Question: need all questions done please will give thumbs up 2. (15 points) A power company is preparing a bid to become the lead contractor on

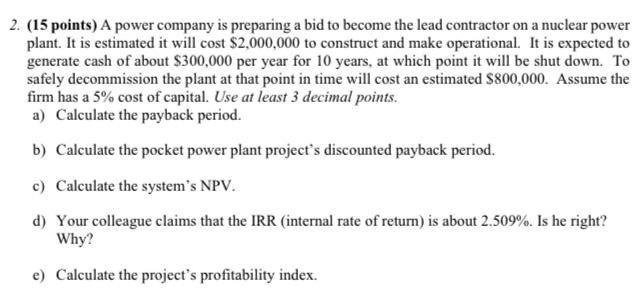

2. (15 points) A power company is preparing a bid to become the lead contractor on a nuclear power plant. It is estimated it will cost $2,000,000 to construct and make operational. It is expected to generate cash of about $300,000 per year for 10 years, at which point it will be shut down. To safely decommission the plant at that point in time will cost an estimated $800,000. Assume the firm has a 5% cost of capital. Use at least 3 decimal points. a) Calculate the payback period. b) Calculate the pocket power plant project's discounted payback period. c) Calculate the system's NPV. d) Your colleague claims that the IRR (internal rate of return) is about 2.509%. Is he right? Why? e) Calculate the project's profitability index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts