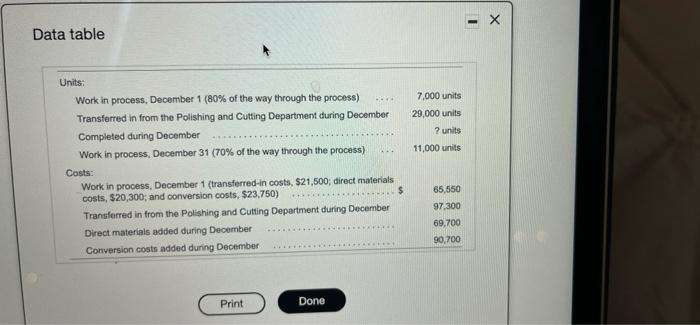

Question: need all requirements - X Data table 7,000 units 29,000 units ? units 11,000 units Units: Work in process, December 1 (80% of the way

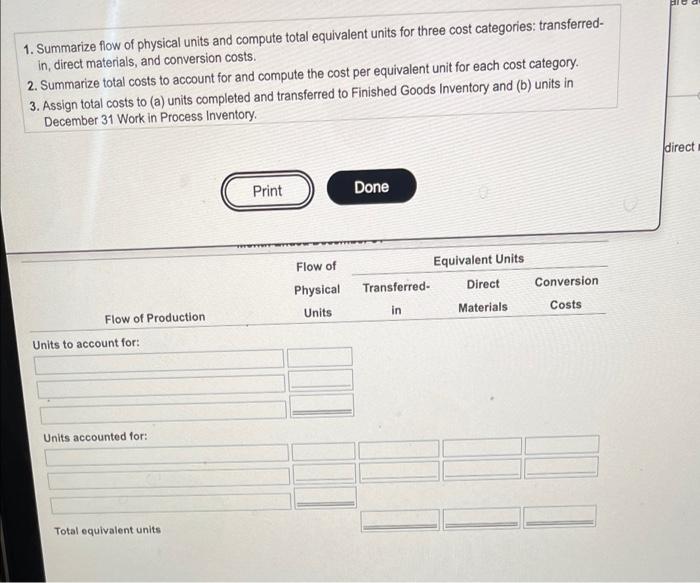

- X Data table 7,000 units 29,000 units ? units 11,000 units Units: Work in process, December 1 (80% of the way through the process) Transferred in from the Polishing and Cutting Department during December Completed during December Work in process, December 31 (70% of the way through the process) Costs Work in process, December 1 (transferred-in costs, $21,500, direct materials costs, $20,300; and conversion costs $23.750) $ Transferred in from the Polishing and Cutting Department during December Direct materials added during December Conversion costs added during December 65,550 97,300 69,700 90,700 Print Done Flo 1. Summarize flow of physical units and compute total equivalent units for three cost categories: transferred- in, direct materials, and conversion costs. 2. Summarize total costs to account for and compute the cost per equivalent unit for each cost category. 3. Assign total costs to (a) units completed and transferred to Finished Goods Inventory and (b) units in December 31 Work in Process Inventory. direct Print Done Equivalent Units Flow of Physical Units Conversion Direct Transferred in Materials Costs Flow of Production Units to account for: Units accounted for: Total equivalent units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts