Question: Need answer for A A closed-end fund starts the year with a net asset value of $17.00. By year-end, NAV equals $17.30. At the beginning

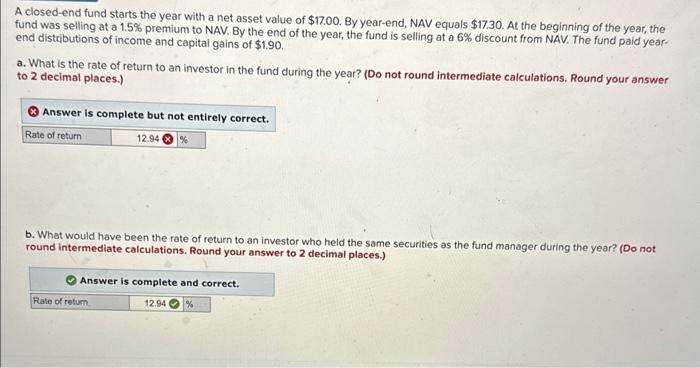

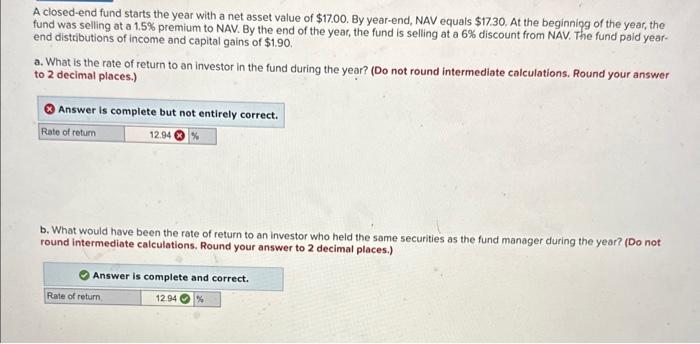

A closed-end fund starts the year with a net asset value of $17.00. By year-end, NAV equals $17.30. At the beginning of the year, the fund was selling at a 1.5% premium to NAV. By the end of the year, the fund is selling at a 6% discount from NAV. The fund paid yearend distributions of income and capital gains of $1.90. a. What is the rate of return to an investor in the fund during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. b. What would have been the rate of return to an investor who held the same securities as the fund manager during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) A closed-end fund starts the year with a net asset value of $17.00. By year-end, NAV equals $17.30. At the beginnigg of the year, the fund was selling at a 1.5% premium to NAV. By the end of the year, the fund is selling at a 6% discount from NAV. The fund paid yearend distributions of income and capital gains of $1.90. a. What is the rate of return to an investor in the fund during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would have been the rate of return to an investor who heid the same securities as the fund manager during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts