Question: Need answer ASAP!!! Dont have to explain too much once the correct answer is provided. Thank you for ALL your help! 25) 6) Nine Point

Need answer ASAP!!! Dont have to explain too much once the correct answer is provided.

Thank you for ALL your help!

25)

6)

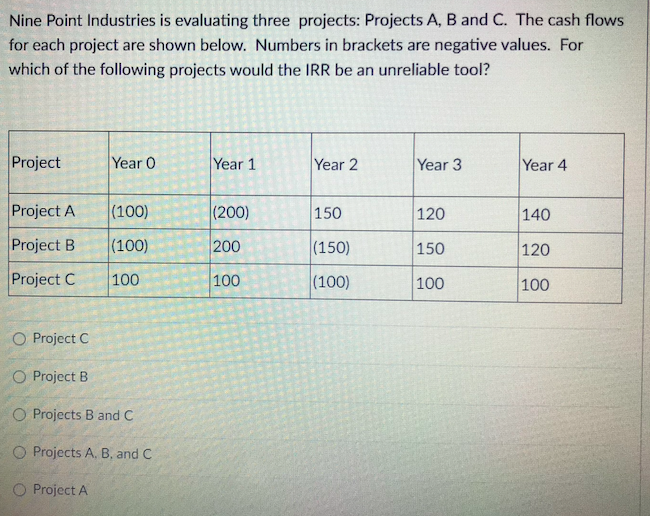

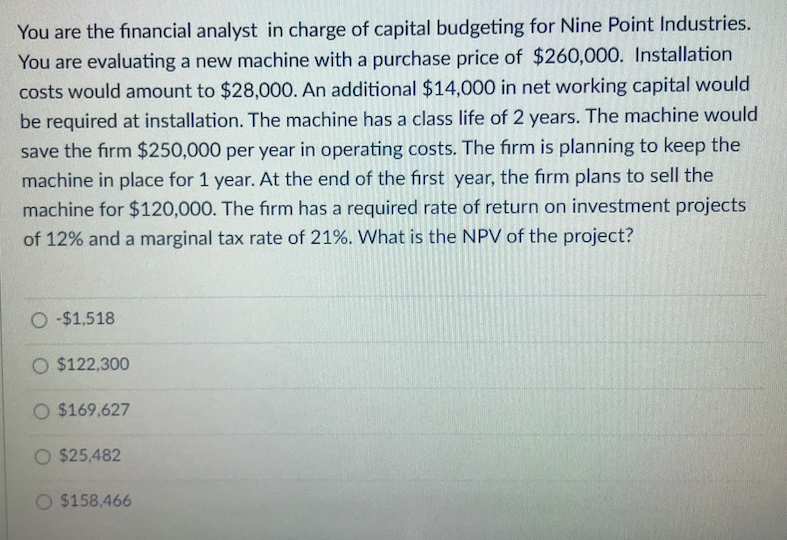

Nine Point Industries is evaluating three projects: Projects A, B and C. The cash flows for each project are shown below. Numbers in brackets are negative values. For which of the following projects would the IRR be an unreliable tool? Project Year 0 Year 1 Year 2 Year 3 Year 4 Project A (100) (200) 150 120 140 Project B (100) 200 (150) 150 120 Project C 100 100 (100) 100 100 O Project C O Project B O Projects B and C O Projects A, B, and C Project A You are the financial analyst in charge of capital budgeting for Nine Point Industries. You are evaluating a new machine with a purchase price of $260,000. Installation costs would amount to $28,000. An additional $14,000 in net working capital would be required at installation. The machine has a class life of 2 years. The machine would save the firm $250,000 per year in operating costs. The firm is planning to keep the machine in place for 1 year. At the end of the first year, the firm plans to sell the machine for $120,000. The firm has a required rate of return on investment projects of 12% and a marginal tax rate of 21%. What is the NPV of the project? O -$1,518 O $122.300 O $169.627 O $25,482 $158.466

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts