Question: Need all reqs = Homework! Homework Unaprer iwelve Save Part 1 of 5 O 0 Points: 0 of 2 Solve various time value of money

Need all reqs

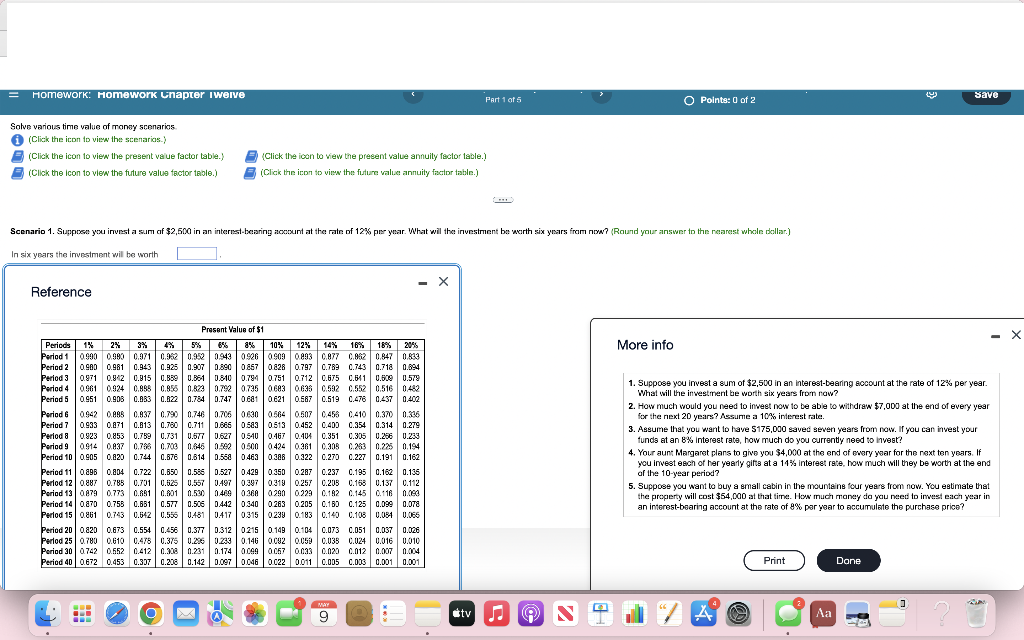

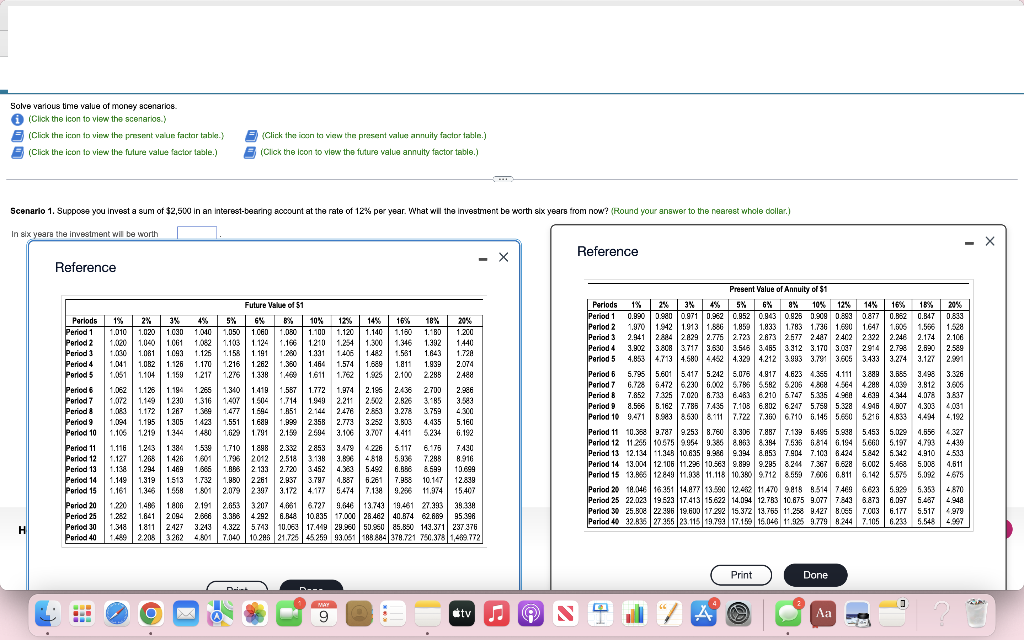

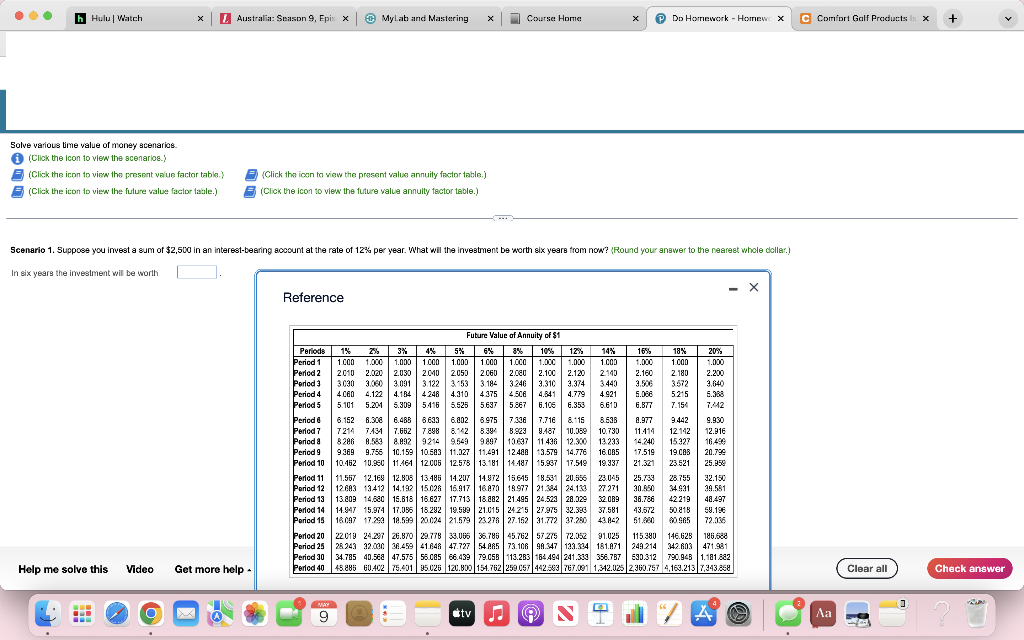

= Homework! Homework Unaprer iwelve Save Part 1 of 5 O 0 Points: 0 of 2 Solve various time value of money scenarios (Click the icon to view the scenarios. 2 (Click the icon to view the present value factor table. (Click the icon to view the future value factor table.) ) 2 (Click the icon to view the present value annuity factor table. (Click the icon to view the future value annuity factor table.) Scenario 1. Suppose your invest a sum of $2,500 in an interest-bearing account at the rate of 12% per year. What will the investment be wirth six years from now? (Round your answer to the nearest whole dollar.) . ? In six years the investment will be worth Reference - X More info Present Value of $1 Periods 18 % 2x 3% 4% % 5% 896 8% 10% 12% 14% 16% 18% 20% % Period 1 0.990 0.990 0.971 0.92 0.952 0.943 0.926 0909 0.893 C.877 C.662 0.847 0.833 Period 20.400 0.981 0.943 0.925 0.907 0.890 08570828 0.797 0.789 0.7430.7180.894 Period 3 0.871 0.942 0.815 0.859 0.851 0.810 0.794 0.751 0.712 0.675 0.511 0.50 0.578 Period 4 0961 0.924 0961 0.924 0.895 0.855 0.823 0.792 0.735 0683 0633 0.592 0.552 0.516 0482 Period 5 0951 0.908 0.951 0.905 0.883 0.122 0.784 0.747 0.681 0.621 0.587 0.519 0.478 0.437 0.402 Period 0.942 0.08 0.437 0.790 0.746 0.70606300564 0507 0.450.410 0.370 0.336 Period 7 0.933 0.271 0.933 0.271 0.813 0.780 0.711 0.813 0.750 0.711 0.665 0.583 0.513 0.452 0.400 0.354 D.B 0.400 0.354 0.314 0.279 Period 8 0.923 0.853 0.759 0.7310.577 0.527 0.540 0.467 0.404 0.351 C.303 0.256 0.233 Period 9 0914 0.37 0.788 0.70 0.6450.50205000424 0.361 0.308 0.263 0.225 9 0.194 Period 100.005 0.820 0.744 0.878 0.614 0.56 0.463 0.388 0.322 .270 0.227 0.191 0.162 Period 110.898 0.804 0.722 0.650 0.58 0.527 0.429 0.350 0.287 0.237 C.195 0.162 0.136 Period 12 0.887 0.785 0.7010.525 0.557 0.497 0.397 0.319 0.257 0.205 0.15 0.137 0.112 Period 130.079 0.773 0.861 0.801 0.53 0.409 0.28 0.801 0.530 0.4690.3600290 0.229 0.192 0.145 0.116 0.16 Period 140.870 0.750 0.831 0.577 0.50 0.4420340 0.263 0.205 0.15) C.125 0.099 0.078 Period 15 0.861 0.743 0.542 0.556 0.481 0.4170315 0.239 0.183 0.140 C.103 0.054 0.066 Period 200.820 0.673 0.554 0.456 0.377 0.312 0215 0.149 0.104 0.073 0.051 0.037 0.026 Perlod 25 0.780 0.610 0.478 0.375 0.26 0.29 0.146 0.092 0.05 0.035 0.024 0.0160.010 Period 30 0.742 0.552 0.412 0.008 0.231 0.174 0.049 0.067 0.093 0.020 0.012 0.007 0.004 Period 400.672 0.453 0.37 0.208 0.142 0.097 0.046 0.022 0.011 0.005 0.003 0.001 0.001 1. Suppose you invest a sum of $2,500 in an interest-bearing account at the rate of 12% per year. What will the investment be worth six years from now? 2. How much would you need to invest now to be able to withdraw $7,000 at the end of every year for the next 20 years? Assume a 10% interest rate. 3. Assume that you want to have $175,000 saved seven years from now. If you can invest your funds at an 8% Interest rate, how much do you currently need to invest? 4. Your aunt Margaret plans to give you $4,000 at the end of every year for the next ten years. If you invest each of her yearly gifts at a 14% interest rate, how much will they be worth at the end of the 10 year period? 5. Suppose you want to buy a small cabin in the mountains four years from now. You estimate that the property will cost $54,000 at that time. How much money do you need to invest each year in an interest-bearing account at the rate of 9% per year to accumulate the purchase price? Print Dane ] MAY 9 "ZA Aa sa . ? Solve various time value of money scenarios (Click the icon to view the scenarios.) (Click the icon to view the present value factar table.) (Click the icon to view the fulure value faclor lable.) E (Click the icon to view the present value annuity factor table.) B (Click the icon to view the future value annuity factor table.) Scenario 1. Suppose you invest a sum of $2,500 in an interest-bearing socount at the rate of 12% per year. What wil the investment be worth six years from now? (Round your answer to the nearest whole dollar. In six years the investment will be worth - X - X Reference Reference Future Value of $1 4587 Periods 1% 2% 3% 19% 49 Period 1 1.010 1020 1090 1.090 Period 2 1.020 1.040 1061 1.082 Period 3 1.000 1.061 1093 1.125 Period 4 4 1.041 1.052 1.126 1.170 Periods 1.061 1.104 1159 1.217 Period 1.052 1.125 1.194 1.266 Period 7 1.072 1.149 1230 1.316 Period & 1.061 1.172 1 267 1.389 Period 9 1.091 1.135 1305 1.423 Period 10 1.106 1.219 1 344 1.480 Period 11 1.116 1.243 1384 1.589 Period 12.127 1205 1426 1001 Period 13 1.138 1.294 14891.866 Period 14 1.148 1.319 1513 1.732 Period 15 1.161 1.346 1558 1.801 Period 20 1498 1 806 2.191 Period 25 1.282 1.841 2094 2.888 Period 30 1.318 1.811 2.427 3.248 Period 40 1489 2.205 326249 4801 5X6% 8% 10% B% 12% 14% 16% % % 18% 20% 1.050 1060 1.000 1.100 1.120 1.140 1.150 1. BD 1.200 1.103 1.124 1.166 1210 1.254 1.300 1.346 1.392 1440 1.156 1.191 1.200 1331 1.406 1482 1.581 1.643 1.728 1.216 1262 1.350 1.464 1.574 1.689 1.811 1.939 2074 1.2761338148 1611 1.762 1.925 1.Ses 2.100 2288 2.488 1.340 1419 1.772 1.174 2.196 2.436 2.700 2.986 1.437 1.714 1949 2.211 2.502 2.826 385 3.583 1.4771594 1.851 2146 2.478 2.853 3.278 3.759 4.300 1.551 1689 1.999 2358 2.773 3.282 3.803 4.435 5.160 1.629 1 791 2.18 2594 3.106 3.707 4.411 5.234 6.192 1.710 1898 2.332 2853 3.479 5117 6.175 7.430 1.796 2012 2.518 3138 3.896 4618 5.336 7.288 8.916 2 133 2.720 3.452 4.3 5.492 6.888 8599 13699 1.800 2261 2.937 3.797 4.387 5.261 7.938 10.147 12.839 2.079 2307 3.172 4.177 5474 7.139 9.296 11.374 15407 2.6533207 6727 9.646 13.743 19461 27.393 39.338 3.3954292 4 292 6.648 10.835 17.000 28.462 40.874 62.889 95.398 4.322 5743 10.06317.449 29.960 50.96085.850 113.371 237376 7,040 10288 21.725 45259 93,06188884 378.721 750.378149772 Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 6X 5 6 8X 10% 12% 14% 16% 18 15% 20% Period 1 0.890 0.90 0.971 0.962 0.852 0.943 0.923 0.909 0.93 0.877 0.862 0.347 0.833 Period 2 1.370 1.942 1.9131.886 1.850 1.833 1.783 1736 1680 1.6471.806 1.5 1.528 Period 3 2.9412224 2029 2.775 2.723 2.873 2577 2407 2402 2122 2.246 2.174 2.106 Period 4 3.902 3.808 3.717 3.630 3.545 3.465 3.312 3.170 3.087 2814 2.79 2.590 2.589 Perlod 5 4.8534,713 4.580 4452 4.320 4212 3.993 3.7 3.805 3433 3.274 3.127 2901 Period 6 5.795 5.601 5:417 5.242 5.075 4.817 4.623 4.355 1.111 3.88 3.355 3.498 3.326 Period 7 6.728 3.472 6230 6.02 5.786 5582 5.205 4388 4964 +298 4.030 3.812 3.805 Period 8 7.852 7.325 7.020 8.750 6.483 6.210 5.747 5.315 4.9 4609 4.344 4.078 3.807 Period 9 3.556 5.162 7.785 735 7.108 6.802 6.247 5.759 5.328 4.946 2.807 4.333 4061 Period 10 9.471 39e38530 & 111 7.722 7.360 6.710 6.145 5660 526 4.833 4.414 4.192 Period 11 10.3589.787 9.253 8.760 8.305 7.887 7.139 5.495 5.908 5.153 5.029 4.556 4.327 Period 12 11.235 10.575 9.954 9.36 8.863 8.384 7.535 6814 6.194 5.660 5.197 4.793 4439 Period 13 12.134 -1.348 10.8359.988 9.394 2.853 7.904 7.102 8.424 5842 5.342 4.910 4513 2.503 Period 14 13.001 12.106 11.235 10.539.899 9.285 8.244 7.367 5.628 5.0025.455.038 4.511 Period 15 13.96 12849 11.38 11.118 10.390 9.712 8559 786 6.811 5.1425.575.092 4875 Period 20 18.046 16351 14.877 13.560 12.432 11.470 9.818 8.514 7.469 6.623 5.929 5.3534870 Period 25 22.022 1952317.413 15.622 14.04 12.763 10.875 9.077 784 3873 6.097 5.437 4948 Period 30 25.300 22 396 19.6001728215.372 13.755 11.258 8:27 8.065 T.C03 6.177 5.517 4978 Period 40 92.836 27.955 23 115 19.799 17.15 15.046 1.925 9.779 8 244 7. 105 6.233 5.548 49e7 18 H Print Done --- ] MAY 9 tv ON "ZA 09 Aa sa h Hulu Watch x Australia: Season 9 Epis X Mylat and Mastering X Course: Home X Do Homework - Home X C Comfort Golf Products is X + Solve various time value of money scenarios (Click the icon to view the scenarios. - (Click the icon to view the present value factor table.) (Click the icon to view the future value factor table.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the future value annuity factor table.) Scenario 1. Suppose you invest a sum of $2,500 in an interest-bearing account at the rate of 12% per year. What wil the investment be worth six years from now? (Round your answer to the nearest whole dollar.) In six years the investment will be worth Reference Future Value of Annuity of $1 Periods 1% 2% 3% % 4 4% 5% 6% 3% 10% 17% 12% 14% 16% 18%20% Period 1 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 Period 2 2010 2.020 2030 | 2010 2040 2050 2060 2.000 2.100 2.120 2.143 2.160 2.180 2.200 Period 3 3030 3.660 3.091 3.122 3153 318-3246 3.310 3.374 3440 3.506 3572 3.640 Period 4 4060 4.122 4.184 4248 4310 43754308 4.341 4.779 4.921 5.086 5215 5.358 period 5 5101 5.204 5.3095416 5.525 56875807 6.10 6.353 6.610 6.577 7.154 7.442 Period 8.152 8.306 6.488 8.633 6.2023.9757.336 7.71 & 15 .. 8.638 2.977 9442 9.930 Period 7 7214 74317.662 7 898 &"42 3.39 3.923 9.487 10.359 10.730 11.414 12.142 12.91 Period & 8286 4.538.9929214 95499897 1967 11 436 12.300 13233 14.240 15327 16.496 period 9 9369 9.755 10.159 10.583 11.027 11.491 12.488 3.579 14.776 16.085 17.519 19.CAB 20.79 Period 10 10.152 10.960 11.464 12.005 12.578 13.181 14.18715.957 17.519 19.937 21.321 23.521 25.950 Period 11 11.567 12.168 12.80813.485 14.207 14.972 15.6458.531 20.356 23.045 25.732 26.755 32.150 Period 12 12.63 13.412 14.192 15.098 15.917 16.870 18.977 21.84 24.13? 27.271 30.850 34931 29.581 Period 13 13.203 14.580 15.618 15.627 17.713 18.282 21.495 24.529 28.029 32.089 36.78 42219 48.497 Period 14 14.947 15.974 17.055 18.292 19.589 21.01524715 27.995 32.390 31.581 43.572 50 818 59.196 Period 15 16.097 17.20 18.59920024 21.57923278 27.15281.772 37.200 43.842 20 SAS 72.836 Perlod 20 22018 24.227 26.870 29.778 33.065 35.785 45.762 57.2 72.352 91.025 115.390 146.625 186.622 Period 25 28 243 32.000 38.459 41.648 47.727.285 73.108 98.347 123.334 181.471 249.214 342.603 471.981 Period 30 34.785 40.5 47.575 55.C85 68.439 79.058 113.283 184.494 241.383 356.787 590.312 790.94 1.181.222 Perlod 40 45.885 60.402 78.20135.026 120.800 154.762 250 057 442.543 767.00 1.312.025 2.360.757 4,16.213 Z.343.2 Help me solve this Video Get more help Clear all Check answer ) MAY 9 tv ON A A 09 Aa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts