Question: Need answer ASAP Question 4 a) In the coming year, King Company expects to sell 28,700 units at RM32 each. King's controller provided the following

Need answer ASAP

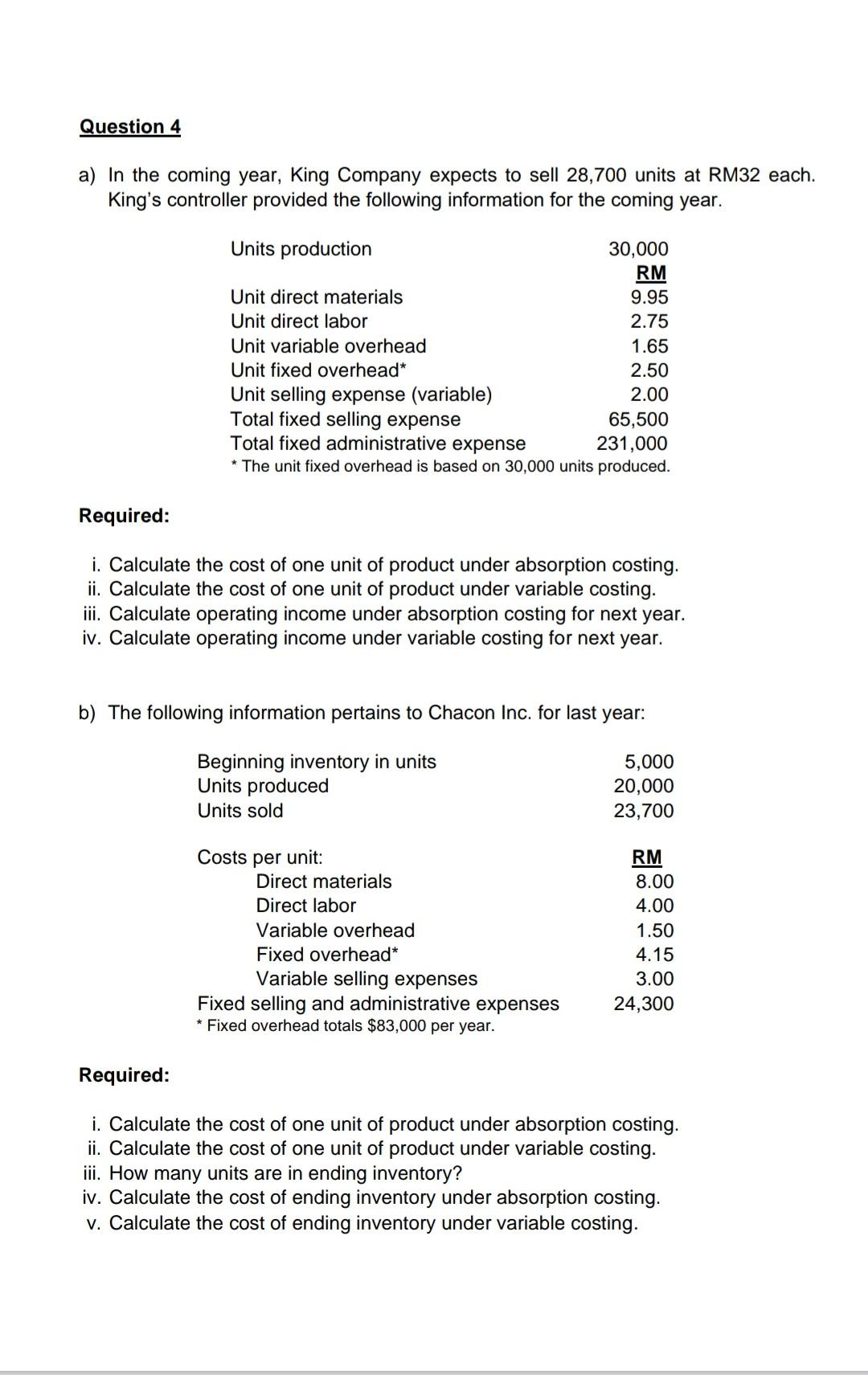

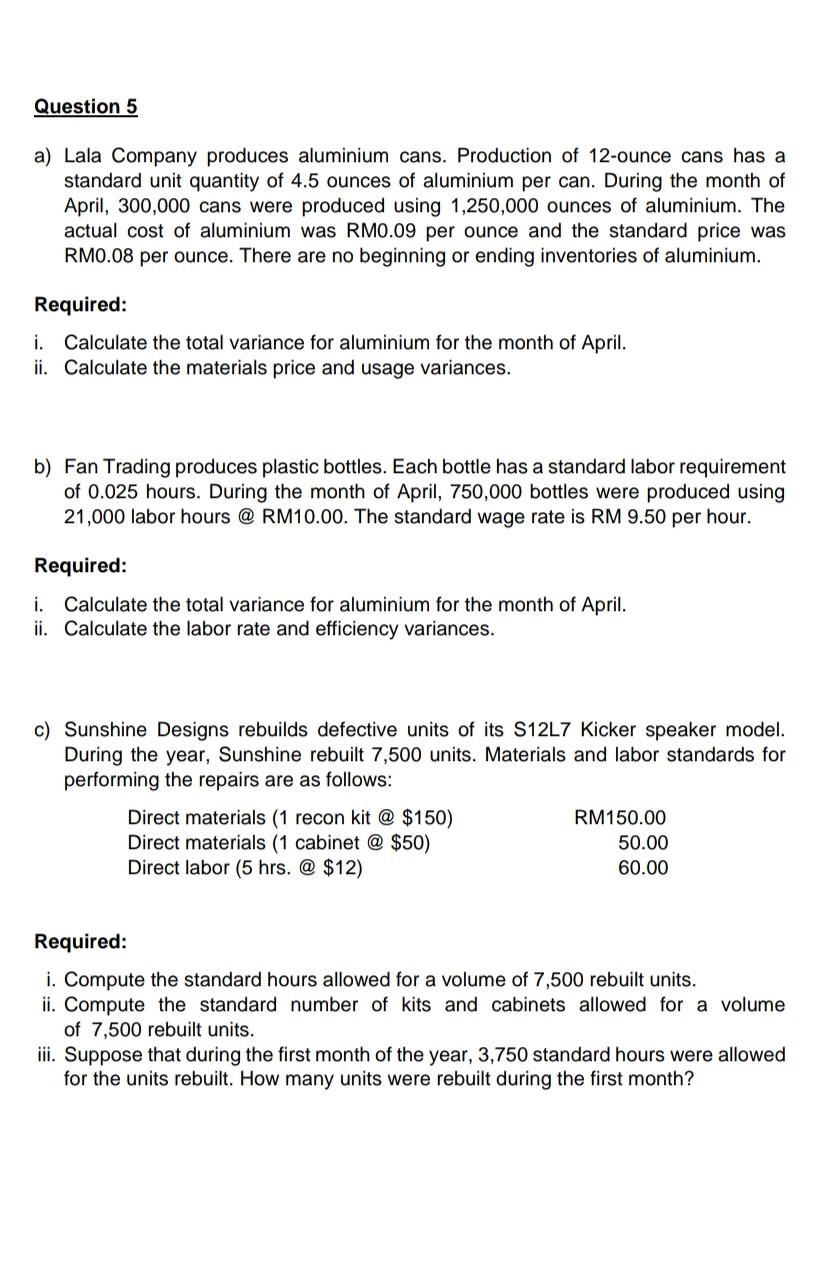

Question 4 a) In the coming year, King Company expects to sell 28,700 units at RM32 each. King's controller provided the following information for the coming year. Units production 30,000 RM Unit direct materials 9.95 Unit direct labor 2.75 Unit variable overhead 1.65 Unit fixed overhead* 2.50 Unit selling expense (variable) 2.00 Total fixed selling expense 65,500 Total fixed administrative expense 231,000 * The unit fixed overhead is based on 30,000 units produced. Required: i. Calculate the cost of one unit of product under absorption costing. ii. Calculate the cost of one unit of product under variable costing. iii. Calculate operating income under absorption costing for next year. iv. Calculate operating income under variable costing for next year. b) The following information pertains to Chacon Inc. for last year: Beginning inventory in units Units produced Units sold 5,000 20,000 23,700 Costs per unit: Direct materials Direct labor Variable overhead Fixed overhead* Variable selling expenses Fixed selling and administrative expenses * Fixed overhead totals $83,000 per year. RM 8.00 4.00 1.50 4.15 3.00 24,300 Required: i. Calculate the cost of one unit of product under absorption costing. ii. Calculate the cost of one unit of product under variable costing. iii. How many units are in ending inventory? iv. Calculate the cost of ending inventory under absorption costing. v. Calculate the cost of ending inventory under variable costing. Question 5 a) Lala Company produces aluminium cans. Production of 12-ounce cans has a standard unit quantity of 4.5 ounces of aluminium per can. During the month of April, 300,000 cans were produced using 1,250,000 ounces of aluminium. The actual cost of aluminium was RM0.09 per ounce and the standard price was RM0.08 per ounce. There are no beginning or ending inventories of aluminium. Required: i. Calculate the total variance for aluminium for the month of April. ii. Calculate the materials price and usage variances. b) Fan Trading produces plastic bottles. Each bottle has a standard labor requirement of 0.025 hours. During the month of April, 750,000 bottles were produced using 21,000 labor hours @ RM10.00. The standard wage rate is RM 9.50 per hour. Required: i. Calculate the total variance for aluminium for the month of April. ii. Calculate the labor rate and efficiency variances. c) Sunshine Designs rebuilds defective units of its S12L7 Kicker speaker model. During the year, Sunshine rebuilt 7,500 units. Materials and labor standards for performing the repairs are as follows: Direct materials (1 recon kit @ $150) RM150.00 Direct materials (1 cabinet @ $50) 50.00 Direct labor (5 hrs. @ $12) 60.00 Required: i. Compute the standard hours allowed for a volume of 7,500 rebuilt units. ii. Compute the standard number of kits and cabinets allowed for a volume of 7,500 rebuilt units. iii. Suppose that during the first month of the year, 3,750 standard hours were allowed for the units rebuilt. How many units were rebuilt during the first month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts