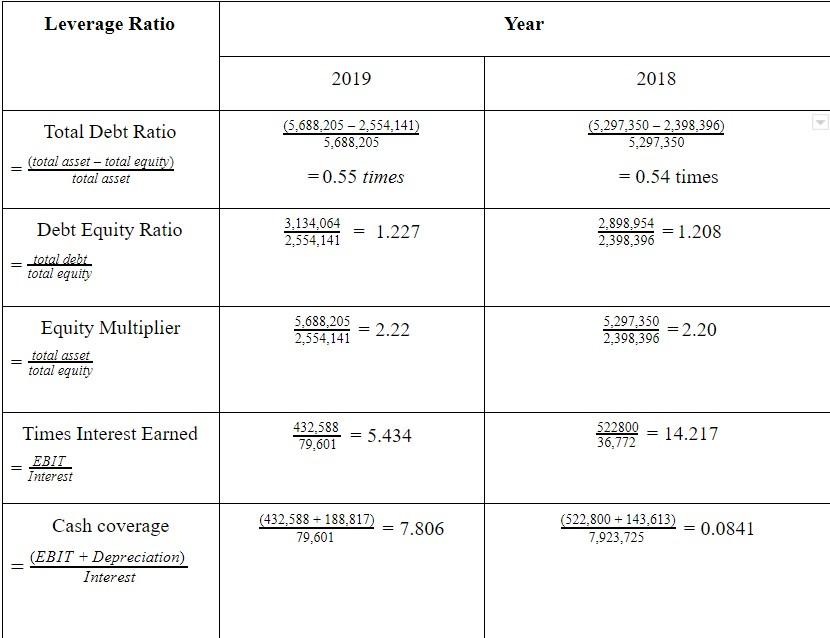

Question: Need analysis for the leverage ratio above. need brief explnation for total debt ratio, cash coverage, debt equity ratio, equity multiplier and times interest earned.

Need analysis for the leverage ratio above. need brief explnation for total debt ratio, cash coverage, debt equity ratio, equity multiplier and times interest earned. compare the figures in both years. need this asap pls help me..

= Leverage Ratio Total Debt Ratio (total asset total equity) total asset - total debt total equity = Debt Equity Ratio Equity Multiplier total asset total equity Times Interest Earned Interest Cash coverage (EBIT+ Depreciation) Interest 2019 (5,688,205 - 2,554,141) 5,688,205 = 0.55 times 3,134,064 2,554,141 5,688,205 2,554,141 432,588 79,601 = 1.227 79,601 = 2.22 = = 5.434 (432,588 188,817) = 7.806 Year 2018 (5,297,350-2,398,396) 5,297,350 = 0.54 times 2,898,954 2,398,396 5,297,350 2,398,396 522800 36,772 = = 1.208 = 2.20 14.217 (522,800+ 143,613) 7,923,725 = 0.0841

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

A Cash coverage ratio The cash coverage ratio is useful for determining the amount of cash available ... View full answer

Get step-by-step solutions from verified subject matter experts