Question: Need all answers separately serial wise please solve all the parts of the questions . Quration 1 Shinfy Cleaning Services Company offers cleasidg services wo

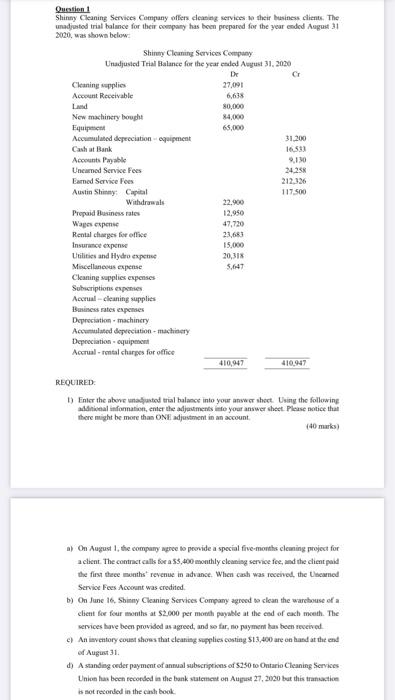

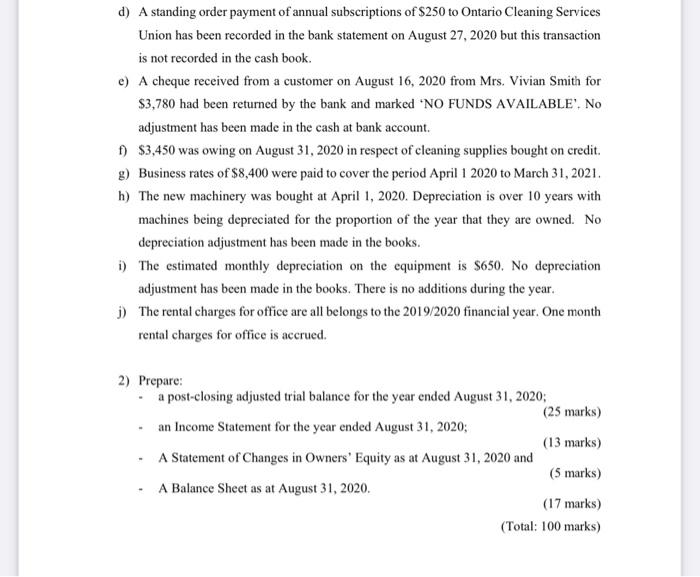

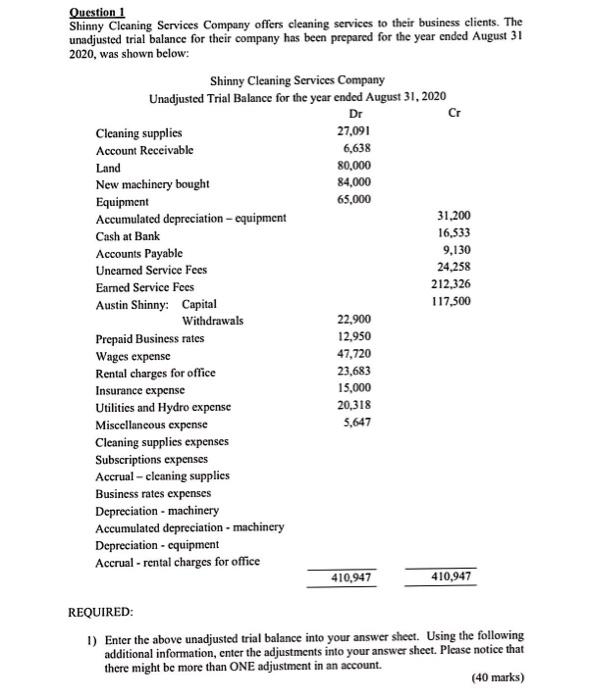

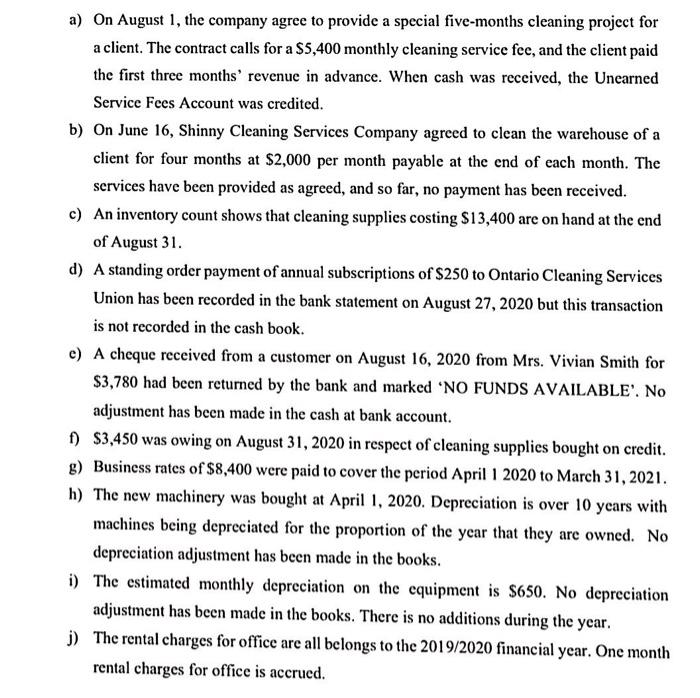

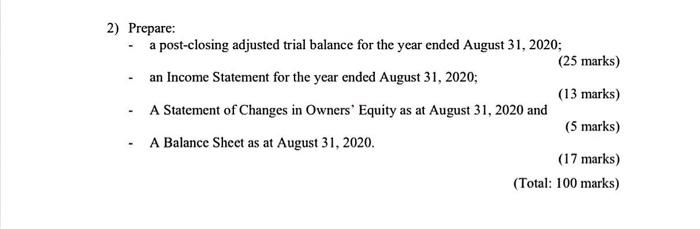

Quration 1 Shinfy Cleaning Services Company offers cleasidg services wo their tusiness dients. The unadjontod trial balance for their ceenpary has boen prepared for the year eoded Aogus 31 2020, was shown below: RERUURED. 1) Enier the abeve unasuated trial balasee into your answer shect. Using the following addineal information, enter the adjenments into yoar answer shect. Please notice that there might be more thas ON1 adjustment in an account. (40 marks) a) On August 1, the company apree to peovide a special fivermonthe clcming project for a client. The contract calls for a 55,400 monthly cleaning service fee, and the client paid the firs thece months' revenue in advance. When cash was received, the Chearned Service Fees Acconnt was credited. b) On June 16, Sbiny Cleaning Scrvices Compamy agrecd to clean the warchouse of a client for four months at $2000 per month payable at the ead of each mieeth. The services have becn providod as agreed, and wo far, no payment has heen reveived. c) An iaventory coust shows that eleanisg sapplies costing $13,400 are on hand at the end of Nugust 31. d) A standiag ceder payment of annual subscripeions of 5250 to Ontario Cleaning ServicesUnion fas been feconded in the bank statement on Auguse 27, 2020 but this transastion is sot reconted in the cinh book. d) A standing order payment of annual subscriptions of $250 to Ontario Cleaning Services Union has been recorded in the bank statement on August 27, 2020 but this transaction is not recorded in the cash book. e) A cheque received from a customer on August 16, 2020 from Mrs. Vivian Smith for $3,780 had been returned by the bank and marked 'NO FUNDS AVAILABLE'. No adjustment has been made in the cash at bank account. f) \$3,450 was owing on August 31, 2020 in respect of cleaning supplies bought on credit. g) Business rates of $8,400 were paid to cover the period April 12020 to March 31,2021 . h) The new machinery was bought at April 1, 2020. Depreciation is over 10 years with machines being depreciated for the proportion of the year that they are owned. No depreciation adjustment has been made in the books. i) The estimated monthly depreciation on the equipment is $650. No depreciation adjustment has been made in the books. There is no additions during the year. j) The rental charges for office are all belongs to the 2019/2020 financial year. One month rental charges for office is accrued. 2) Prepare: - a post-closing adjusted trial balance for the year ended August 31, 2020; (25 marks) - an Income Statement for the year ended August 31, 2020; (13 marks) - A Statement of Changes in Owners' Equity as at August 31, 2020 and (5 marks) - A Balance Sheet as at August 31, 2020. (17 marks) (Total: 100 marks) Qucstion1 Shinny Cleaning Services Company offers cleaning services to their business clients. The unadjusted trial balance for their company has been prepared for the year cnded August 31 2020 , was shown below: 1) Enter the above unadjusted trial balance into your answer sheet. Using the following additional information, enter the adjustments into your answer sheet. Please notice that there might be more than ONE adjustment in an account. (40 marks) a) On August 1, the company agree to provide a special five-months cleaning project for a client. The contract calls for a $5,400 monthly cleaning service fee, and the client paid the first three months' revenue in advance. When cash was received, the Unearned Service Fees Account was credited. b) On June 16, Shinny Cleaning Services Company agreed to clean the warehouse of a client for four months at $2,000 per month payable at the end of each month. The services have been provided as agreed, and so far, no payment has been received. c) An inventory count shows that cleaning supplies costing $13,400 are on hand at the end of August 31 . d) A standing order payment of annual subscriptions of $250 to Ontario Cleaning Services Union has been recorded in the bank statement on August 27, 2020 but this transaction is not recorded in the cash book. e) A cheque received from a customer on August 16, 2020 from Mrs. Vivian Smith for $3,780 had been returned by the bank and marked 'NO FUNDS AVAILABLE'. No adjustment has been made in the cash at bank account. f) $3,450 was owing on August 31,2020 in respect of cleaning supplies bought on credit. g) Business rates of $8,400 were paid to cover the period April 12020 to March 31,2021. h) The new machinery was bought at April 1, 2020. Depreciation is over 10 years with machines being depreciated for the proportion of the year that they are owned. No depreciation adjustment has been made in the books. i) The estimated monthly depreciation on the equipment is $650. No depreciation adjustment has been made in the books. There is no additions during the year. j) The rental charges for office are all belongs to the 2019/2020 financial year. One month rental charges for office is accrued. 2) Prepare: - a post-closing adjusted trial balance for the year ended August 31,2020; (25 marks) - an Income Statement for the year ended August 31, 2020; (13 marks) - A Statement of Changes in Owners' Equity as at August 31, 2020 and (5 marks) - A Balance Shect as at August 31, 2020. (17 marks) (Total: 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts