Question: need an answer on the mutually exclusive projects question i need an answer on the Matta Manufacturing problem st-Cutting Proposals Blue Line Machine Shop is

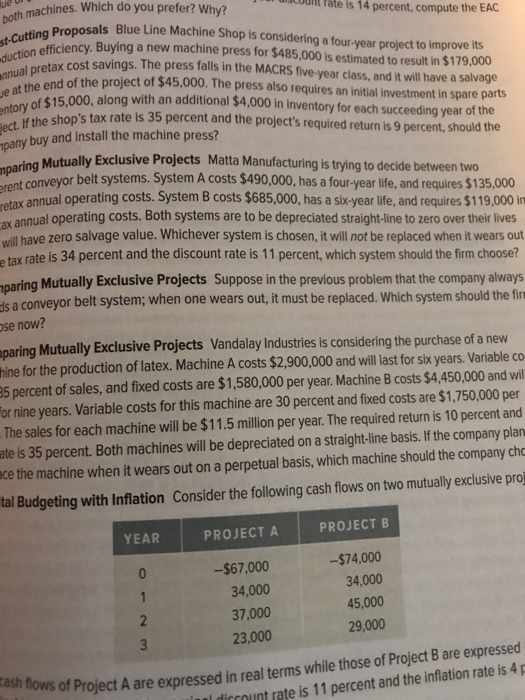

st-Cutting Proposals Blue Line Machine Shop is considering a four-year project to improve its duction efficiency. Buying a new machine press for $485,000 is estimated to result in $179,000 annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage Je at the end of the project of $45,000. The press also requires an initial investment in spare parts entory of $15,000, along with ject. If the shop's tax rate is 35 percent and the project's required return is 9 percent, should the an additional $4,000 in inventory for each succeeding year of the oany buy and install the machine press? mparing Mutually Exclusive Projects Matta Manufacturing is trying to decide between two erent conveyor belt systems. System A costs $490,000, has a four-year life, and requires $135,000 ax annual operating costs. System B costs $685,000, has a six-year life, and requires $119,000 im ay annual operating costs. Both systems are to be depreciated straight-line to zero over their lives will have zero salvage value. Whichever system is chosen, it will not be replaced when it wears out o tax rate is 34 percent and the discount rate is 11 percent, which system should the firm choose? paring Mutually Exclusive Projects Suppose in the previous problem that the company always ds a conveyor belt system; when one we ose now? aparing Mutually Exclusive Projects Vandalay Industries is considering the purchase of a new hine for the production of latex. Machine A costs $2,900,000 and will last for six years. Variable co- 85 percent of sales, and fixed costs are For nine years. Variable costs for this machine are 30 percent and fixed costs are $1,750,000 per The sales for each machine will be $11.5 million per year. The required return is 10 percent and ate is 35 percent. Both machines will be depreciated ace the machine when it wears out on a perpetual basis, which machine should the company ch ears out, it must be replaced. Which system should the firm $1,580,000 per year. Machine B costs $4,450,000 and wil straight-line basis. If the company plan on a tal Budgeting with Inflation Consider the following cash flows on two mutually exclusive pro PROJECT B PROJECT A YEAR -$74,000 -$67,000 0 34,000 34,000 1 45,000 37,000 2 29,000 23,000 3 ash flows of Project A are expressed in real terms while those of Project B are expressed nl diccount rate is 11 percent and the inflation rate is 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts