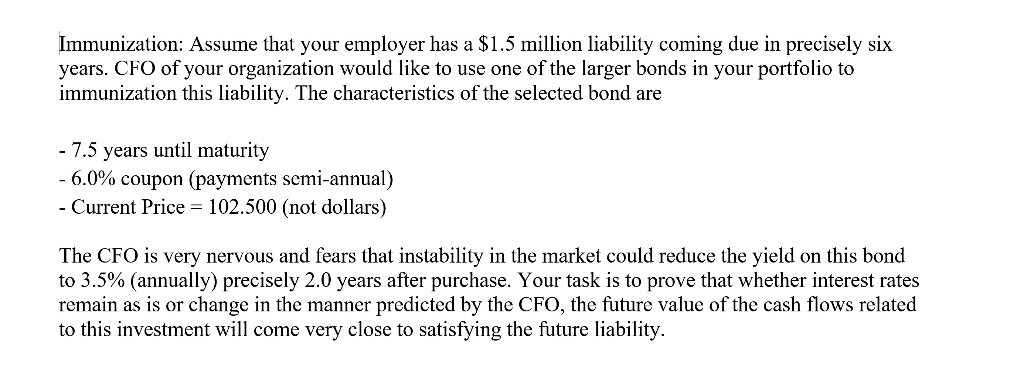

Immunization: Assume that your employer has a $1.5 million liability coming due in precisely six years. CFO of your organization would like to use one of the larger bonds in your portfolio to immunization this liability. The characteristics of the selected bond are - 7.5 years until maturity -6.0% coupon (payments semi-annual) - Current Price = 102.500 (not dollars) The CFO is very nervous and fears that instability in the market could reduce the yield on this bond to 3.5% (annually) precisely 2.0 years after purchase. Your task is to prove that whether interest rates remain as is or change in the manner predicted by the CFO, the future value of the cash flows related to this investment will come very close to satisfying the future liability. Immunization: Assume that your employer has a $1.5 million liability coming due in precisely six years. CFO of your organization would like to use one of the larger bonds in your portfolio to immunization this liability. The characteristics of the selected bond are - 7.5 years until maturity -6.0% coupon (payments semi-annual) - Current Price = 102.500 (not dollars) The CFO is very nervous and fears that instability in the market could reduce the yield on this bond to 3.5% (annually) precisely 2.0 years after purchase. Your task is to prove that whether interest rates remain as is or change in the manner predicted by the CFO, the future value of the cash flows related to this investment will come very close to satisfying the future liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts