Question: Need a tutor that understands how to correctly use Excel to answer question 4-10. Please do not attempt to use A.I, as it is not

Need a tutor that understands how to correctly use Excel to answer question 4-10. Please do not attempt to use A.I, as it is not entirely familiar with excel functions, (=PV, =PMT, =SUM, =ROUND, to name a few) it will present the incorrect answers. Please and thank you. So far we seem to be only getting 7 0f 10 correct

Question 1

An efficient portfolio:

I. has only unique risk

II. provides the highest expected return for a given level of risk

III. provides the least risk for a given level of expected return

IV. has no risk at all

Group of answer choices

A. II and III only

B. IV only

C. I only

D. II only

Question 2

The correlation coefficient between the efficient portfolio and the risk-free asset is:

Group of answer choices

A. -1.0

B. 0.0

C. need further information

D. +1.0

Question 3

The presence of a risk-free asset enables the investor to:

I. invest in the market portfolio

II. find an interior portfolio using quadratic programming

III. borrow or lend at the risk-free rate

IV. form portfolios having greater Sharpe ratios

Group of answer choices

A. III and IV only

B. IV only

C. I and II only

D. I and III only

Question 4

A stock had returns of 8.26 percent, -1.76 percent, and 3.35 percent for the past three years. What is the standard deviation of the returns? (Note that this is a sample of returns.)

Enter your answer as a decimal rounded to the nearest fourth decimal place. For example, enter 12.345% as .1235.

Question 5

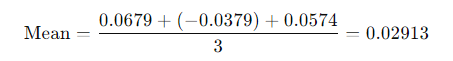

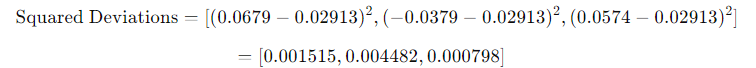

A stock had returns of 6.79 percent, -3.79 percent, and 5.74 percent for the past three years. What is the variance of the returns? (Note that this is a sample of returns.)

Enter your answer as a decimal rounded to the nearest fourth decimal place. For example, enter 12.345% as .1235.

Question 6

What is the arithmetic average return for a stock with annual returns of -4.35 percent, 13.18 percent, 4.21 percent, and -1.84 percent?

Enter your answer as a decimal rounded to the nearest fourth decimal place. For example, enter 12.345% as .1235.

Question 7

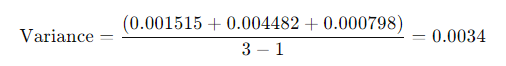

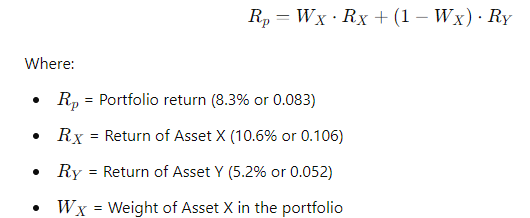

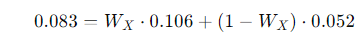

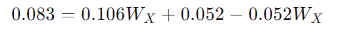

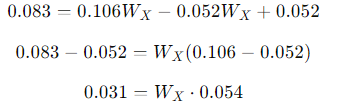

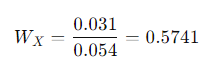

You're constructing a portfolio comprised of two assets, X and Y. Asset X generates an expected annual return of 10.6%. Asset Y generates an expected annual return of 5.2%. If you want your portfolio to have an expected return of 8.3%, then how much (i.e., what percentage of your funds) should in vest in Asset X?

Enter your answer as a decimal rounded to the nearest fourth decimal place. For example, enter 12.345% as .1235.

Question 8

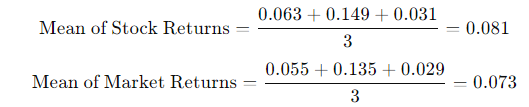

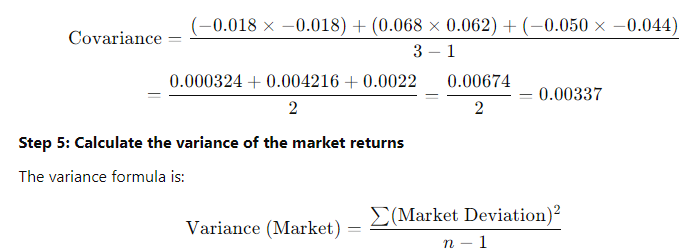

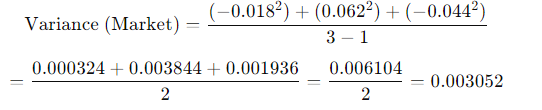

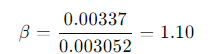

The annual returns for three years for stock B were 6.3%, 14.9%, and 3.1%. Annual returns for three years for the market portfolio were 5.5%, 13.5%, and 2.9%. Calculate the beta for the stock.

Enter your answer rounded to the second decimal place. For example, enter 1.234 as 1.23.

Question 9

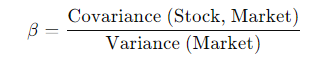

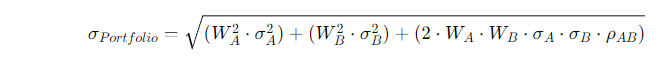

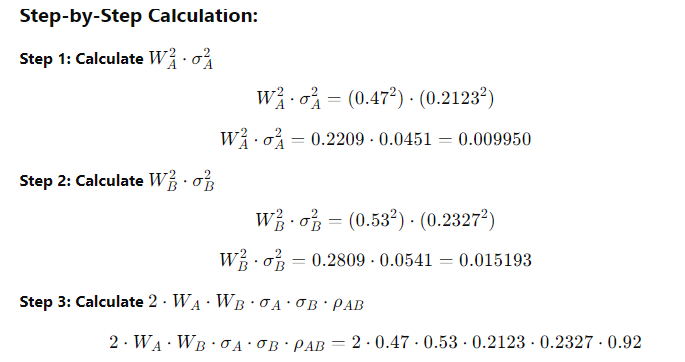

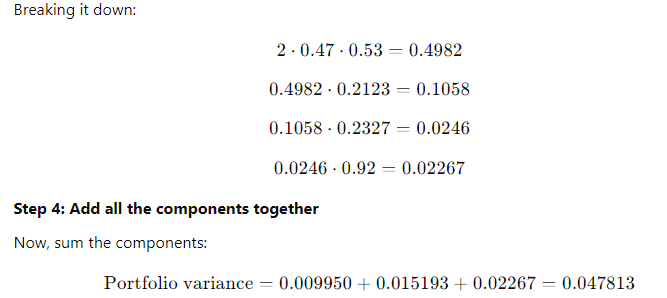

Ebenezer Scrooge has invested 47% of his money in asset A and the remainder in asset B. The returns on asset A have a standard deviation of 21.23% and the returns on asset B have a standard deviation of 23.27%. The correlation between returns is 0.92. What is the standard deviation of Scrooge's portfolio?

Enter your answer as a decimal rounded to the nearest fourth decimal place. For example, enter 12.345% as .1235.

Question 10

Janet wants to construct a portfolio comprised of an index fund and U.S. Treasury bills. The index fund as an expected annual return of 10.83% and the Treasury bills have an expected annual return of 2.21%. The index fund has a standard deviation of 12.28% and the Treasury bills have a standard deviation of 0%. Additionally, there is no correlation between index fund returns and Treasury bill returns.

If Janet wants to construct a portfolio to generate an expected annual return of 7.4% using this index fund and Treasury bills, then what will be her portfolio's standard deviation?

Enter your answer as a decimal rounded to the nearest fourth decimal place. For example, enter 12.345% as .1235.

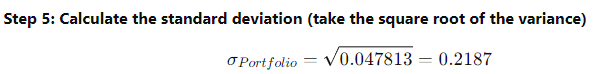

0.0679 + (-0.0379) + 0.0574 Mean 0.02913Squared Deviations = [(0.0679 - 0.02913)', (-0.0379 - 0.02913), (0.0574 - 0.02913)2] - [0.001515, 0.004482, 0.000798\fRo = Wx . Rx + (1 - Wx) . RY Where: Ro = Portfolio return (8.3% or 0.083) Rx = Return of Asset X (10.6% or 0.106) Ry = Return of Asset Y (5.2% or 0.052) . Wy = Weight of Asset X in the portfolio0.083 = Wx . 0.106 + (1 - Wx ) . 0.0520.083 = 0.106Wx + 0.052 - 0.052Wx\f0.031 WX - 0.5741 0.0540.063 + 0.149 + 0.031 Mean of Stock Returns = = 0.081 3 0.055 + 0.135 + 0.029 Mean of Market Returns = - 0.073 3(0.018 x 0.018) + (0.068 x 0.062) + (0.050 x 0.044) 31 ~0.000324 + 0.004216 + 0.0022 0.00674 2 2 Covariance 0.00337 Step 5: Calculate the variance of the market returns The variance formula is: 3 (Market Deviation)? Variance (Market) 3 n \f\f\fPortfolio ( 40 . =V(W.O )+ (W . OR) + (2 . WA . WB . GA . OB . PAB)\fBreaking it down: 2.0.47-0.53 0.4982 0.4982 - 0.2123 0.1058 0.1058 - 0.2327 0.0246 0.0246 - 0.92 0.02267 Step 4: Add all the components together Now, sum the components: Portfolio variance 0.009950 + 0.015193 + 0.02267 0.047813 Step 5: Calculate the standard deviation (take the square root of the variance) T Port folio V 0.047813 0.2187

0.0679 + (-0.0379) + 0.0574 Mean 0.02913Squared Deviations = [(0.0679 - 0.02913)', (-0.0379 - 0.02913), (0.0574 - 0.02913)2] - [0.001515, 0.004482, 0.000798\fRo = Wx . Rx + (1 - Wx) . RY Where: Ro = Portfolio return (8.3% or 0.083) Rx = Return of Asset X (10.6% or 0.106) Ry = Return of Asset Y (5.2% or 0.052) . Wy = Weight of Asset X in the portfolio0.083 = Wx . 0.106 + (1 - Wx ) . 0.0520.083 = 0.106Wx + 0.052 - 0.052Wx\f0.031 WX - 0.5741 0.0540.063 + 0.149 + 0.031 Mean of Stock Returns = = 0.081 3 0.055 + 0.135 + 0.029 Mean of Market Returns = - 0.073 3(0.018 x 0.018) + (0.068 x 0.062) + (0.050 x 0.044) 31 ~0.000324 + 0.004216 + 0.0022 0.00674 2 2 Covariance 0.00337 Step 5: Calculate the variance of the market returns The variance formula is: 3 (Market Deviation)? Variance (Market) 3 n \f\f\fPortfolio ( 40 . =V(W.O )+ (W . OR) + (2 . WA . WB . GA . OB . PAB)\fBreaking it down: 2.0.47-0.53 0.4982 0.4982 - 0.2123 0.1058 0.1058 - 0.2327 0.0246 0.0246 - 0.92 0.02267 Step 4: Add all the components together Now, sum the components: Portfolio variance 0.009950 + 0.015193 + 0.02267 0.047813 Step 5: Calculate the standard deviation (take the square root of the variance) T Port folio V 0.047813 0.2187

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts