Question: Need answer, Help ASAP please (Question 1) Decious Enterprise is a catering company that offers a variety of services. They prepared its account on 31

Need answer, Help ASAP please

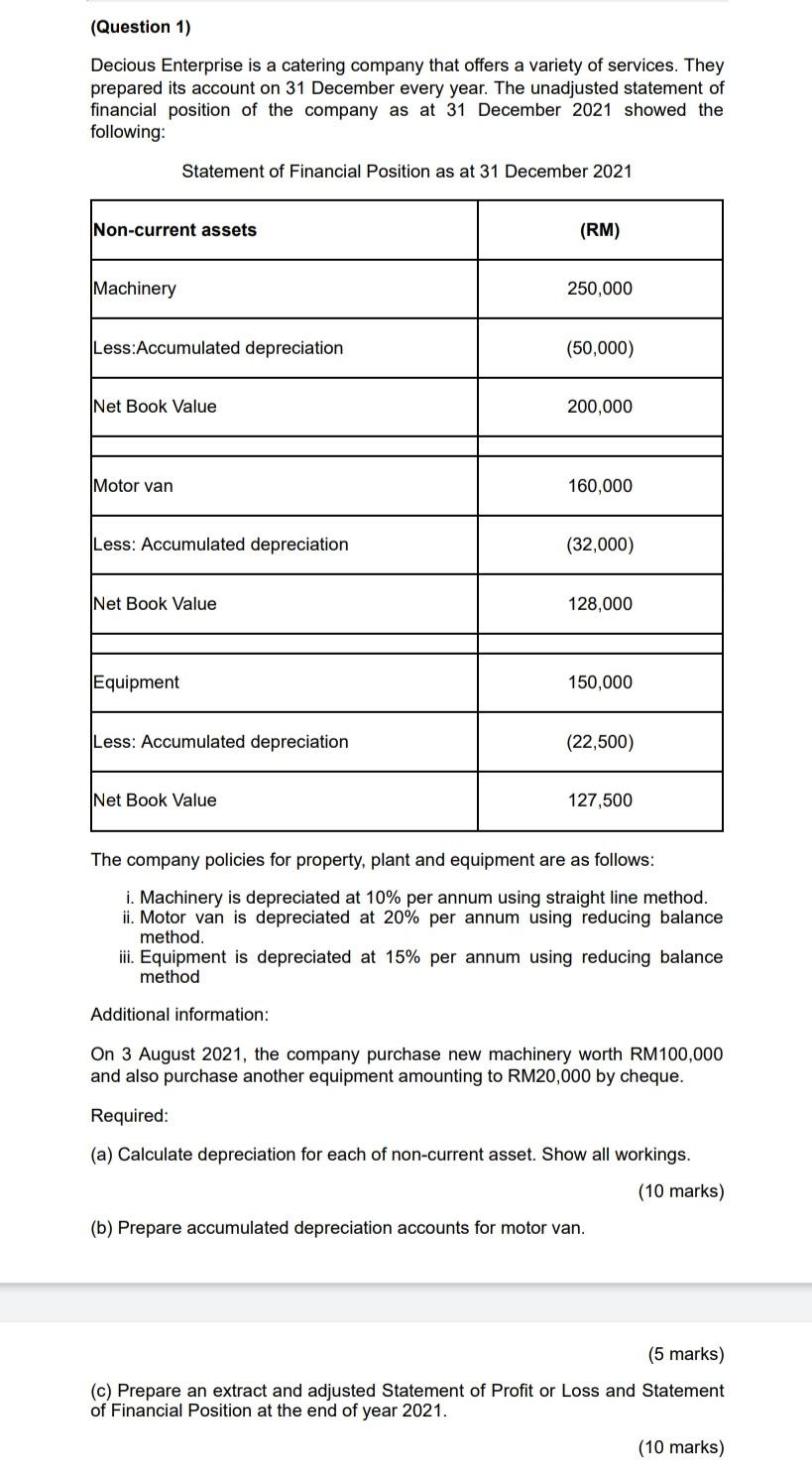

(Question 1) Decious Enterprise is a catering company that offers a variety of services. They prepared its account on 31 December every year. The unadjusted statement of financial position of the company as at 31 December 2021 showed the following: Statement of Financial Position as at 31 December 2021 Non-current assets (RM) Machinery 250,000 Less:Accumulated depreciation (50,000) Net Book Value 200,000 Motor van 160,000 Less: Accumulated depreciation (32,000) Net Book Value 128,000 Equipment 150,000 Less: Accumulated depreciation (22,500) Net Book Value 127,500 The company policies for property, plant and equipment are as follows: i. Machinery is depreciated at 10% per annum using straight line method. ii. Motor van is depreciated at 20% per annum using reducing balance method. iii. Equipment is depreciated at 15% per annum using reducing balance method Additional information: On 3 August 2021, the company purchase new machinery worth RM100,000 and also purchase another equipment amounting to RM20,000 by cheque. Required: (a) Calculate depreciation for each of non-current asset. Show all workings. (10 marks) (b) Prepare accumulated depreciation accounts for motor van. (5 marks) (c) Prepare an extract and adjusted Statement of Profit or Loss and Statement of Financial Position at the end of year 2021. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts