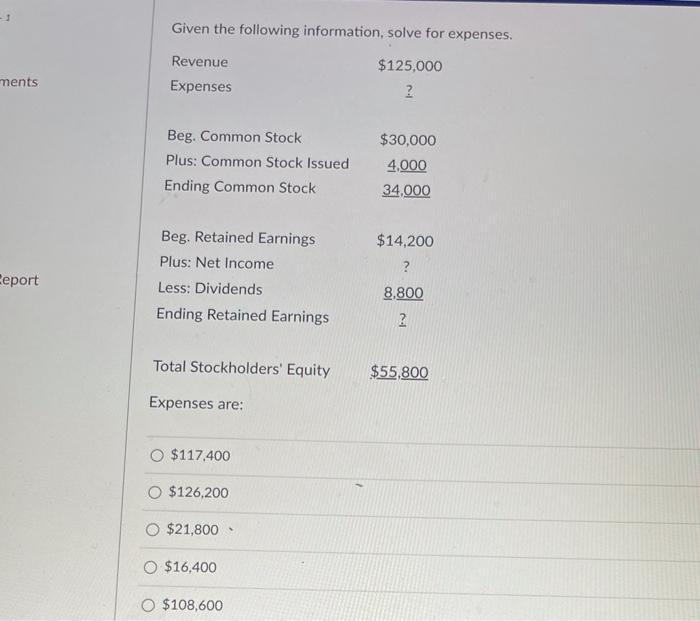

Question: need answer asap, will leave thumbs up Given the following information, solve for expenses. ments Revenue Expenses $125,000 ? Beg. Common Stock Plus: Common Stock

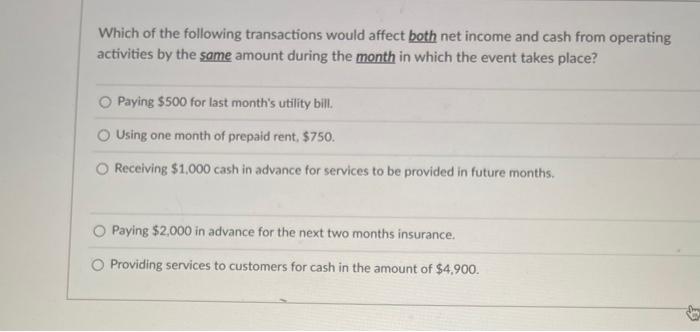

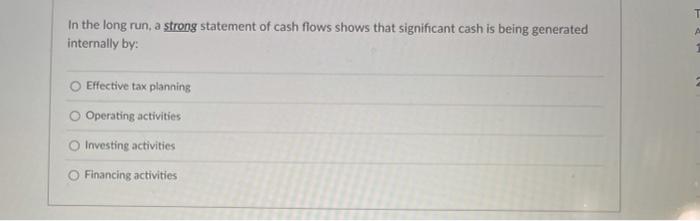

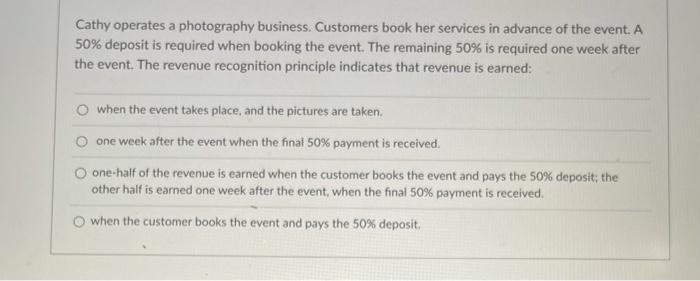

Given the following information, solve for expenses. ments Revenue Expenses $125,000 ? Beg. Common Stock Plus: Common Stock Issued Ending Common Stock $30,000 4,000 34.000 $14,200 ? Report Beg, Retained Earnings Plus: Net Income Less: Dividends Ending Retained Earnings 8,800 ? Total Stockholders' Equity $55,800 Expenses are: $117.400 O $126,200 O $21,800 O $16,400 $108,600 Which of the following transactions would affect both net income and cash from operating activities by the same amount during the month in which the event takes place? O Paying $500 for last month's utility bill. Using one month of prepaid rent $750. Receiving $1,000 cash in advance for services to be provided in future months. O Paying $2,000 in advance for the next two months insurance. O Providing services to customers for cash in the amount of $4.900. In the long run, a strong statement of cash flows shows that significant cash is being generated internally by: Effective tax planning Operating activities Investing activities Financing activities Cathy operates a photography business. Customers book her services in advance of the event. A 50% deposit is required when booking the event. The remaining 50% is required one week after the event. The revenue recognition principle indicates that revenue is earned: o when the event takes place, and the pictures are taken one week after the event when the final 50% payment is received one-half of the revenue is earned when the customer books the event and pays the 50% deposit; the other half is earned one week after the event, when the final 50% payment is received. when the customer books the event and pays the 50% deposit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts