Question: need answer for b)asap..will give good rating An entity currently uses a process costing system. There is no opening work in progress at the beginning

need answer for b)asap..will give good rating

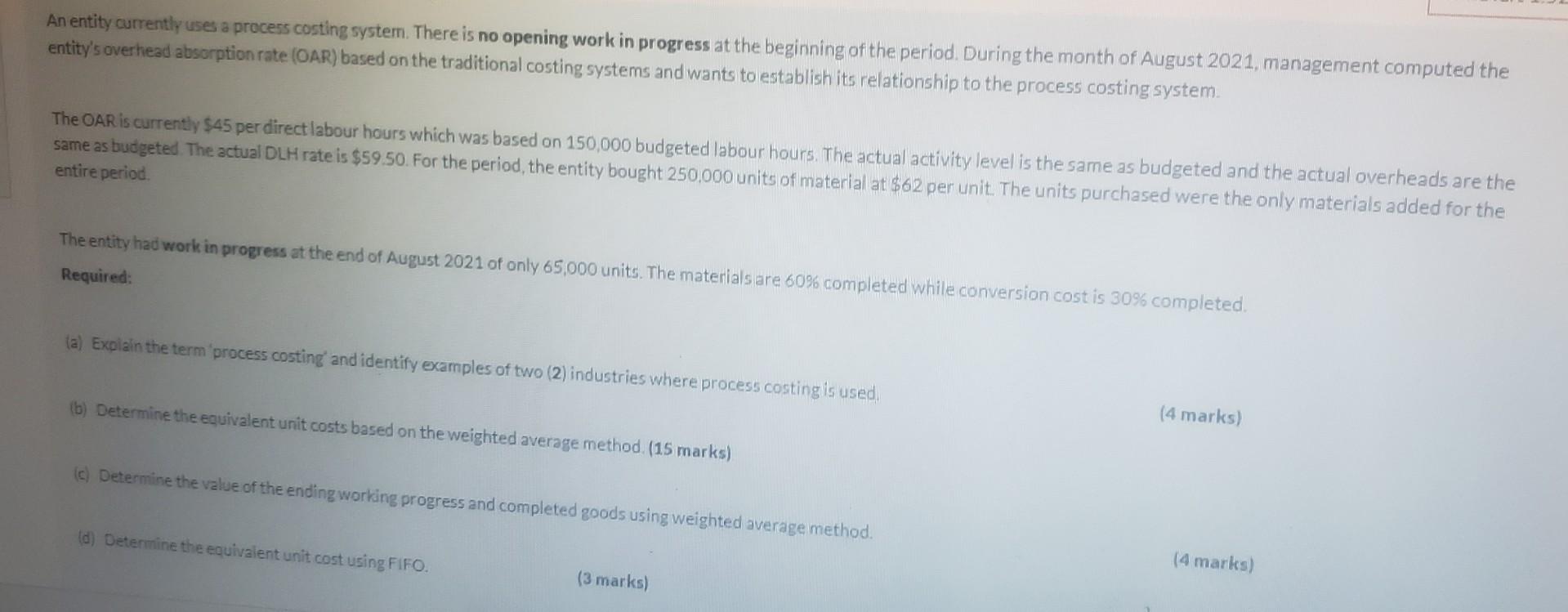

An entity currently uses a process costing system. There is no opening work in progress at the beginning of the period. During the month of August 2021 , management computed the entity's overhead absorption rate (OAR) based on the traditional costing systems and wants to establish its relationship to the process costing system. The OAR is currently $45 per direct labour hours which was based on 150,000 budgeted labour hours. The actual activity level is the same as budgeted and the actual overheads are the same as budgeted The actual DLH rate is $59.50. For the period, the entity bought 250,000 units of material at $62 per unit. The units purchased were the only materials added for the entire period. The entity had work in progress at the end of August 2021 of only 65,000 units. The materials are 60% completed while conversion cost is 30% completed. Required: (a) Explain the term 'process costing' and identify examples of two (2) industries where process costing is used. (4 marks) (b) Determine the equivalent unit costs based on the weighted average method. (15 marks) (c) Determine the value of the ending working progress and completed goods using weighted average method. (4 marks) (d) Determine the equivalent unit cost using FiFO. (3 marks) An entity currently uses a process costing system. There is no opening work in progress at the beginning of the period. During the month of August 2021 , management computed the entity's overhead absorption rate (OAR) based on the traditional costing systems and wants to establish its relationship to the process costing system. The OAR is currently $45 per direct labour hours which was based on 150,000 budgeted labour hours. The actual activity level is the same as budgeted and the actual overheads are the same as budgeted The actual DLH rate is $59.50. For the period, the entity bought 250,000 units of material at $62 per unit. The units purchased were the only materials added for the entire period. The entity had work in progress at the end of August 2021 of only 65,000 units. The materials are 60% completed while conversion cost is 30% completed. Required: (a) Explain the term 'process costing' and identify examples of two (2) industries where process costing is used. (4 marks) (b) Determine the equivalent unit costs based on the weighted average method. (15 marks) (c) Determine the value of the ending working progress and completed goods using weighted average method. (4 marks) (d) Determine the equivalent unit cost using FiFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts