Question: Need answer asap plz. no explaniation needed Chrome File Edit View History Bookmarks People People Tab Window Help ->) 36% D Tue 10:46 AM OO

Need answer asap plz. no explaniation needed

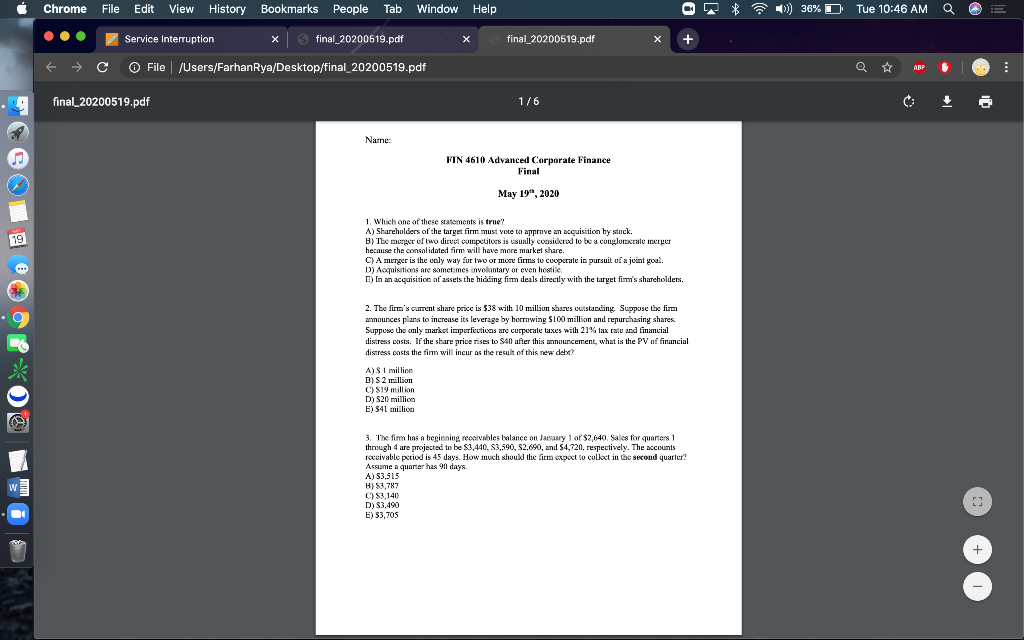

Chrome File Edit View History Bookmarks People People Tab Window Help ->) 36% D Tue 10:46 AM OO Service Interruption X final_20200519.pdf X final_20200519.pdf + > C O File /Users/Farhan Rya/Desktop/final_20200519.pdf ABP *** final_20200519.pdf 1/6 Name: FIN 4610 Advanced Corporate Finance May 19, 2020 19 1. Which one of these statements is true? A) Shareholders of the target firm must vote to approve an acquisition by stock. B) The merger of two direct competitors is usually considered to be a conglomerate merger hecause the consolidated firm will have more market share. C) A merger is the caly way for two or more firms to cooperate in pursuit of a juint youl. D) Acquisitions are sometimes involuntary or even hostile D) In an acquisition of assets the hiding fim deals directly with the target firm's shareholders. 20*2 2. The firm's current share price is $38 with 10 million shares outstanding Suppose the firm announces plans to increase its leverage by hortuwing 5100 million and repurchasing shares Suppose the only marot imperfections are curporate taxes with 21% tax rate and financial distress costs. If the share price rises to S40 after this amouncement, what is the PV of financial distress costs the firm will incur as the result of this new dele? A) SI million B) S 2 million $19 million D) $20 million E) 541 million 3. The firm has a beginning receivables balance on January 1 of $2,640. Sales for quarters 1 through 4 ure projected to be $1,440, S3,590, 52,690, and $4,720, respectively. The accounts receivable period is 45 days. How much should the firm expect to collect in the second quarter! Assume a quarter has 90 days. A) 53.515 B) 83,787 C) 89,140 D) S3,490 E) 53,705 W + Chrome File Edit View History Bookmarks People People Tab Window Help ->) 36% D Tue 10:46 AM OO Service Interruption X final_20200519.pdf X final_20200519.pdf + > C O File /Users/Farhan Rya/Desktop/final_20200519.pdf ABP *** final_20200519.pdf 1/6 Name: FIN 4610 Advanced Corporate Finance May 19, 2020 19 1. Which one of these statements is true? A) Shareholders of the target firm must vote to approve an acquisition by stock. B) The merger of two direct competitors is usually considered to be a conglomerate merger hecause the consolidated firm will have more market share. C) A merger is the caly way for two or more firms to cooperate in pursuit of a juint youl. D) Acquisitions are sometimes involuntary or even hostile D) In an acquisition of assets the hiding fim deals directly with the target firm's shareholders. 20*2 2. The firm's current share price is $38 with 10 million shares outstanding Suppose the firm announces plans to increase its leverage by hortuwing 5100 million and repurchasing shares Suppose the only marot imperfections are curporate taxes with 21% tax rate and financial distress costs. If the share price rises to S40 after this amouncement, what is the PV of financial distress costs the firm will incur as the result of this new dele? A) SI million B) S 2 million $19 million D) $20 million E) 541 million 3. The firm has a beginning receivables balance on January 1 of $2,640. Sales for quarters 1 through 4 ure projected to be $1,440, S3,590, 52,690, and $4,720, respectively. The accounts receivable period is 45 days. How much should the firm expect to collect in the second quarter! Assume a quarter has 90 days. A) 53.515 B) 83,787 C) 89,140 D) S3,490 E) 53,705 W +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts