Question: need allowance for doubtful accounts @ Support ~ My 3 Partially correct Mark 57 65 out of 60.00 P Flag question Journal Entries for Credit

need allowance for doubtful accounts

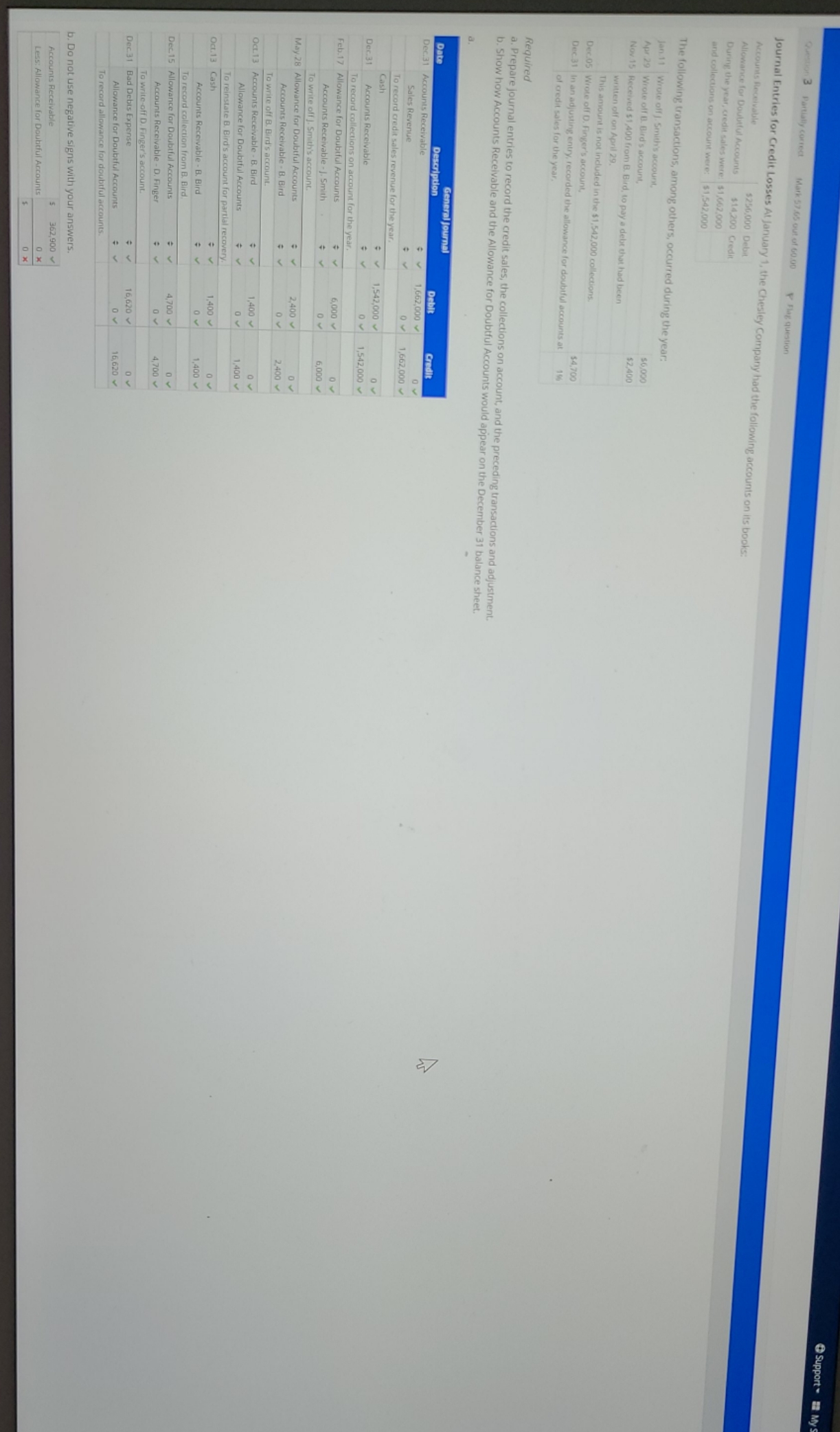

@ Support ~ My 3 Partially correct Mark 57 65 out of 60.00 P Flag question Journal Entries for Credit Losses At January 1, the Chesley Company had the following accounts on its books: $256,000 Debit Allowance for Doubtful Accounts $14,200 Credit During the year, credit sales were: $1,662,000 and collections on account were: $1,542,000 The following transactions, among others, occurred during the year: Jan.11 Wrote off J. Smith's account, Apr 29 Wrote off B. Bird's account, $6,000 Nov.15 Received $1,400 from B. Bird, to pay a debt that had been $2,400 written off on April 29. This amount is not included in the $1,542,000 collections. Dec.05 Wrote off D. Finger's account, $4,700 Dec.31 In an adjusting entry, recorded the allowance for doubtful accounts at of credit sales for the year. Required a. Prepare journal entries to record the credit sales, the collections on account, and the preceding transactions and adjustment. b. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the December 31 balance sheet. General Journal Date Description Debit Credit Dec.31 Accounts Receivable 1,662,000 Ov Sales Revenue 1,662,000 To record credit sales revenue for the year. Cash 1,542,000 0 Dec.31 Accounts Receivable 0 1,542,000 To record collections on account for the year. Feb.17 Allowance for Doubtful Accounts 6,000 O V Accounts Receivable - J. Smith Ov 6,000 To write off J. Smith's account. May.28 Allowance for Doubtful Accounts 2,400 Ov Accounts Receivable . B. Bird Ov 2.400 To write off B. Bird's account. Oct.13 Accounts Receivable . B. Bird 1,400 Allowance for Doubtful Accounts Ov 400 To reinstate B. Bird's account for partial recovery. Oct. 13 Cash v 1,400 0 Accounts Receivable - B. Bird OV .400 To record collection from B. Bird. Dec. 15 Allowance for Doubtful Accounts 4.700 Accounts Receivable - D. Finger OV 4,700 To write-off D. Finger's account. Dec.31 Bad Debts Expense 16,620 0 v S Allowance for Doubtful Accounts OV 16,620 To record allowance for doubtful accounts. b. Do not use negative signs with your answers. Accounts Receivable $ 362,900 Less: Allowance for Doubtful Accounts 0 X 0 X