Question: Need all work shown and an explanation for each answer. 1. HHH Company grants Willow one incentive stock option (ISO) on January 10, 2020. The

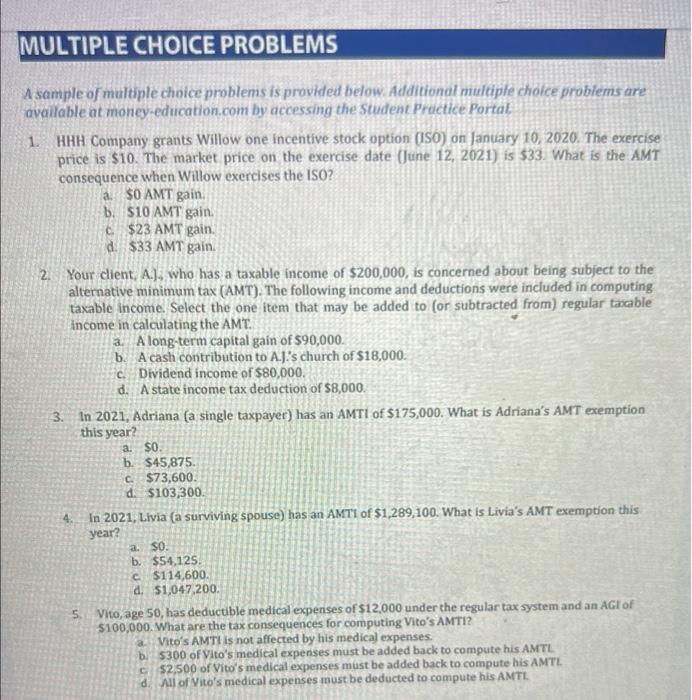

MULTIPLE CHOICE PROBLEMS A sample of multiple choice problems is provided below. Additional multiple choice problems are available at money education.com by accessing the Student Practice Portal 1. HHH Company grants Willow one incentive stock option (150) on January 10, 2020. The exercise price is $10. The market price on the exercise date (June 12, 2021) is $33. What is the AMT consequence when Willow exercises the ISO? a. $0 AMT gain b. $10 AMT gain c. $23 AMT gain. d. $33 AMT gain. 2. Your client, A., who has a taxable income of $200,000, is concerned about being subject to the alternative minimum tax (AMT). The following income and deductions were included in computing taxable income. Select the one item that may be added to (or subtracted from) regular wable income in calculating the AMT. a Along-term capital gain of $90,000. b. A cash contribution to A.J's church of $18,000. c. Dividend income of $80,000. d. A state income tax deduction of $8,000 3. In 2021, Adriana (a single taxpayer) has an AMTI of $175,000. What is Adriana's AMT exemption this year? a SO b. $45,875. c. $73,600 d. $103,300 4. In 2021, Livia (a surviving spouse) has an AMTI of $1,289,100. What is Livia's AMT exemption this year? a SO. b. $54,125 $114,600 d. $1,047,200. 5. Vito, age 50, has deductible medical expenses of $12,000 under the regular tax system and an AGI of $100,000. What are the tax consequences for computing Vito's AMTI? Vito's AMTI is not affected by his medical expenses. b. $300 of Vito's medical expenses must be added back to compute his AMTL $2,500 of Vito's medical expenses must be added back to compute his AMTL d. All of Vito's medical expenses must be deducted to compute his AMTL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts