Question: need an answer for question #2 23.000 soutie maker y the straight line o make and price ould the company ect QUESTIONS AND PROBLEMS 1.

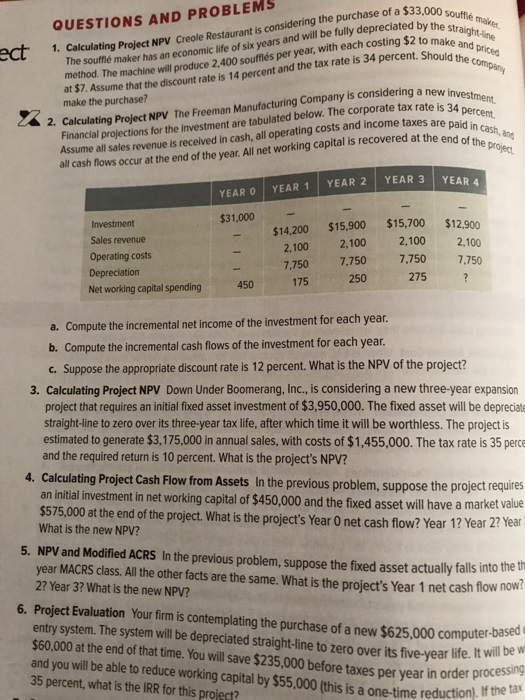

23.000 soutie maker y the straight line o make and price ould the company ect QUESTIONS AND PROBLEMS 1. calculating Project NPV Creole Restaurant is considering the purchase of a $33.000 The souffle maker has an economic life of six years and will be fully depreciated by the method. The machine will produce 2.400 souffls per year, with each costing $2 to ma at $7. Assume that the discount rate is 14 percent and the tax rate is 34 percent. Should make the purchase? 4. Calculating Project NPV The Freeman Manufacturing Company is considering a new Financial projections for the investment are tabulated below. The corporate tax rate le Assume all sales revenue is received in cash, all operating costs and income taxes are all cash flows occur at the end of the vear. All networking capital is recovered at the end a new investment rate is 34 percent are paid in cash, and he end of the project YEAR 3 YEAR 2 YEAR 4 YEAR O YEAR 1 $31,000 $14,200 $12.900 2,100 2.100 Investment Sales revenue Operating costs Depreciation Net working capital spending $15,700 2,100 7,750 275 $15,900 2,100 7.750 250 7.750 7.750 175 450 a. Compute the incremental net income of the investment for each year. b. Compute the incremental cash flows of the investment for each year. c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project? 3. Calculating Project NPV Down Under Boomerang, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $3,950,000. The fixed asset will be depreciate straight-line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $3,175,000 in annual sales, with costs of $1,455,000. The tax rate is 35 perce and the required return is 10 percent. What is the project's NPV? 4. Calculating Project Cash Flow from Assets In the previous problem, suppose the project requires an initial investment in net working capital of $450,000 and the fixed asset will have a market value $575,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1? Year 2 Tea What is the new NPV? 5. NPV and Modified ACRS In the previous problem, suppose the fixed asset actually falls into the year MACRS class. All the other facts are the same. What is the project's Year 1 net cash flow now 2? Year 3? What is the new NPV? 6. Project Evaluation Your firm is contemplating the purchase of a new $625,000 computer-base entry system. The system will be depreciated straight-line to zero over its five-year life. it wm $60.000 at the end of that time. You will save $235,000 before taxes per year in order proces and you will be able to reduce working capital by $55,000 (this is a one-time reduction. 35 percent, what is the IRR for this project? a one-time reduction). If the tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts