Question: Need answer for question B and C Section 2 - Short Problems (60 points total) 9. 130 POINTS TOTAL] Wabash Associates acquired $8,000,000 par value,

Need answer for question B and C

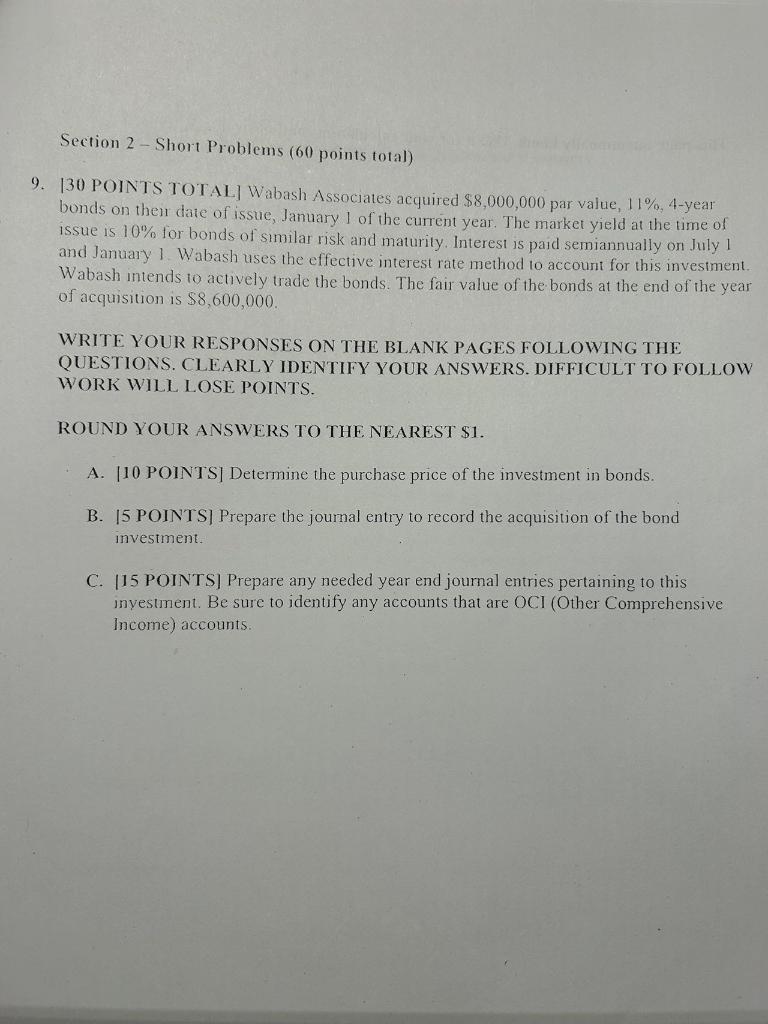

Section 2 - Short Problems (60 points total) 9. 130 POINTS TOTAL] Wabash Associates acquired $8,000,000 par value, 11\%, 4-year bonds on then date of issue, January 1 of the current year. The market yield at the time of issue is 10% for bonds of similar risk and maturity. Interest is paid semiannually on July 1 and January I. Wabash uses the effective interest rate method to account for this investment. Wabash intends 10 actively trade the bonds. The fair value of the bonds at the end of the year of acquisition is $8,600,000. WRITE YOUR RESPONSES ON THE BLANK PAGES FOLLOWING THE QUESTIONS. CLEARLY IDENTIFY YOUR ANSWERS. DIFFICULT TO FOLLOW WORK WILL LOSE POINTS. ROUND YOUR ANSWERS TO THE NEAREST $1. A. [10 POINTS] Determine the purchase price of the investment in bonds. B. [5 POINTS] Prepare the journal entry to record the acquisition of the bond investment. C. [15 POINTS] Prepare any needed year end journal entries pertaining to this inyestment. Be sure to identify any accounts that are OCI (Other Comprehensive Income) accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts