Question: need answer ASAP Presented here are selected transactions for Alpine Tours Inc. during September of the current year. Alpine Tours uses a periodic inventory system.

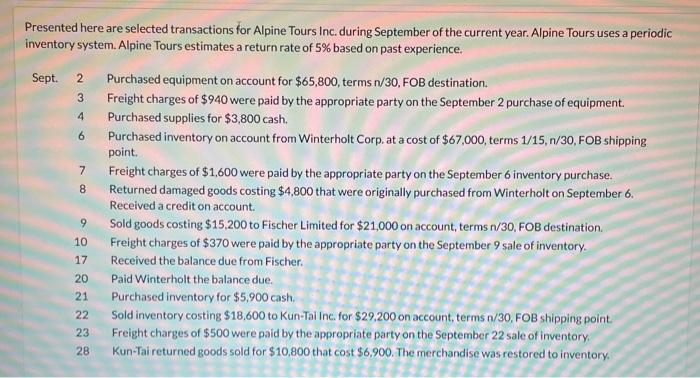

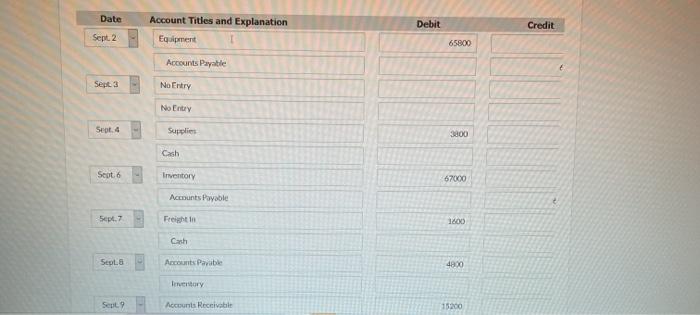

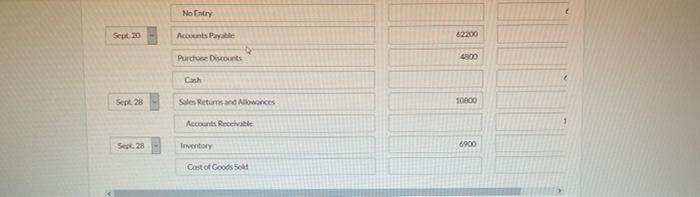

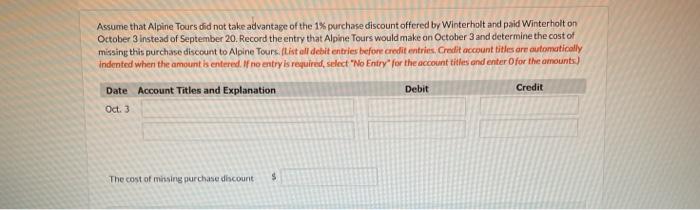

Presented here are selected transactions for Alpine Tours Inc. during September of the current year. Alpine Tours uses a periodic inventory system. Alpine Tours estimates a return rate of 5% based on past experience. Sept. 2 3 4 6 7 8 Purchased equipment on account for $65,800, terms n/30, FOB destination. Freight charges of $940 were paid by the appropriate party on the September 2 purchase of equipment Purchased supplies for $3,800 cash. Purchased inventory on account from Winterholt Corp. at a cost of $67,000, terms 1/15, 1/30, FOB shipping point. Freight charges of $1,600 were paid by the appropriate party on the September 6 inventory purchase. Returned damaged goods costing $4,800 that were originally purchased from Winterholt on September 6. Received a credit on account Sold goods costing $15,200 to Fischer Limited for $21,000 on account, terms 1/30, FOB destination Freight charges of $370 were paid by the appropriate party on the September 9 sale of inventory. Received the balance due from Fischer. Paid Winterholt the balance due. Purchased inventory for $5.900 cash, Sold inventory costing $18.600 to Kun-Tal Inc. for $29,200 on account, terms n/30, FOB shipping point Freight charges of $500 were paid by the appropriate party on the September 22 sale of inventory Kun-Tai returned goods sold for $10,800 that cost $6,900. The merchandise was restored to inventory 9 10 17 20 21 22 23 28 Date Account Titles and Explanation Debit Credit Sept 2 Equipment 65800 Accounts Payable Sept 3 No Entry No Entry Sept. 4 Supplies 3000 Cash Seot 6 Inventory 67000 Accounts Payable Frei 1600 Cash Sept. Accounts Payable 49.00 Restory Sept. Accounts Receivable 15200 Inventory Sept. Accounts Receivable 15200 Sales Discounts 5800 Cash Sept9 Cost of Goods Sold 15200 Irowy 15% Sept. 10 Frecht Out 370 Sept. 17 Ganh 2010 Sales Discounts Accounts Recable Nonry 62200 Nery Accounts Pile 62200 Onts 4800 No Entry Sept 20 Accounts Payable 62200 Purchase Discounts 40 Cash Sept. 28 Sales Returns and Allowances 10600 Accounts Receivable 1 Sept. 28 Inventory 6900 Cast of Goods 50 Assume that Alpine Tours did not take advantage of the 1% purchase discount offered by Winterholt and paid Winterholt on October 3 instead of September 20. Record the entry that Alpine Tours would make on October 3 and determine the cost of missing this purchase discount to Alpine Tours (List all debit entries before credit entries. Credit account titles are automatically Indented when the amount is entered. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Oct. 3 The cost of missing purchase discount $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts