Question: Need an answer to this, please. A car cost $12,000. It will be kept for three (3) years and then sold for $3,000. Calculate the

Need an answer to this, please.

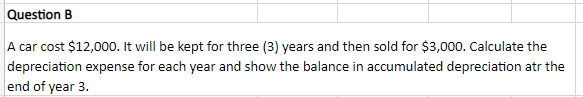

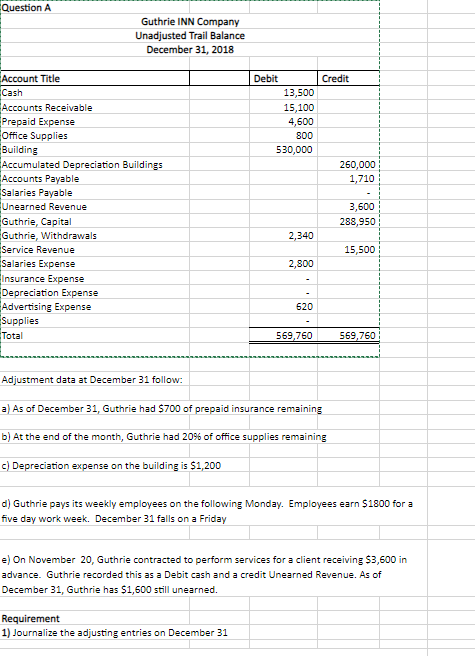

A car cost $12,000. It will be kept for three (3) years and then sold for $3,000. Calculate the depreciation expense for each year and show the balance in accumulated depreciation atr the end of year 3 . Question A Guthrie INN Company Unadjusted Trail Balance December 31, 2018 Account Title \begin{tabular}{|r|r|} \hline \multicolumn{1}{|l|}{ Debit } & Credit \\ \hline 13,500 & \\ 15,100 & \\ 4,600 & \\ 800 & \\ \hline 530,000 & \\ & 260,000 \\ & 1,710 \\ & - \\ & 3,600 \\ \hline 2,340 & 288,950 \\ \hline 2,800 & 15,500 \\ - & \\ \hline 620 & \\ \hline- & \\ \hline 569,760 & 569,760 \\ \hline \hline \end{tabular} Accounts Receivable Prepaid Expense Office Supplies Building Accumulated Depreciation Buildings Accounts Payable Salaries Payable Unearned Revenue Guthrie, Capital Guthrie, Withdrawals Service Revenue Salaries Expense Insurance Expense Depreciation Expense Advertising Expense Supplies Total Adjustment data at December 31 follow: a) As of December 31 , Guthrie had $700 of prepaid insurance remaining b) At the end of the month, Guthrie had 20% of office supplies remaining c) Depreciation expense on the building is $1,200 d) Guthrie pays its weekly employees on the following Monday. Employees earn $1800 for a five day work week. December 31 falls on a Friday e) On November 20, Guthrie contracted to perform services for a client receiving $3,600 in advance. Guthrie recorded this as a Debit cash and a credit Unearned Revenue. As of December 31 , Guthrie has $1,600 still unearned. Requirement 1) Journalize the adjusting entries on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts