Question: need all solution only An 1. V 2 3. I end of the Introductory Stage. Concept Illustration: Examine the validity of the following statements under

need all solution only

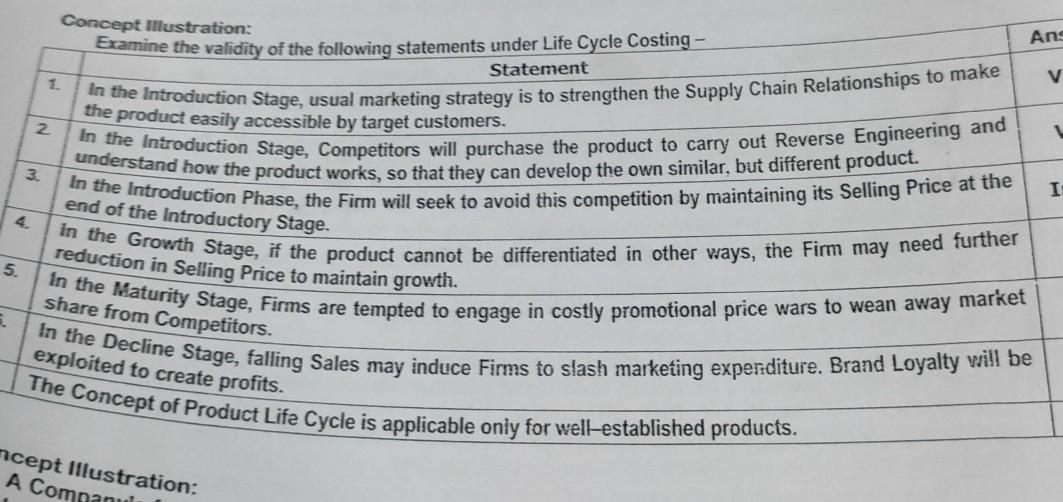

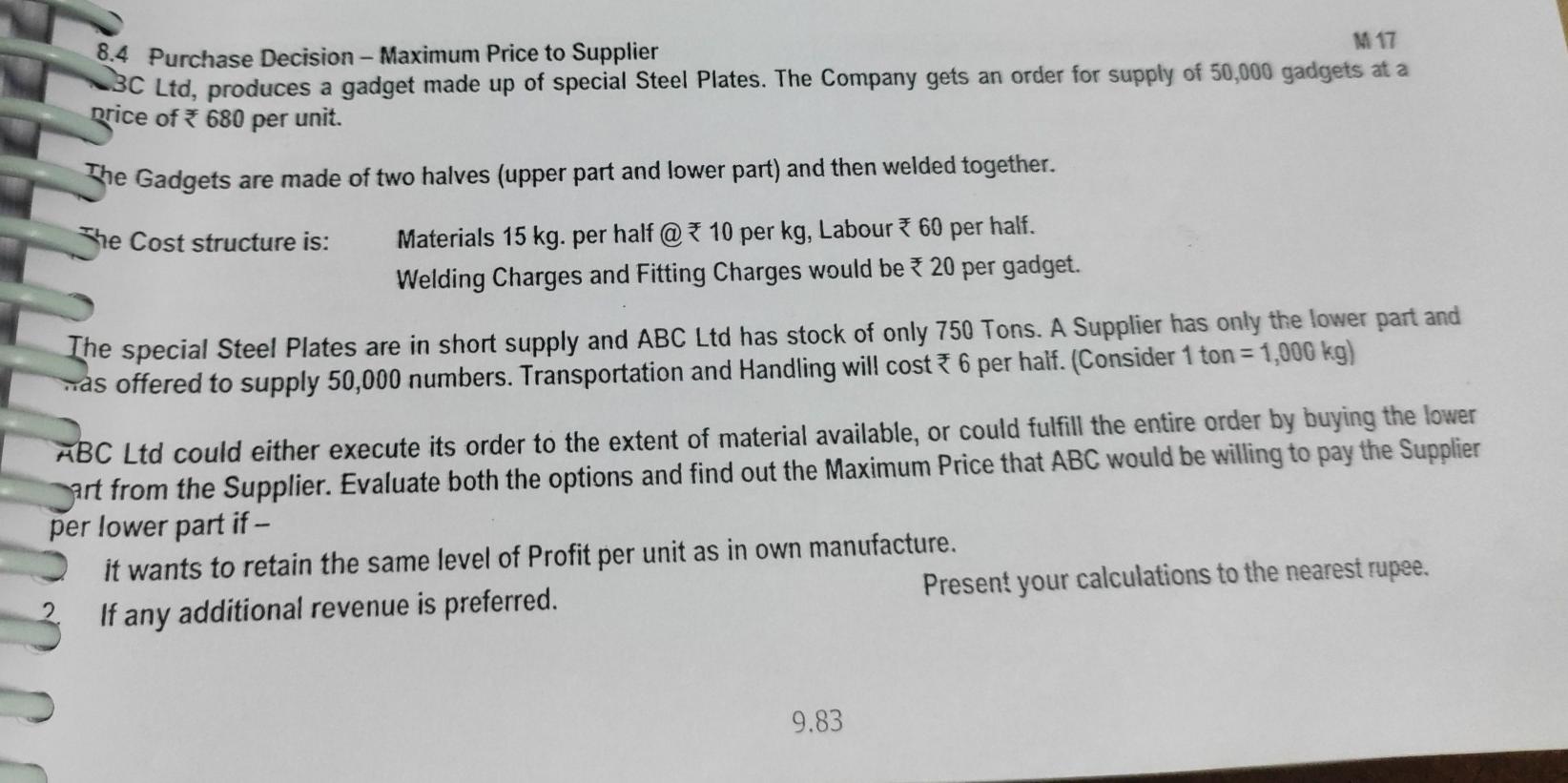

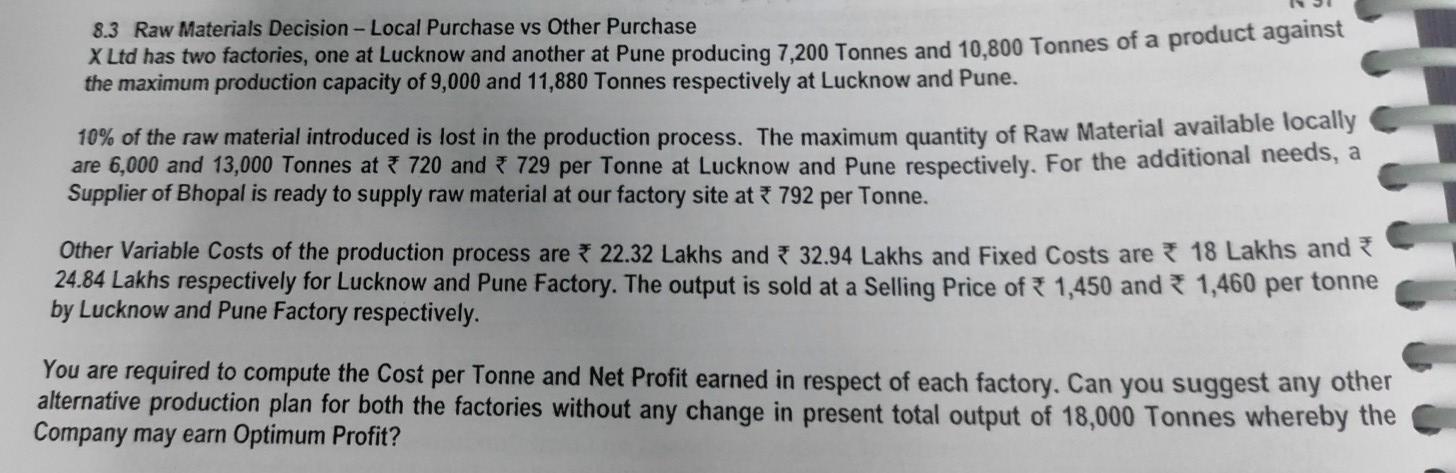

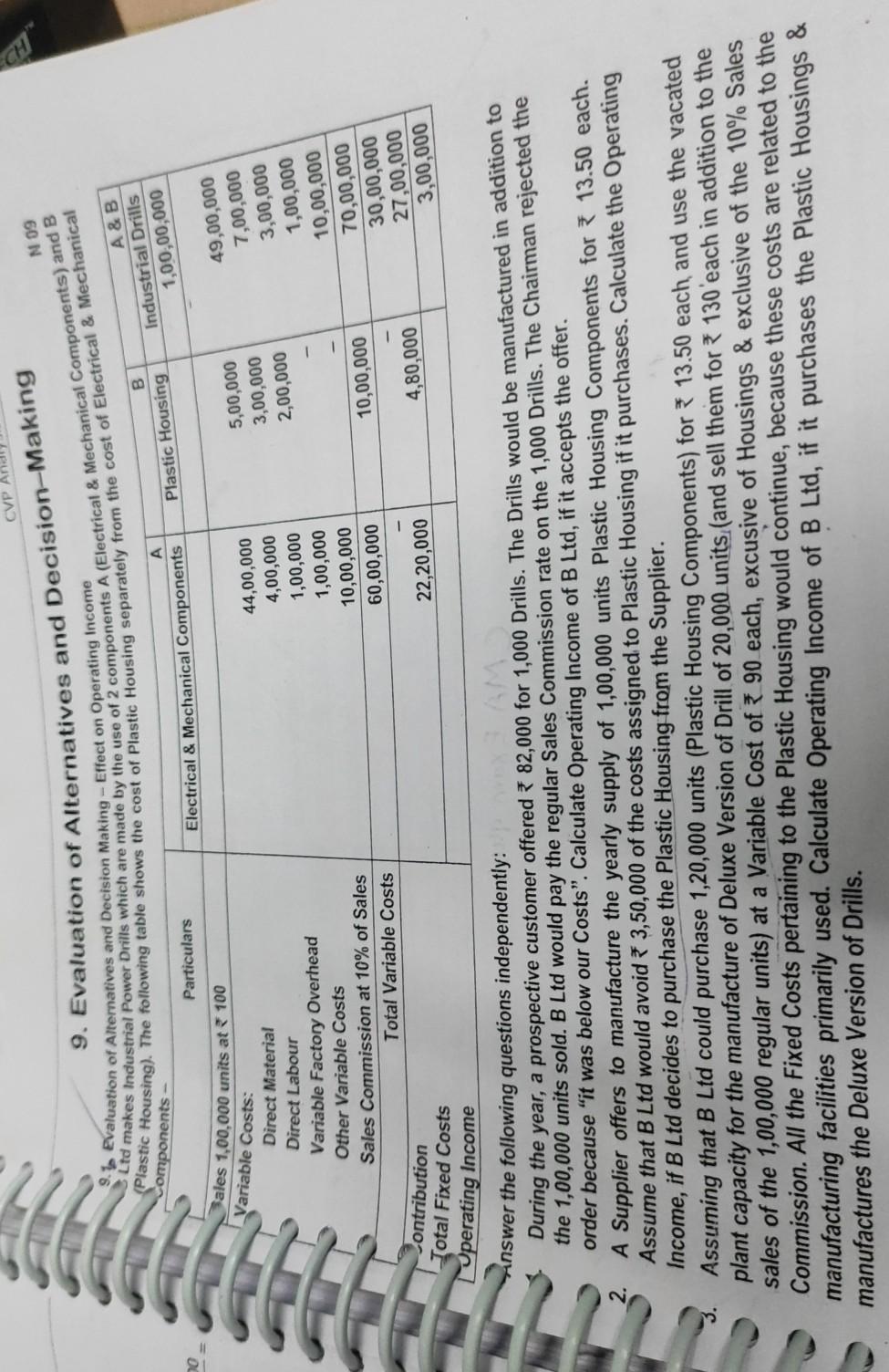

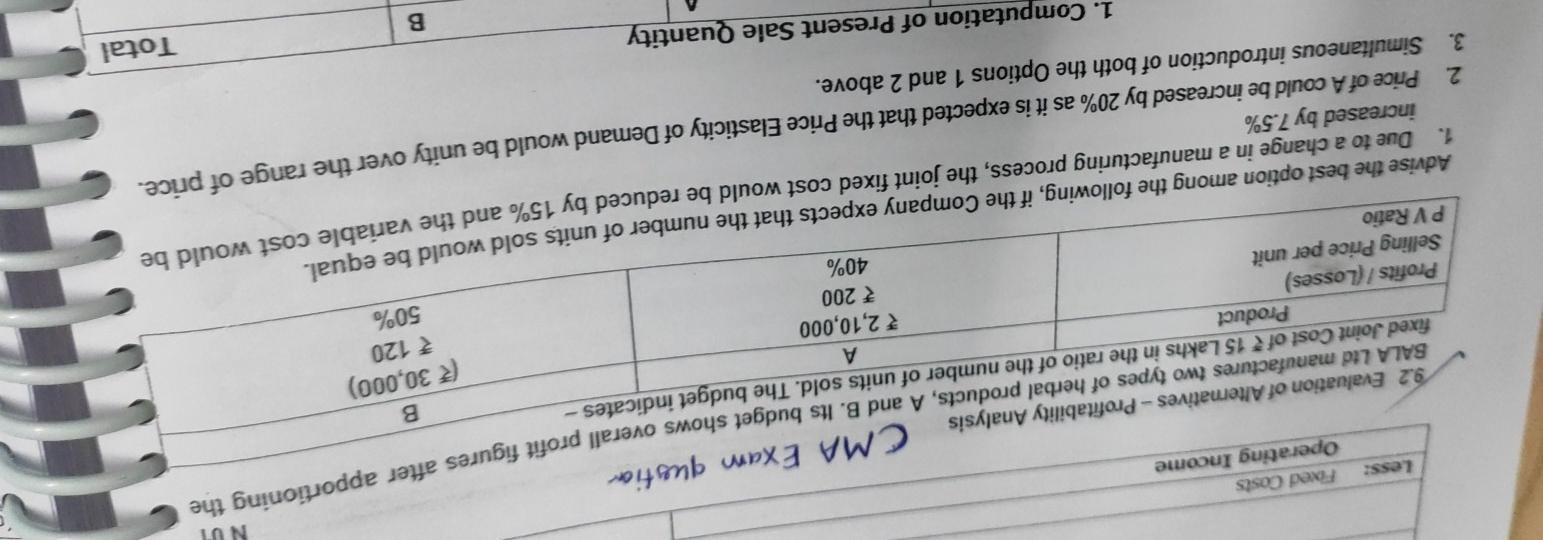

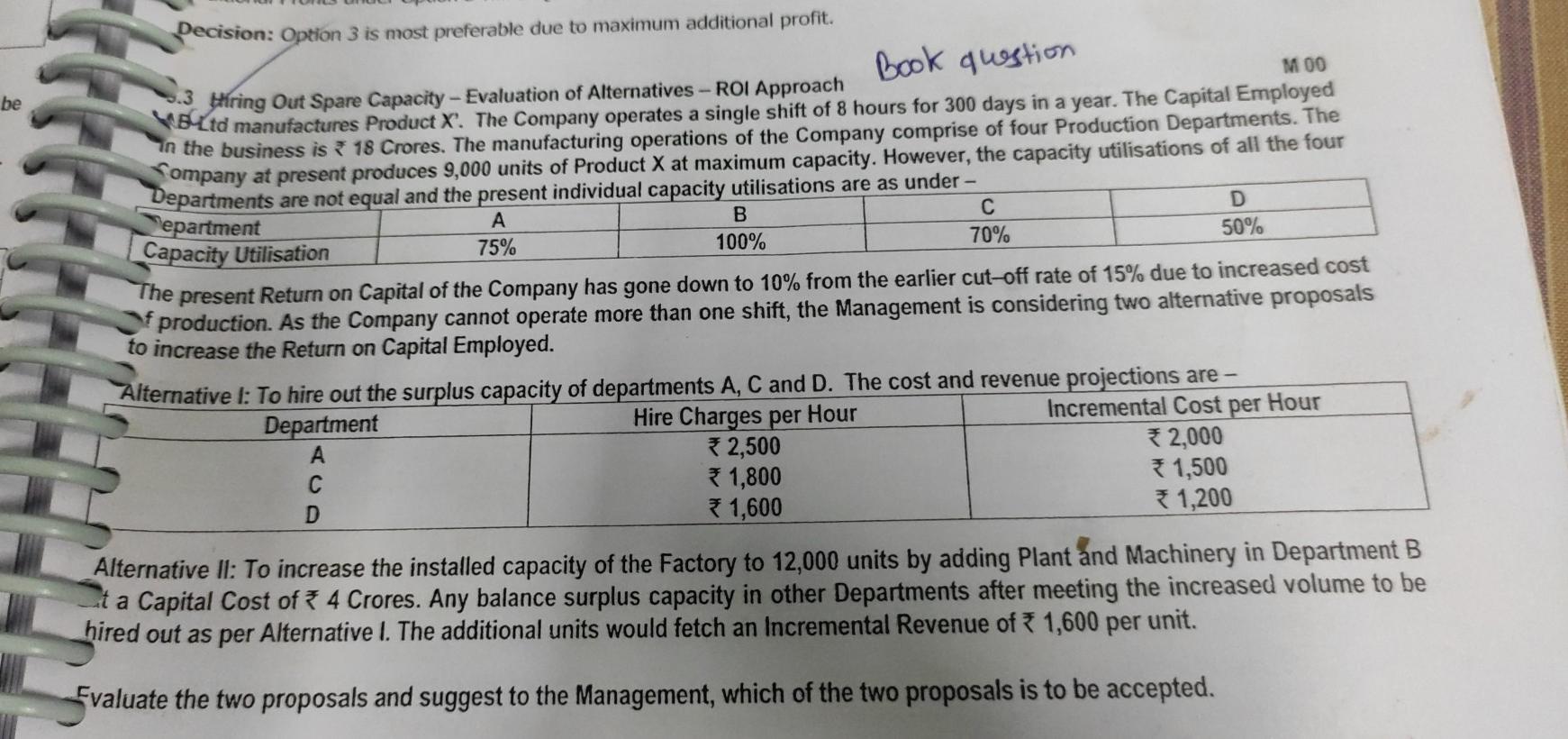

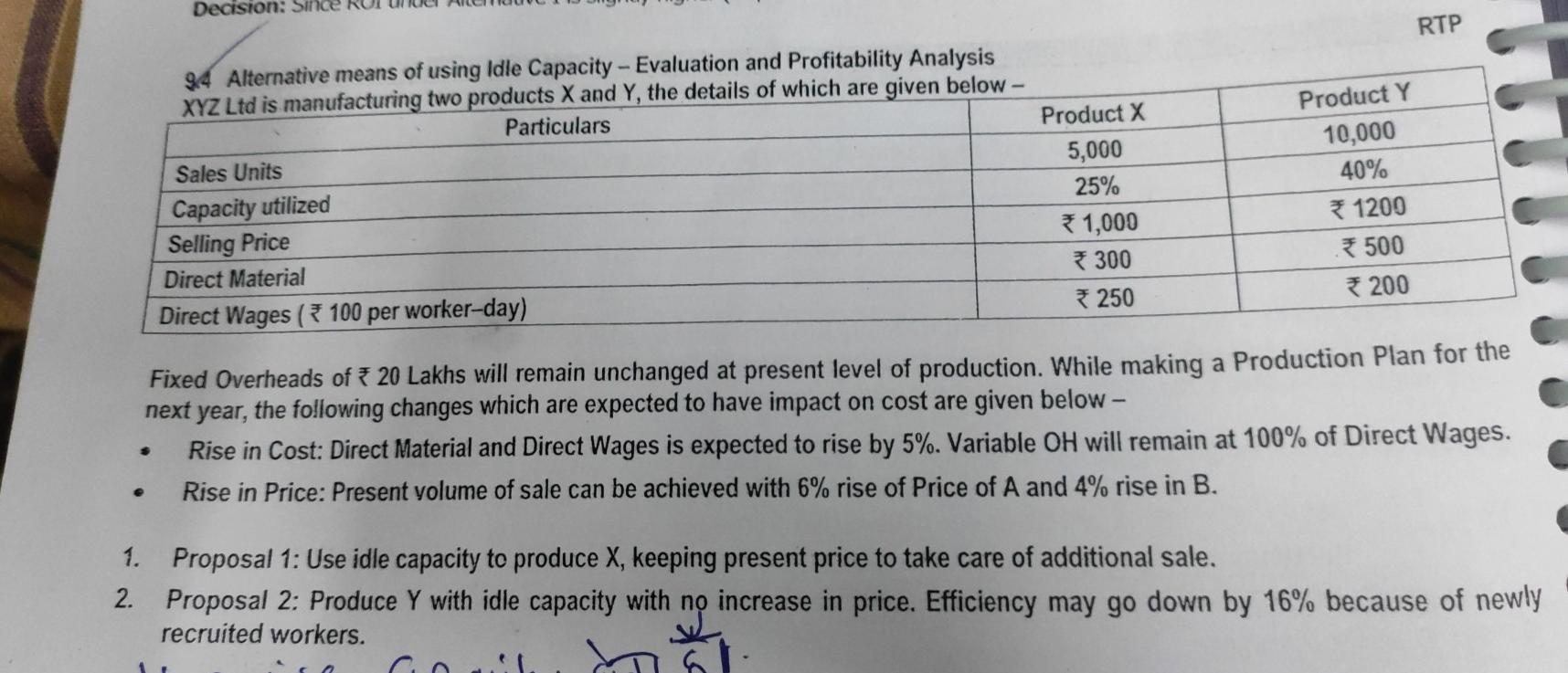

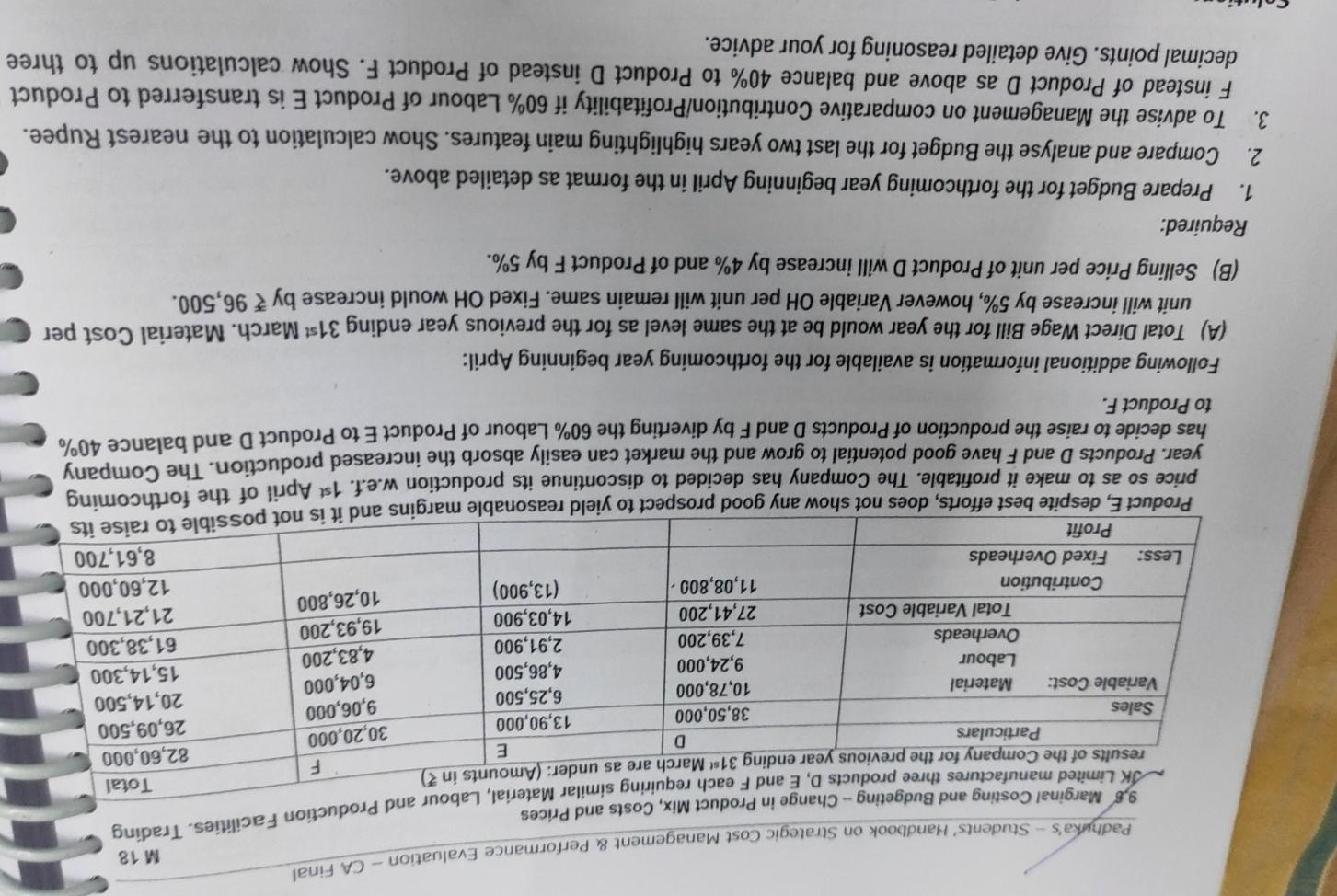

An 1. V 2 3. I end of the Introductory Stage. Concept Illustration: Examine the validity of the following statements under Life Cycle Costing - Statement In the Introduction Stage, usual marketing strategy is to strengthen the Supply Chain Relationships to make the product easily accessible by target customers. In the Introduction Stage, Competitors will purchase the product to carry out Reverse Engineering and understand how the product works, so that they can develop the own similar, but different product. Price at the in the Growth Stage, if the product cannot be differentiated in other ways, the Firm may need further In the Maturity Stage, Firms are tempted to engage in costly promotional price wars to wean away market In the Decline Stage, falling Sales may induce Firms to slash marketing expenditure. Brand Loyalty will be The Concept of Product Life Cycle is applicable only for well-established products. reduction in Selling Price to maintain growth. 5. share from Competitors. exploited to create profits. ncept Illustration: A Companul M17 8.4 Purchase Decision - Maximum Price to Supplier 30 Ltd, produces a gadget made up of special Steel Plates. The Company gets an order for supply of 50,000 gadgets at a price of 680 per unit. The Gadgets are made of two halves (upper part and lower part) and then welded together. The Cost structure is: Materials 15 kg. per half @* 10 per kg, Labour 60 per half. Welding Charges and Fitting Charges would be * 20 per gadget. The special Steel Plates are in short supply and ABC Ltd has stock of only 750 Tons. A Supplier has only the lower part and as offered to supply 50,000 numbers. Transportation and Handling will cost 6 per half. (Consider 1 ton = 1,000 kg) ABC Ltd could either execute its order to the extent of material available, or could fulfill the entire order by buying the lower art from the Supplier. Evaluate both the options and find out the Maximum Price that ABC would be willing to pay the Supplier per lower part if- it wants to retain the same level of Profit per unit as in own manufacture. If any additional revenue is preferred. Present your calculations to the nearest rupee. 2 9.83 8.3 Raw Materials Decision - Local Purchase vs Other Purchase X Ltd has two factories, one at Lucknow and another at Pune producing 7,200 Tonnes and 10,800 Tonnes of a product against the maximum production capacity of 9,000 and 11,880 Tonnes respectively at Lucknow and Pune. 10% of the raw material introduced is lost in the production process. The maximum quantity of Raw Material available locally are 6,000 and 13,000 Tonnes at * 720 and * 729 per Tonne at Lucknow and Pune respectively. For the additional needs, a Supplier of Bhopal is ready to supply raw material at our factory site at * 792 per Tonne. Other Variable costs of the production process are *22.32 Lakhs and * 32.94 Lakhs and Fixed Costs are * 18 Lakhs and * 24.84 Lakhs respectively for Lucknow and Pune Factory. The output is sold at a Selling Price of 1,450 and 1,460 per tonne by Lucknow and Pune Factory respectively. You are required to compute the cost per Tonne and Net Profit earned in respect of each factory. Can you suggest any other alternative production plan for both the factories without any change in present total output of 18,000 Tonnes whereby the Company may earn Optimum Profit? CVP PP N 09 9. Evaluation of Alternatives and Decision-Making Si la evaluation of Alternatives and Decision Making - Effect on Operating Income Ltd makes Industrial Power Drills which are made by the use of 2 components A (Electrical & Mechanical Components) and B Plastic Housing). The following table shows the cost of Plastic Housing separately from the cost of Electrical & Mechanical B A&B Industrial Drills 1,00,00,000 Components A Electrical & Mechanical Components Plastic Housing Particulars 10 Sales 1,00,000 units at 100 Variable Costs: 5,00,000 3,00,000 2,00,000 49,00,000 7,00,000 3,00,000 1,00,000 10,00,000 70,00,000 30,00,000 27,00,000 3,00,000 Direct Material 44,00,000 Direct Labour 4,00,000 Variable Factory Overhead 1,00,000 Other Variable Costs 1,00,000 Sales Commission at 10% of Sales 10,00,000 10,00,000 60,00,000 Total Variable Costs Contribution Total Fixed Costs 22,20,000 4,80,000 Operating Income nswer the following questions independently: During the year, a prospective customer offered * 82,000 for 1,000 Drills. The Drills would be manufactured in addition to the 1,00,000 units sold. B Ltd would pay the regular Sales Commission rate on the 1,000 Drills. The Chairman rejected the order because "it was below our Costs". Calculate Operating Income of B Ltd, if it accepts the offer. 2. A Supplier offers to manufacture the yearly supply of 1,00,000 units Plastic Housing Components for 13.50 each. Assume that B Ltd would avoid * 3,50,000 of the costs assigned to Plastic Housing if it purchases. Calculate the Operating Income, if B Ltd decides to purchase the Plastic Housing from the Supplier. Assuming that B Ltd could purchase 1,20,000 units (Plastic Housing Components) for * 13.50 each and use the vacated plant capacity for the manufacture of Deluxe Version of Drill of 20,000 units (and sell them for 130'each in addition to the sales of the 1,00,000 regular units) at a Variable Cost of 90 each, excusive of Housings & exclusive of the 10% Sales Commission. All the Fixed Costs pertaining to the Plastic Housing would continue, because these costs are related to the manufacturing facilities primarily used. Calculate Operating Income of B Ltd, if it purchases the Plastic Housings & manufactures the Deluxe Version of Drills. NUT Fixed Costs Operating Income CMA Exam question 9.2 Evaluation of Alternatives - Profitability Analysis BALA Ltd manufactures two types of herbal products, A and B. Its budget shows overall profit figures after apportioning the fixed Joint Cost of * 15 Lakhs in the ratio of the number of units sold. The budget indicates - Profits/(Losses) 2,10,000 Selling Price per unit 200 PV Ratio 50% Less: B 30,000) * 120 A Product 40% Advise the best option among the following, if the Company expects that the number of units sold would be equal. 1. Due to a change in a manufacturing process, the joint fixed cost would be reduced by 15% and the variable cost would be increased by 7.5% 2. Price of A could be increased by 20% as it is expected that the Price Elasticity of Demand would be unity over the range of price. 3. Simultaneous introduction of both the Options 1 and 2 above. Total 1. Computation of Present Sale Quantity B M00 be D A Decision: Option 3 is most preferable due to maximum additional profit. Book question 1-3 Hiring Out Spare Capacity - Evaluation of Alternatives - ROI Approach WBLtd manufactures Product x. The Company operates a single shift of 8 hours for 300 days in a year. The Capital Employed In the business is 18 Crores. The manufacturing operations of the Company comprise of four Production Departments. The Company at present produces 9,000 units of Product X at maximum capacity. However, the capacity utilisations of all the four Departments are not equal and the present individual capacity utilisations are as under - Repartment B C Capacity Utilisation 75% 100% 70% 50% The present Return on Capital of the Company has gone down to 10% from the earlier cut-off rate of 15% due to increased cost production. As the Company cannot operate more than one shift, the Management is considering two alternative proposals to increase the Return on Capital Employed. Alternative l: To hire out the surplus capacity of departments A, C and D. The cost and revenue projections are - Department Hire Charges per Hour Incremental Cost per Hour A *2,500 *2,000 C 1,800 1,500 1,600 *1,200 D Alternative II: To increase the installed capacity of the Factory to 12,000 units by adding Plant and Machinery in Department B ta Capital Cost of 4 Crores. Any balance surplus capacity in other Departments after meeting the increased volume to be hired out as per Alternative I. The additional units would fetch an incremental Revenue of * 1,600 per unit. Evaluate the two proposals and suggest to the Management, which of the two proposals is to be accepted. Decision: Since RTP Product X 94 Alternative means of using Idle Capacity - Evaluation and Profitability Analysis XYZ Ltd is manufacturing two products X and Y, the details of which are given below - Particulars Sales Units Capacity utilized Selling Price Direct Material Direct Wages (100 per worker-day) 5,000 25% 1,000 300 250 Product Y 10,000 40% *1200 500 200 Fixed Overheads of * 20 Lakhs will remain unchanged at present level of production. While making a Production Plan for the next year, the following changes which are expected to have impact on cost are given below - Rise in Cost: Direct Material and Direct Wages is expected to rise by 5%. Variable OH will remain at 100% of Direct Wages. Rise in Price: Present volume of sale can be achieved with 6% rise of Price of A and 4% rise in B. 1. Proposal 1: Use idle capacity to produce X, keeping present price to take care of additional sale. 2. Proposal 2: Produce Y with idle capacity with no increase in price. Efficiency may go down by 16% because of newly recruited workers. M 18 SK Limited manufactures three products D, E and F each requiring similar Material, Labour and Production Facilities. Trading E D Padluka's - Students Handbook on Strategic Cost Management & Performance Evaluation - CA Final 9.8. Marginal Costing and Budgeting - Change in Product Mix, Costs and Prices results of the Company for the previous year ending 31st March are as under: (Amounts in 3) Total 82,60,000 38,50,000 13,90,000 26,09,500 10,78,000 6,25,500 20,14,500 9,24,000 4,86,500 15,14,300 7,39,200 2,91,900 61,38,300 27,41,200 14,03,900 21,21,700 11,08,800 (13,900) 12,60,000 8,61,700 Product E, despite best efforts, does not show any good prospect to yield reasonable margins and it is not possible to raise its price so as to make it profitable. The Company has decided to discontinue its production w.e.f. 1st April of the forthcoming year . Products D and F have good potential to grow and the market can easily absorb the increased production. The Company to Product F. has decide to raise the production of Products D and F by diverting the 60% Labour of Product E to Product D and balance 40% Particulars Sales Variable Cost: Material Labour Overheads Total Variable Cost Contribution Less: Fixed Overheads Profit F 30,20,000 9,06,000 6,04,000 4,83,200 19,93,200 10,26,800 Following additional information is available for the forthcoming year beginning April: (A) Total Direct Wage Bill for the year would be at the same level as for the previous year ending 31st March. Material Cost per unit will increase by 5%, however Variable OH per unit will remain same. Fixed OH would increase by * 96,500. (B) Selling Price per unit of Product D will increase by 4% and of Product F by 5%. Required: 1. Prepare Budget for the forthcoming year beginning April in the format as detailed above. 2. Compare and analyse the Budget for the last two years highlighting main features. Show calculation to the nearest Rupee. 3. To advise the Management on comparative Contribution/Profitability if 60% Labour of Product E is transferred to Product F instead of Product D as above and balance 40% to Product D instead of Product F. Show calculations up to three decimal points. Give detailed reasoning for your adviceStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock