Question: need answer Presented here are selected transactions for Oriole Limited for 2021. Oriole uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a

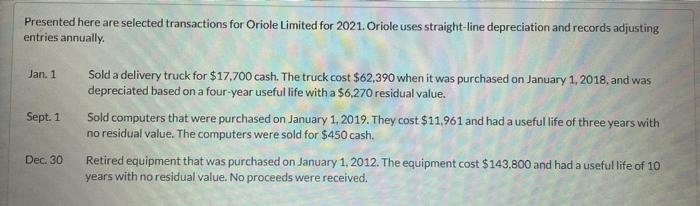

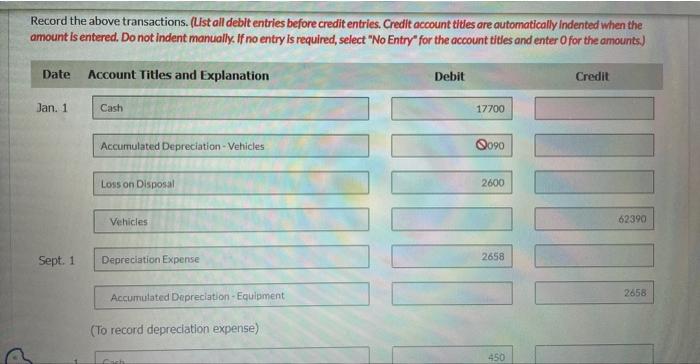

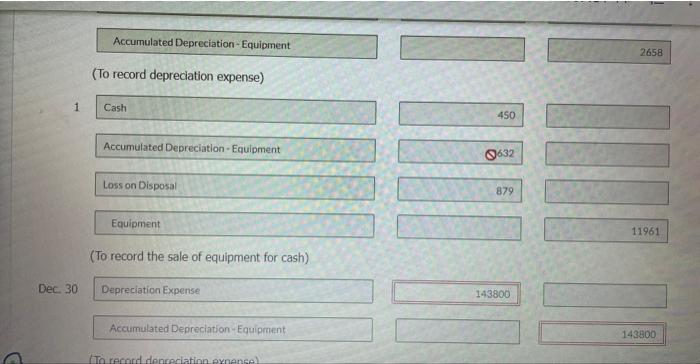

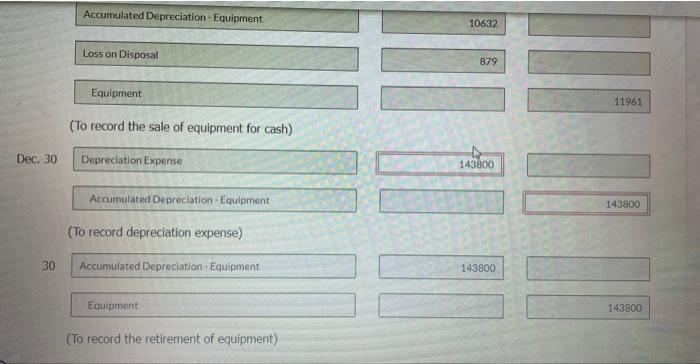

Presented here are selected transactions for Oriole Limited for 2021. Oriole uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a delivery truck for $17,700 cash. The truck cost $62,390 when it was purchased on January 1,2018 , and was depreciated based on a four-year useful life with a $6,270 residual value. Sept. 1 Sold computers that were purchased on January 1,2019 . They cost $11,961 and had a useful life of three years with no residual value. The computers were sold for $450 cash. Dec. 30 Retired equipment that was purchased on January 1, 2012. The equipment cost $143,800 and had a useful life of 10 years with no residual value. No proceeds were received. Record the above transactions. (List all deblt entries before credit entries. Credit account tites are autornatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Accumulated Depreciation - Equipment (To record depreciation expense) 1 Cash Accumulated Depreciation - Equipment Loss on Disposal 879 Equipment (To record the sale of equipment for cash) Dec 30 Depreciation Expense Accumulated Depreciation-Equipment. \begin{tabular}{|l|r|} \hline Accurnulated Depreciation-Equipment & 10632 \\ \hline Loss on Disposal & 879 \\ \hline \end{tabular} Equipment (To record the sale of equipment for cash) Dec, 30 Depreciation Expense Accumulated Depreciation - Equipment (To record depreciation expense) 30 Accumulated Depreciation-Equipment Equipment (To record the retirement of equipment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts